Oil prices soar after attacks on Saudi facilities

- Published

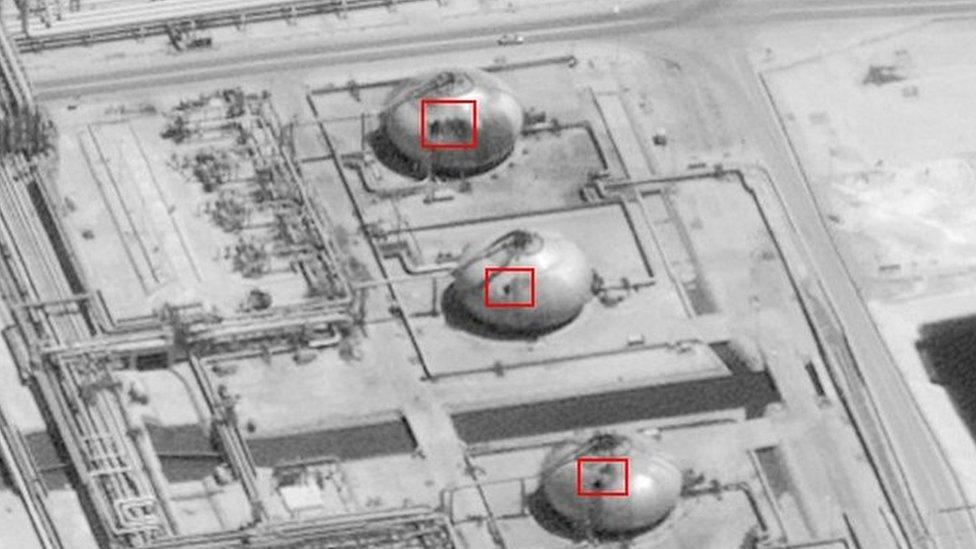

Abqaiq is the site of Aramco's largest oil processing plant

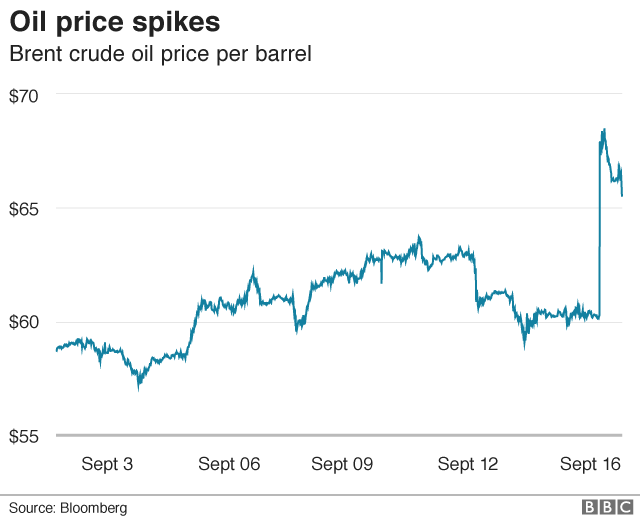

Oil prices ended nearly 15% higher on Monday, with the Brent benchmark seeing its biggest jump in about 30 years.

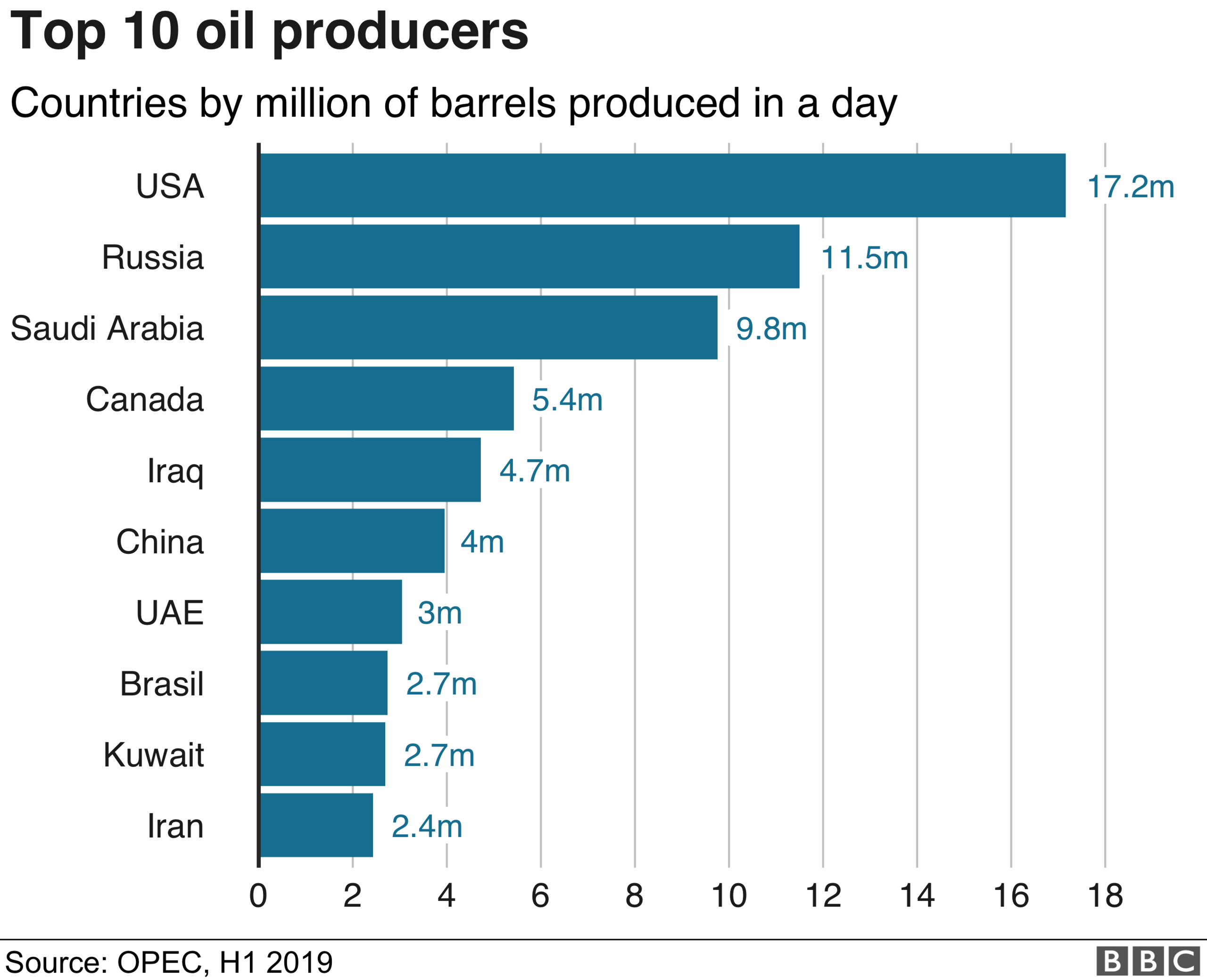

The rise came after two attacks on Saudi Arabian facilities on Saturday knocked out about 5% of global supply.

Brent crude initially surged 20% at the start of trading, but eased back to end at $69 a barrel, up 14.6%. US oil prices finished up 14.7%, the biggest jump since 2008.

Prices fell back after President Donald Trump vowed to release US reserves.

The strike, which the US blames on Iran, has sparked fears of increased risk to energy supplies in the region.

However, prices remain below Brent's 12-month high of $86.29 a barrel seen last October, when West Texas Intermediate also climbed to more than $76 a barrel.

The drone attacks on plants in the heartland of Saudi Arabia's oil industry hit the world's biggest petroleum-processing facility as well as a nearby oil field, both of which are operated by energy giant Aramco.

Together they account for about 50% of Saudi Arabia's oil output, or 5% of daily global oil production. It could take weeks before the facilities are fully back on line.

Aneeka Gupta, commodities strategist at the fund manager Wisdom Tree, said that higher oil prices would not have an immediate impact on consumers as they "could take a bit of time of feed through".

However, she says that if the outage lasts for more than six weeks, oil prices could hit "north of" $75 a barrel.

Bob McNally, president of Rapidan Energy Group and a former energy adviser in George W. Bush's administration, told the BBC: "I think it's going to last. As long as the United States and Saudi Arabia on one hand and Iran on the other remain in this escalatory conflict then we're going to build in a risk premium because it's getting very serious."

US Secretary of State Mike Pompeo claimed that Tehran was behind the attacks. Iran accused the US of "deceit."

Later, Mr Trump said in a tweet the US knew who the culprit was and was "locked and loaded" but waiting to hear from the Saudis about how they wanted to proceed.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

In another tweet he said there was "plenty of oil!".

What will be the impact on oil supplies?

The Saudis have provided little detail about the attacks, apart from saying there were no casualties, but have given a few more indications about oil production.

Energy Minister Prince Abdulaziz bin Salman said some of the fall in production would be made up by tapping huge storage facilities.

The kingdom is the world's biggest oil exporter, shipping more than seven million barrels daily. Saudi stocks stood at 188 million barrels in June, according to official data.

"Saudi authorities have claimed to control the fires, but this falls far short of extinguishing them," said Abhishek Kumar, head of analytics at Interfax Energy in London. "The damage to facilities at Abqaiq and Khurais appears to be extensive, and it may be weeks before oil supplies are normalised."

However, Jeffery Halley, senior market analyst at Oanda, said the disruption would not affect crude supplies in the near-term.

"There's enough capacity in storage to meet the shortfall in the short-term."

Will petrol prices rise?

Drivers will not immediately see an increase at the pump, according to international energy policy expert Prof Nick Butler.

"The direct impact of the attacks could be short-lived," he said.

"The market has adjusted without blinking over the last two years to the loss for political reasons of over two millions barrels a day of production from Venezuela and Iran."

In the UK, 40% of the price of a litre of petrol is made up of oil, fuel production and profit. The rest is tax.

"There are currently savings in the wholesale price that have only just started to be passed on to drivers by retailers," says Simon Williams from the RAC.

"Many retailers cut their prices by 3p on Friday and we believe that average prices were six pence too high before that, so the impact of these fires may not be too great."

But Mr Halley said that global fuel prices are likely to increase: "You'll see price hikes in gasoline all over world. Consumers will first notice it quite quickly in higher petrol prices."

He also warned to "watch airline fuel surcharges" which could also rise, depending on an airline's fuel price hedging policies.

How much oil is held in reserve?

The US held 644.8 million barrels of oil in storage as of 6 September, according to the Department of Energy.

The US Strategic Petroleum Reserve, external keeps the oil in underground salt caverns across four sites in Texas and Louisiana along the Gulf of Mexico coast.

The cylindrical caverns are typically 200 foot in diameter and 2,000 foot high, and in total they can store up to 727 million barrels of oil.

A salt cavern in Louisiana where the US stores millions of barrels of oil

The US also has around 416.1 million barrels of oil in commercial storage held by the likes of oil producers and refineries, based on data from the US Energy Information Administration, external.

In Saudi Arabia, oil production has plunged by 5.7 million barrels a day because of the attacks.

It has around 188 million barrels of oil in reserve, according to energy consultancy the Rapidan Energy Group.

- Published16 September 2019

- Published16 September 2019

- Published16 September 2019

- Published15 September 2019

- Published15 September 2019