Top stockpicker Neil Woodford suspends flagship fund

- Published

Fund manager Neil Woodford

One of the UK's most high-profile stockpickers has suspended trading in his largest fund as rising numbers of investors ask for their money back.

Neil Woodford said after "an increased level of redemptions", investors would not be allowed to "redeem, purchase or transfer shares" in the fund.

Investors have withdrawn about £560m from the fund over the past four weeks.

Kent County Council also wanted to withdraw its £263m investment, but was unable to do so before trading halted.

In a statement, the council said: "The announcement on Monday that trading in the investment fund was suspended was not anticipated. KCC is disappointed that, as a major investor in the fund, we did not receive this prior notification.

"We do not know whether the decision to suspend trading was linked to the council's decision to redeem."

A stockpicker - or fund manager - analyses the potential of different stocks to try to decide whether or not they will make a good investment.

'Liquid investments'

At its peak, the Woodford Equity Income fund managed £10.2bn worth of assets, such as local authority pension funds.

However, it now manages £3.7bn, according to the financial services and research firm Morningstar.

Mr Woodford's firm, Woodford Investment Management, is also the biggest investor in Kier Group, the construction and services group which on Monday warned on profits, sending its shares crashing 41%.

It is understood that the fall in Kier's share price is not connected to the decision to suspend trading in the Woodford Equity Income fund.

The firm said the suspension would give it "time to reposition the element of the fund's portfolio invested in unquoted and less liquid stocks, in to more liquid investments".

The Financial Conduct Authority, the city watchdog, said: "The FCA is aware of this situation and in contact with the firms involved to ensure that actions undertaken are in the best interests of all the fund's investors."

Daniel Godfrey, an adviser to fund management groups, told BBC Radio 4's Today programme that Neil Woodford was "one of the finest fund managers that Britain's ever produced, although clearly he is having a dark and terrible moment."

He believes Mr Woodford could bounce back from this blow.

"There could be a new dawn and it's not necessarily the end," he said.

"It's clearly a very dark and difficult moment for Neil Woodford and his business and there may well have to be a hit to valuations to get rid of some of the unlisted holdings. But from there it'll still be probably a reasonably big fund.

"It could well be the case that in five years' time, we're looking at it and anyone who bought when it reopens will have had a great performance."

Hargreaves Lansdown shares fall

The suspension of Mr Woodford's Equity Income fund has hit shares in fund platform Hargreaves Lansdown, which included the fund in its flagship list of share recommendations, Wealth 50.

Hargreaves removed the fund from its recommendation list on Monday, but investors have not responded positively.

Shares in the company have slumped more than 4%, leaving it the biggest loser in the FTSE 100.

Who is Neil Woodford?

Mr Woodford launched his own fund five years ago this month, with its corporate headquarters in Oxford.

In its first year, it gave investors a return of 18% on their money, compared with an average rise of only 2% on the London Stock Exchange at the time.

However, after the figures were released he warned: "It's far too early to conclude that the fund's strategy has worked."

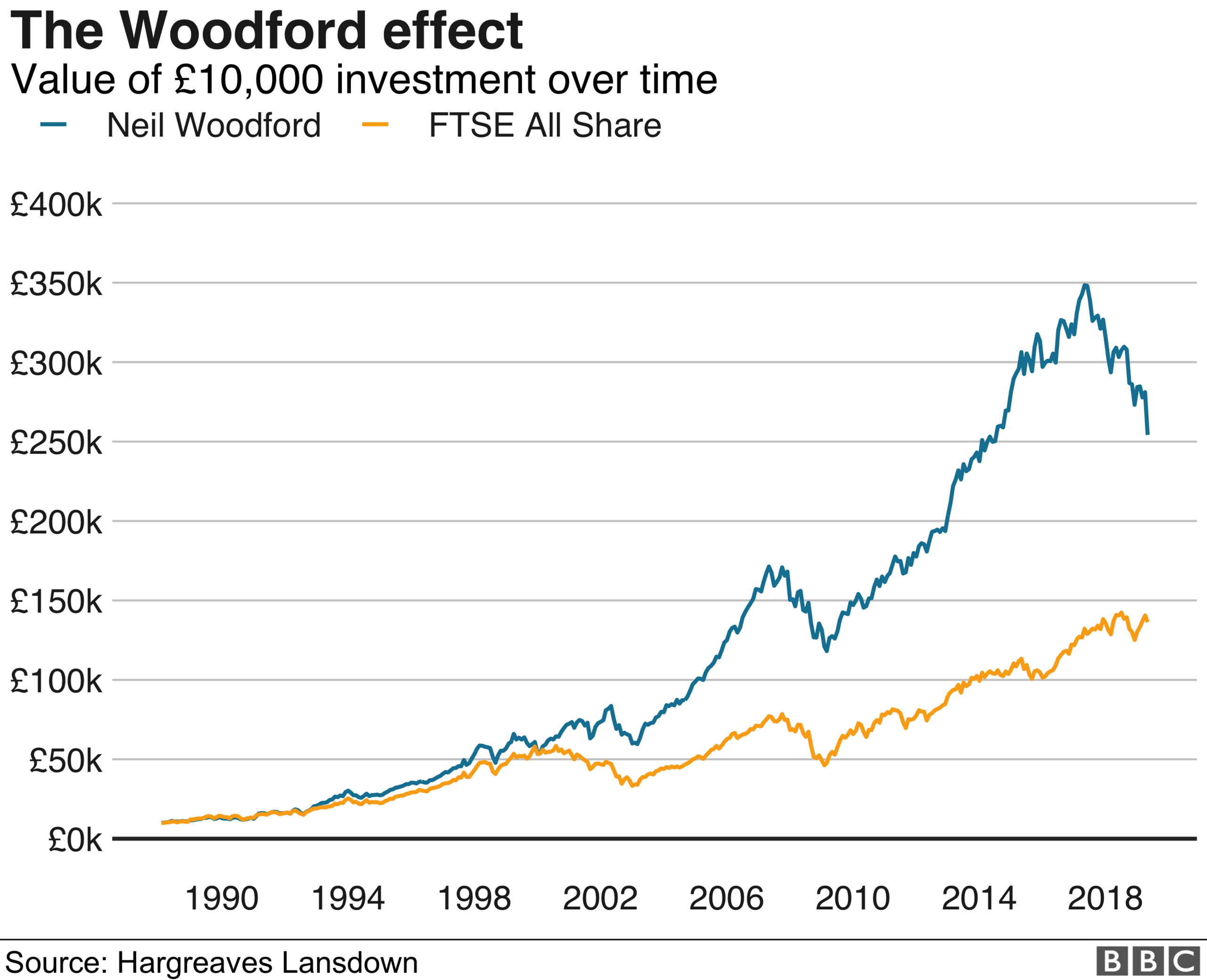

Before that, the 59-year-old had worked as part of the UK equities team at investment managers Invesco Perpetual for more than 26 years.

He was appointed a CBE for his services to the economy in 2013.

Analysis

By Dominic O'Connell, Today programme business presenter

Thanks to the banking crisis a decade ago, we know what a "liquidity" crisis looks like. When a bank's customers all want their money back at the same time, it fails; no modern lender holds enough reserves to cope with the outflow.

Neil Woodford's problems are a fund-management version of that old-fashioned bank run. Investors in the Woodford Equity Income fund have been asking for their money back at a rapid rate - about £10m a week. Unlike a bank, the fund has all the money - but it is invested in a series of companies.

To come up with the cash at once, the fund would be forced into a fire sale, with the result that investors would almost certainly get back less - much less - than they put in.

The situation has been exacerbated by Woodford's choice of investments - many of the public companies, like Kier, Circassia and Purplebricks, have turned out to be dogs, while about 10% of the fund is in non-quoted companies, whose shares are not listed on a public stock exchange.

Selling those shares can be difficult and time-consuming, so the fund has decided to stop the rot and end withdrawals. We do not know when they will resume; while the gates are up, the fund's management will be scrabbling to raise cash.

The big question now is what next for Woodford?

People invested with him for one reason - his reputation as a canny stockpicker who was happy to defy market convention and produced better-than-average results.

If that reputation is shot - and on top of that he has stopped people from accessing their money - then the reason to choose him over his rivals has been lost.

- Published4 June 2019

- Published17 July 2017

- Published16 April 2019

- Published19 November 2018

- Published19 June 2015