Twitter shares plunge as ad bugs see profit fall short

- Published

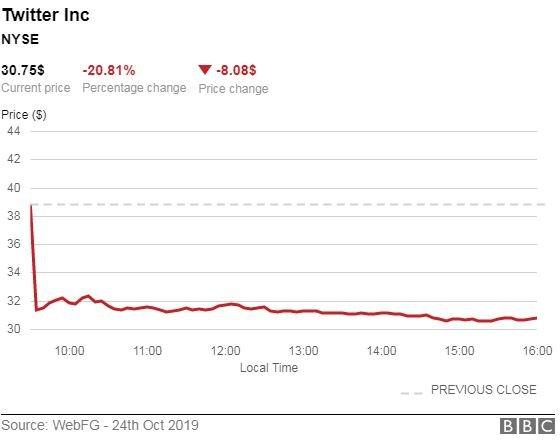

Twitter shares tumbled 17% in early trading as quarterly profits came in at less than a quarter of what analysts had predicted.

The company said it made $37m (£28.7m) profit in the third quarter.

Product bugs and unusually low demand over the summer hampered advertising sales.

Revenues were 9% higher than the previous year at $824m, but still at the lower end of Wall Street forecasts.

The micro-blogging site said revenue had been predicted to fall from the first two quarters, but that unexpected problems had weighed on sales, including bugs which had an impact on its ability to target ads and share data.

Twitter has also lowered fourth-quarter revenue predictions. The firm now expects to earn between $940m and $1.02bn in the fourth quarter, down from a previously forecast $1.06bn.

The social media platform did boost the number of daily users who see ads on the site, known as monetisable daily active users (mDAU), which reached 145 million, beating analyst estimates for 141 million, up 17% year-on-year.

Twitter's chief executive Jack Dorsey said the company was making improvements to the platform's algorithm.

"We also continue to make progress on health, improving our ability to proactively identify and remove abusive content, with more than 50% of the Tweets removed for abusive content in Q3 taken down without a bystander or first-person report," he said.

This crackdown on abusive behaviour is something analysts say separates Twitter from Facebook, which admitted on Thursday to being unable to confirm if hate speech from political candidates would be taken off the platform.

"Twitter has focused on the core experience for their users instead of politics," said Wendy Johansson of digital consultancy Publicis Sapient. "They're not out fighting a political war like Facebook - they're focused on building the best tech and getting users addicted to the tech."

Anthony Macro, head of social advertising at Croud, said the social media platform's attempts to root out bad activity would appeal to advertisers, but that their record was not flawless.

"It might be even harder to convince more people to join the platform after Twitter admitted in August it may have shared users' data with advertising platforms without consent, external," he said.

"With privacy so top of mind for users, across all social media platforms, it's absolutely critical for Twitter to sort these issues out if they want to make serious headway with future results," he added.

Mr Macro said the big question for Twitter was whether it could monetise its profile and turn its political influence into advertising revenue.