Shares surge as political and trade tensions ease

- Published

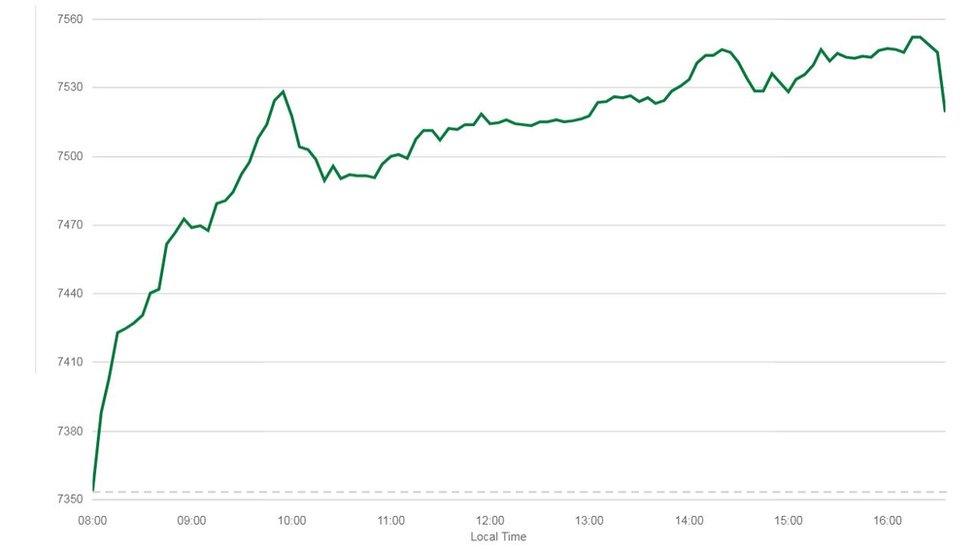

UK shares rose again on Monday as investors welcomed more political certainty following the election and easing of global trade tensions.

New York's indexes closed at record closing highs after Washington and Beijing agreed to pause their ongoing trade dispute.

London's FTSE 100 rose another 2.6% on top of Friday's gains to reach its highest level in more than four months.

The FTSE 250, which reflects the UK economy more closely, rose 1.8%.

Will Hobbs, chief investment officer for Barclays Investment Solutions, said assets closely related to the outlook for the UK economy "had laboured under a black cloud of UK related political and economic uncertainty for a few years".

"Following the recent election results, and a clearer path out of the EU in sight, this cloud seems to have dissipated a little. Nonetheless, for the world's investors, there have been more important developments to digest, namely the progress made towards a phase 1 trade deal between the US and China," he added.

FTSE 100 share index given boost

UK shares surged on Friday after it became clear that Boris Johnson's Conservative Party would have a decisive parliamentary majority, allowing them to pass legislation and move ahead with the stalled Brexit process.

The prime minister now plans to submit his Withdrawal Agreement Bill to Parliament on Friday.

While many businesses oppose Brexit they have also struggled to plan for the future due to the prolonged period of uncertainty.

Beyond the UK's domestic climate investors have also been encouraged by the agreement between the US and China which avoided a new round of tariffs being imposed at the weekend.

US and European indexes all traded higher on Monday.

Joshua Mahony, senior market analyst at IG, said "positive sentiment over an impending US-China trade deal" was continuing to cheer investors.

The so-called phase one agreement was agreed on Friday, and includes elements dealing with intellectual property protections, technology, currency and financial services.

Under the deal Phase One trade deal Washington will reduce some tariffs on Chinese imports and China will purchase US agricultural, manufactured and energy products.

The Dow Jones closed up 0.35% at 28,234. The S&P 500 gained 0.71% to close at 3,191 and the Nasdaq Composite added 0.91% to reach 8,814.

- Published13 December 2019

- Published13 December 2019

- Published16 December 2019