Trade war fears send shudder through stock markets

- Published

US President Donald Trump appears to have ended his truce with China

Fears of a US-China trade war sent shudders through US and European stock markets on Monday, with Wall Street recording its worst day of 2019.

The Dow Jones and S&P 500 fell 3%, while the tech-heavy Nasdaq shed 3.5%.

It followed comments from President Donald Trump who accused Beijing of currency manipulation.

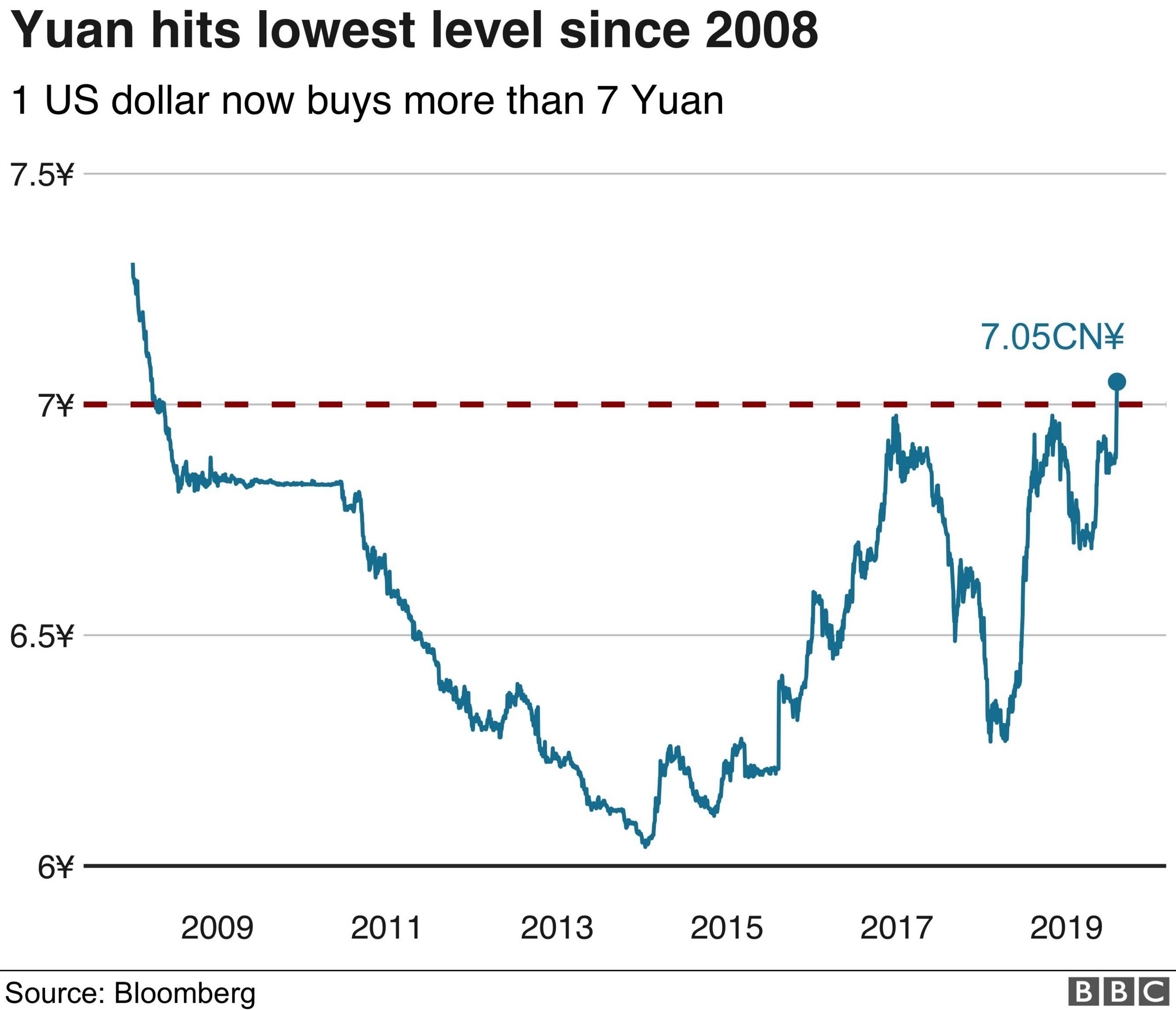

The Chinese yuan passed the seven-per-dollar level for the first time since 2008 - which surprised traders as Beijing usually supports the currency.

In Europe, the FTSE 100 closed 2.5% lower, while the main markets in Germany and France dropped around 2%.

Major exporters such as construction equipment maker Caterpillar and plane manufacturer Boeing fell 2.5%, while Apple was among the biggest casualties, sinking 5.2%.

Few sectors were left unscathed, with Nike and Macy's both seeing their respective share prices drop by around 3% each.

'Fading hopes'

Gold was trading at more than a six-year high on Monday, as investors put money into so-called safe haven assets. The Japanese yen and government bonds also rose as investors sought to cut back on risk.

The VIX volatility index, the so-called fear measure among investors, jumped 36%.

"Any hopes of a quick resolution with China are fading quickly," said Ryan Detrick, senior market strategist at LPL Financial.

Harry Tchilinguirian, global oil strategist at BNP Paribas, added: "The escalation of trade measures only reinforces concerns over global economic growth."

Crude oil prices fell - Brent crude was down 2.5% to $60.36 per barrel, while US West Texas Intermediate fell 1.7%, to $54.69.

Truce over

The market moves come amid rising trade tension between the US and China.

Chinese authorities said on Friday that they would fight back against Mr Trump's decision to impose 10% tariffs on $300bn of Chinese imports.

Mr Trump's move brought an end to a month-long trade truce, which he cemented on Monday when the president started tweeting about the yuan's move.

He tweeted it was "currency manipulation" which would "greatly weaken China".

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The US Treasury department defines currency manipulation as when "countries manipulate the rate of exchange between their currency and the United States dollar for purposes of preventing effective balance of payments adjustment or gaining unfair competitive advantage in international trade".

No country has officially been named a currency manipulator by the US since Bill Clinton's administration did so to China in 1994.

China's central bank said it was not using its yuan currency as a tool to cope with external disturbances such as trade disputes. The yuan's exchange rate now was at an appropriate level in line with China's economic fundamentals and market demand and supply, it added.

In offshore markets, the yuan fell to its weakest since international trading in the Chinese currency began.

It now takes 7.0835 yuan to buy a dollar. The currency, down 1.5% in offshore markets, is heading for its biggest one-day drop in four years.

US stock markets tumbled on Monday

There are two yuan markets. The offshore one - based in places such as Hong Kong, Singapore, Taiwan, and London - doesn't fluctuate within a tight band like the onshore yuan market and is free of Beijing's control in that respect.

"The fallout has been most evident in the Asia region," MUFG analyst Derek Halpenny said. "We certainly expect to see general FX volatility increase in the coming days, with daily PBOC [People's Bank of China] yuan fixes an important focus each day."

While other Asian currencies such as the South Korean won were hit, falling 1.4% against the dollar, it also spurred demand for safe-haven currencies such as the Swiss franc and Japanese yen.

The breaching of the seven-per-dollar limit could lead to a flight out of domestic assets. In the last decade, there have been two periods of yuan weakness, in 2010 and a slower contraction between 2014 and 2016.

Those incidents precipitated bursts of capital flight that distorted the Chinese economy and forced the authorities to prop up the currency by using capital controls and purchases by state-run banks.

Meanwhile, Chinese seed and food company shares and rare-earth firms were boosted on hopes that Beijing will not buy more from the US.

- Published2 August 2019

- Published31 October 2018

- Published19 September 2018