HSBC to bring in single overdraft rate of 40%

- Published

- comments

The bank said it would cut fees on unarranged overdrafts

HSBC is to bring in a single overdraft rate of 39.9% for UK customers from March 2020, as much as quadrupling the rate it charges some customers.

However, the bank is removing a £5 daily fee for going into an unarranged overdraft and introducing an interest-free £25 buffer on some accounts.

It follows a similar move from Nationwide Building Society in July.

The new annual rate comes in response to tough new rules from regulators designed to protect consumers.

But one analyst warned that steep overdraft rates could now become the "new normal".

HSBC UK currently charges rates of 9.9% to 19.9% on arranged overdrafts, but the higher rate will be applied across its whole range of accounts except for its student bank account.

The £25 buffer will apply to Bank Accounts and Advance Bank Accounts, providing leeway for those going slightly overdrawn.

HSBC said that as a result of this and the removal of the £5 daily fee for unarranged overdrafts, seven in 10 who use an overdraft would be better off or the same as a result of the changes.

But that suggests around a third could end up worse off. The bank has eight to nine million current account holders in the UK.

Madhu Kejriwal, HSBC UK's head of lending and payments, said: "By simplifying our overdraft charging structure we are making them easier to understand, more transparent and giving customers tools to help them make better financial decisions."

Nationwide has also raised its overdraft rates

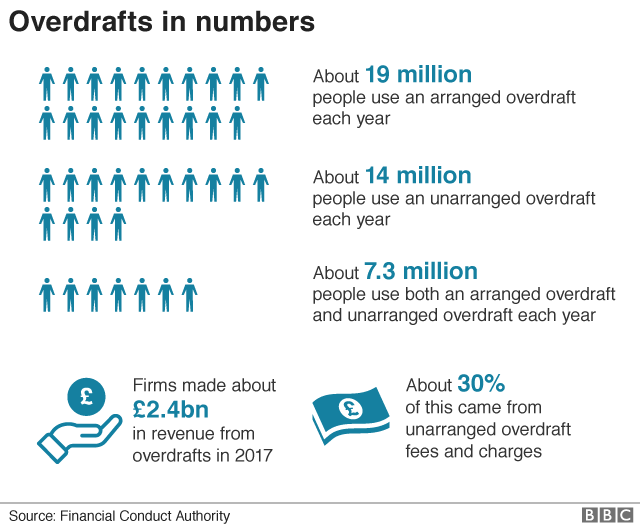

The move comes in response to Financial Conduct Authority's plans to shake up the "dysfunctional" overdraft market - including stopping banks and building societies from charging higher prices for unarranged overdrafts than for arranged overdrafts.

The new rules, which come into force next April, will require providers to charge a simple annual interest rate on all overdrafts and get rid of fixed fees.

But there have been concerns that banks will hike authorised overdraft charges to claw back some revenue lost from unauthorised overdraft fees.

In July, Nationwide also unveiled a new single rate of 39.9% across its adult current account range. Its changes came into force in November.

Helen Saxon, banking editor at MoneySavingExpert.com, said: "With both of the first banks to announce changes moving overdraft interest rates to around 40%, we have to wonder if this is the new normal."

The FCA has acknowledged banks may look to increase their arranged overdraft prices as a result of the new rules.

But it argues the net effect will still be better for consumers - and increased competition between providers as a result of the changes will constrain any price increases.

Rachel Springall, a finance expert at Moneyfacts.co.uk, said: "It's disappointing to see such a hike in overdraft charges but there may be more brands coming out in the coming weeks to announce changes too.

"This shake-up is designed to make things fairer and more transparent to consumers.

"Borrowers would be wise to scrutinise any changes to their current account and look to switch elsewhere if they find that the account has lost its shine."

- Published8 August 2019

- Published7 June 2019