The UK cities where rent is rising the fastest

- Published

Nottingham recorded the fastest increase, the figures show

The cost of renting a home rose fastest in Nottingham, Leeds and Bristol in the past year, research indicates, while Aberdeen recorded the biggest fall.

The survey, from property website Zoopla, said tenants moving into a Nottingham home this summer paid 5.4% more in rent than a year earlier.

Leeds and Bristol (up 4.5%) were the only other UK cities where rents rose faster than UK average wage growth.

On average, renting a UK home has become more affordable, Zoopla said.

Part of the reason lies in an increase in the number of people buying their first own home, relieving some of the pressure on the rental sector.

Tenants moving in Aberdeen - where the local economy is affected significantly by the oil industry - saw rents drop by 4.1% in the third quarter of the year, compared with a year earlier.

Coventry and Middlesbrough also saw renting become cheaper, according to the inaugural Zoopla quarterly rental report.

Who is affected?

Nearly three-quarters of 16 to 24-year-olds and almost half of 25 to 34-year-olds rent from a private landlord, according to the government's Family Resources Survey.

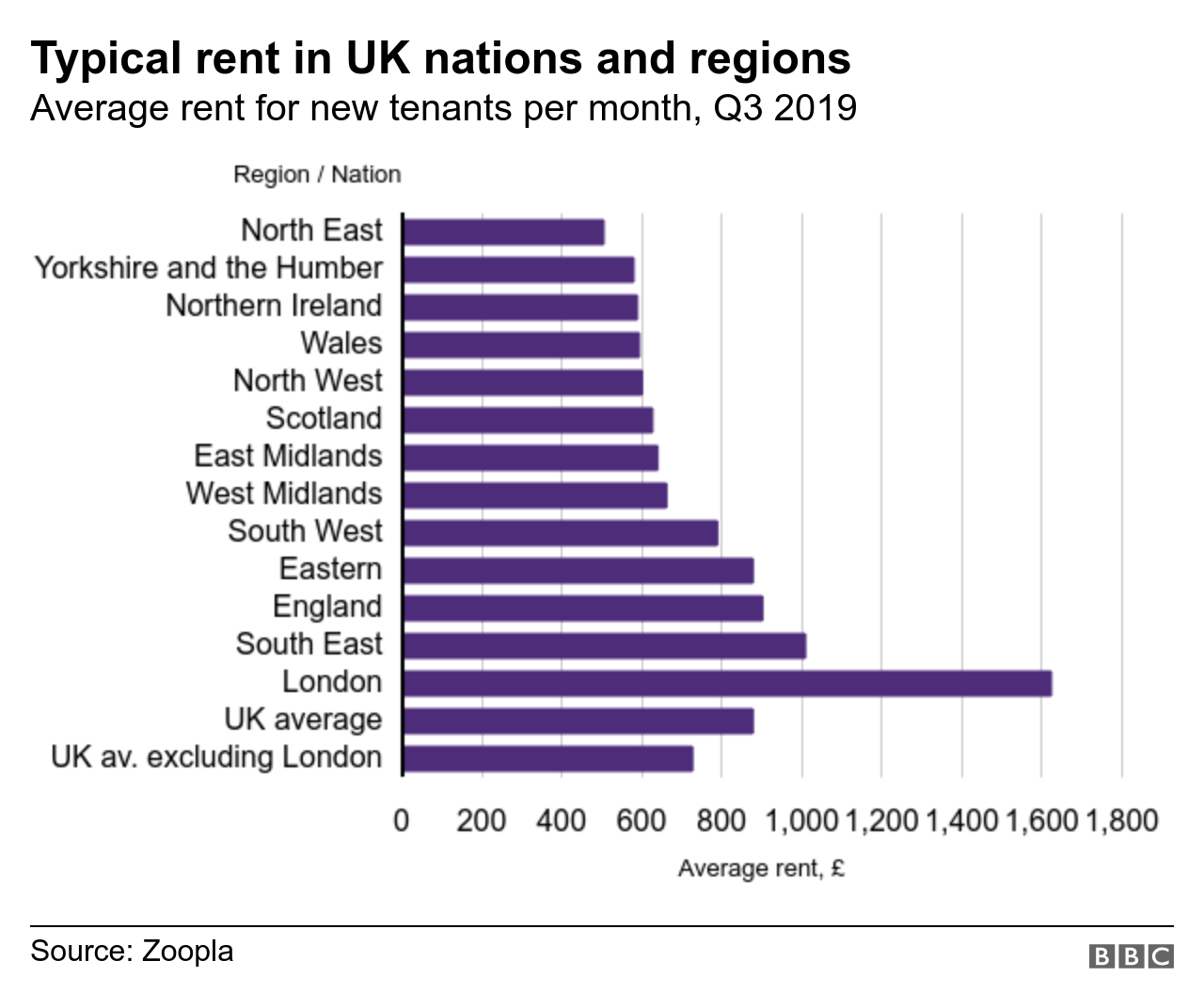

The sector is concentrated in London, with about a third of rental properties in the UK found in the city. This is also where the typical rent per month is the most expensive.

The Zoopla report suggests that the typical tenant in the UK spends nearly a third of their earnings on rent (31.8%), slightly less than the peak in 2016.

Outside of London, tenants spent the highest proportion of earnings in Oxford, Brighton and Cambridge, with the lowest in Hull, Bradford and Stoke.

UK-wide rental prices are up by an average of 2% in the last year, which is about half the typical level of wage rises.

'You end up changing your whole lifestyle'

Amy moved to Bristol five years ago and has found renting in the city has become increasingly expensive.

"There's a much smaller pool of houses within my budget now," said the 28-year-old, who works full-time in insurance.

"I have had to move further away from the centre to find somewhere I can afford."

She has also had to compromise on space as it was too expensive to rent a flat on her own.

"I'm 28 - I should be living in my own place but instead I have to share," she said.

Amy is moving house again later this month and said she spent months trying to find somewhere affordable, despite the fact her wages have gone up since she first moved to Bristol.

"You end up changing your whole lifestyle," she said.

"I've had to find other areas where I can cut my spending.

"I've been trying to save up to go back to university but I have had to put that on hold."

"Renting is more affordable today than the 10-year average. [An increase in] first-time buyers, 80% of whom exit the private renting sector to buy, has also moderated rental demand," said Richard Donnell, of Zoopla, which has based the figures on its listings and other data.

"Rental affordability varies widely across the country, reflecting the relative strength of local economies."

Across the UK, homes take an average of 17 days to rent, based on the time between a listing being posted and removed. This is down from one year ago, when homes took 19 days to rent, and much shorter than the time it takes to sell a property.

The typical tenant spent nearly four years in the same property, Mr Donnell said.

Where can you afford to live? Try our housing calculator to see where you could rent or buy

This interactive content requires an internet connection and a modern browser.

- Published3 October 2018

- Published1 June 2019

- Published19 June 2019