Stock markets drop on new Trump China tariffs

- Published

US stock markets have fallen for a second day following a decision by Donald Trump to impose new tariffs on a further $300bn of Chinese imports.

The three main US indexes all closed the week down, following sharp falls in Europe and Asia.

The US President's move came after the latest round of bilateral talks showed little sign of a breakthrough.

The 10% tariffs, due to take effect on 1 September, effectively tax all Chinese imports to the US.

The tariffs are likely to target a wide range of goods, from smartphones to clothing.

A spokeswoman for China's foreign ministry warned the country would retaliate against the US for imposing duties.

"If the US implements the tariff measures, China will have to take necessary counter-measures to resolutely defend the core interests of the country and its people."

She declined to say what this might involve, but earlier this year it China signalled that it may curb exports of rare earth minerals to the US.

China is the largest producer of rare earths which are vital to a number of US industries such as electric car manufacturing and wind turbine production.

US stock markets have dropped since Donald Trump announced new tariffs on Chinese imports

Mr Trump announced the tariff plan on Twitter on Thursday, while taking aim at China for not honouring promises to buy more US agricultural products at this week's negotiations in Shanghai.

He also attacked Chinese President Xi Jinping for failing to do more to stem sales of the synthetic opioid fentanyl.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

In later remarks, the US president told reporters the 10% tariffs were a short-term measure and could be lifted in stages to more than 25%.

This would be on top of the $250bn of Chinese goods that are already being taxed at 25% by the Trump administration.

Research firm Oxford Economics said: "We expect this step to make China less keen to achieve a deal and more determined to prepare itself for long-term economic tension with the US."

At the end of June, Mr Trump said the US wasn't about to add any new tariffs on Chinese goods

What has the response been so far?

The move surprised markets because Washington and Beijing had described this week's trade negotiations as constructive and scheduled another round of talks for September.

The US Chamber of Commerce, which represents more than three million US companies, said the latest tariffs on China "will only inflict greater pain on American businesses, farmers, workers and consumers, and undermine an otherwise strong US economy".

Gary Cohn, Trump's former US chief economic adviser, weighs in on US-China trade war

It urged the two sides to remove all tariffs.

The latest round of duties comes amid growing concern that Mr Trump's strategy may be backfiring.

On Thursday, his former chief economic adviser, Gary Cohn, told the BBC that the tariff battle was having a "dramatic impact" on US manufacturing and capital investment.

The resulting tensions have also influenced the US central bank, the Federal Reserve, which cut interest rates on Wednesday for the first time in a decade.

Fed chair Jerome Powell said it was not the central bank's job to criticise US trade policy, but added that trade tensions had "nearly boiled over" during May and June.

How have markets reacted?

In the US, the Nasdaq index was the biggest faller on Friday, down 1.3%. The technology companies listed on the index are seen as particularly vulnerable to tariffs on Chinese goods because many source components from China or produce their goods there.

The US indexes had already fallen sharply on Thursday when Mr Trump made the surprise announcement, but the Dow Jones Industrial Average and the S&P 500 closed 0.37% and 0.73% lower respectively on Friday.

In Europe, the UK's FTSE 100 index ended 2.3% lower, Germany's Dax index dropped 2.9% and the Cac 40 in France fell 3.3% by the close of trading. Earlier in Asia, Japan's Nikkei index had fallen more than 2%.

Mr Trump says his trade tactics are working, and that Beijing is feeling the pain. But China isn't the only country that is hurting. The International Monetary Fund has warned that the US-China trade war is the biggest risk to the global economy.

There's mounting evidence to show it's also hitting the American economy. Data released last week showed that the US economy grew less than previously thought last year.

The figures showed foreign trade and business investment shrank as the trade war wore on.

US firms are holding off on expansion plans and investments, meaning new factories aren't being built and new jobs aren't being created.

All of this is making investors increasingly nervous, and there are now concerns that trade wars are being fought on multiple fronts, with a fresh one brewing between Japan and South Korea.

How did we get here?

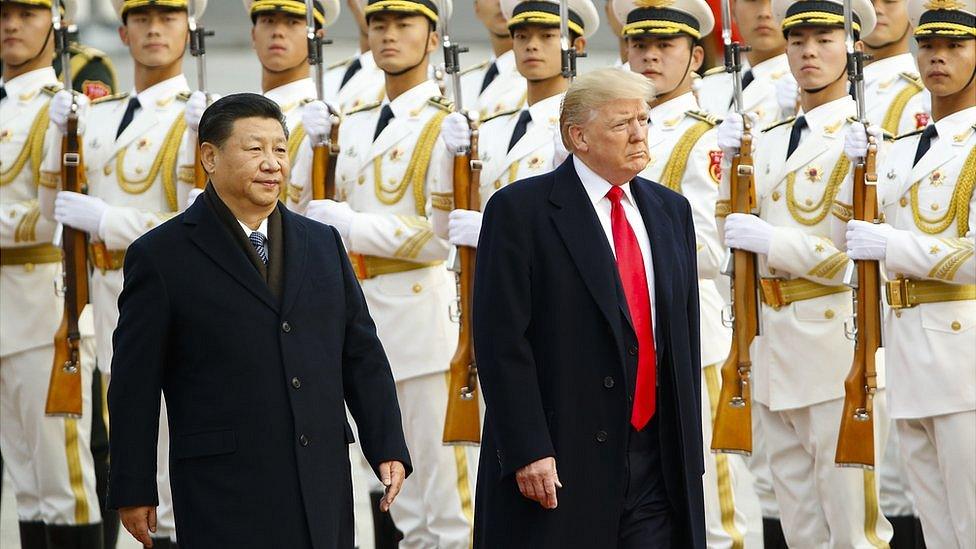

China and the US have been engaged in a fractious dispute over trade since the early days of Mr Trump's presidency.

While campaigning for the presidential election in 2016, Mr Trump repeatedly accused China of unfair trading practices and intellectual property theft.

He also wants to cut America's trade deficit with China, which he says is hurting US manufacturing.

Over the past year, both sides have imposed tariffs on billions of dollars of one another's goods.

Despite several rounds of talks, the world's two largest economies have failed to reach an agreement to end the trade war which has rattled investors and cast a shadow over the global economy.

- Published2 August 2019

- Published1 August 2019

- Published16 January 2020

- Published10 May 2019

- Published22 April 2019

- Published30 May 2019