Eddie Stobart chief leaves as shares suspended

- Published

Eddie Stobart has suspended trading in its shares and announced that its chief executive will stand down with immediate effect, as the firm looks into accounting discrepancies.

The firm also warned its results for the first half of 2019 would be "significantly lower" than forecast.

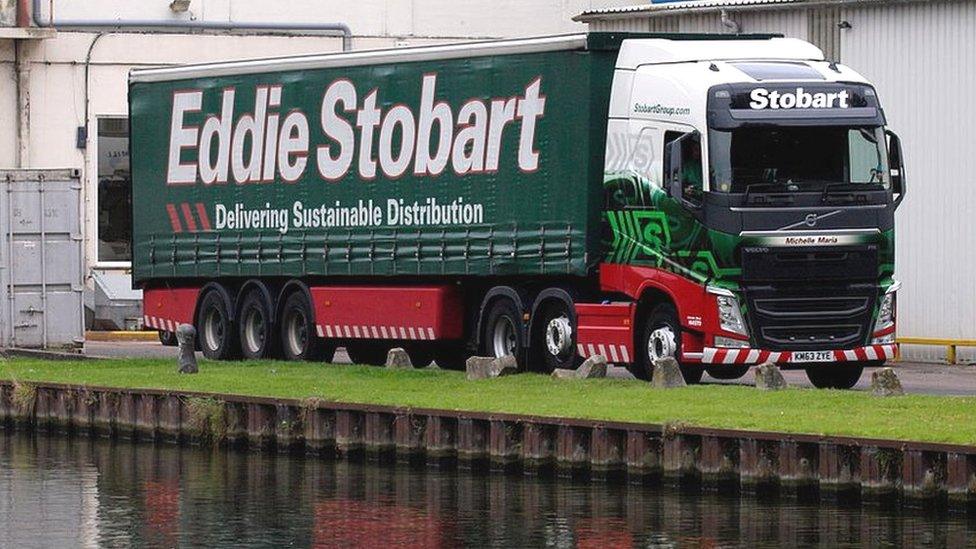

The transport company, known for its green and red lorries, revealed a £2m error in its 2018 results last month.

A review of past accounts uncovered the problem.

The review is being undertaken by chief financial officer, Anoop Kang, who joined in April, alongside auditors PwC. It found that in 2018 operating profits were overstated by about 4%.

Publication of the firm's results for the six months to 31 May has also been delayed, They were due to be released on 29 August, but are now expected in early September.

The firm warned that profits for that six-month period were likely to be revised down from recent projections, and that it is "applying a more prudent approach to revenue recognition". The group's dividend policy would also be reviewed, it said.

In December last year, Eddie Stobart announced that PwC had been appointed as its auditor, replacing KPMG.

KPMG resigned from the role, stating in a letter, external that there had been a "breakdown" in the relationship between the firms, and citing "difficulties in obtaining sufficient appropriate audit evidence," although that information was "ultimately obtained". Eddie Stobart have declined to comment on the letter.

Outgoing chief executive Alex Laffey, who spent four years at Eddie Stobart, will be replaced by Sebastien Desreumaux.

Mr Desreumaux, formerly head of the group's retail delivery arm iForce, joined the company in July 2018.

The accounting revisions are likely to add to pressure on high-profile investment manager Neil Woodford, who is the largest shareholder in Eddie Stobart, with a 22.9% stake.

In June this year, Mr Woodford suspended trading in his largest fund after rising numbers of investors asked for their money back.

Eddie Stobart shares, listed on the Alternative Investment Market (AIM), a less regulated alternative to the main FTSE exchanges, have nearly halved over the past year.

Founded by Edward Stobart in 1970, the firm operates 2,700 vehicles and 43 logistical hubs in the UK and Europe, and employs around 6,600 people, according to its website.

Its distinctive lorries are a mainstay on British motorways, while its merchandise spin-off offers a wide range of branded goods including model trucks, teddy bears, watches and wrapping paper.

- Published1 April 2011