Sirius: 'You feel sorry for people who've invested a lot'

- Published

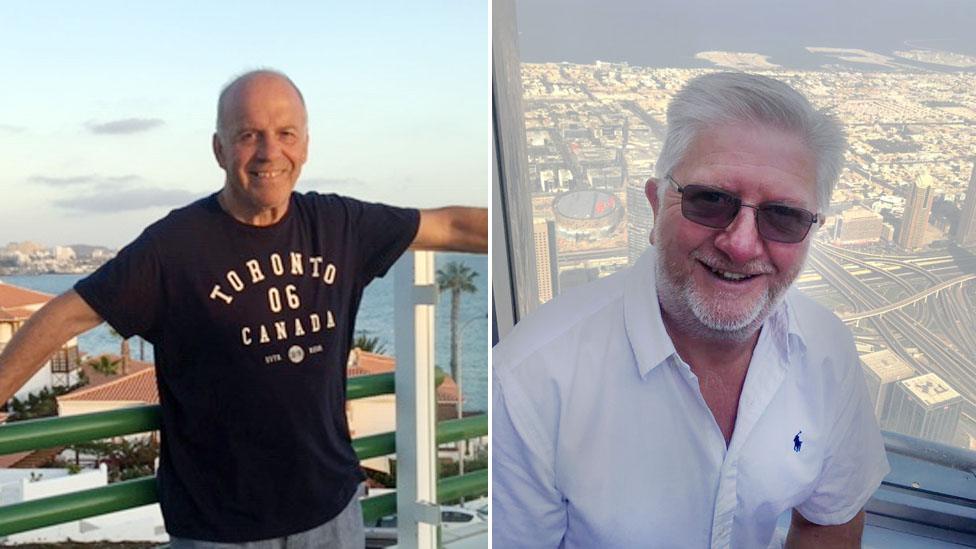

Mark Lightowler has lost two thirds of his investment in Sirius Minerals

Workers on the huge Woodsmith mine may have breathed a sigh of relief after its struggling owner Sirius Minerals received a takeover bid.

Anglo American will buy the mine for £404m, or 5.5p per share.

But since the shares were being bought for 24p each only nine months ago, some small investors are nursing big losses, including those who put entire pensions behind the firm.

"You feel extremely sorry for people who've invested a lot of money," says Mark Lightowler, a retiree who invested in Sirius.

He will lose two thirds of his investment, "but because it was high risk it wasn't very big, it was only a couple of thousand pounds."

He says he will back the deal. It promises to be a good employer in a "difficult area of the country to get work".

No checks?

Sirius says that if shareholders don't accept the offer, there is a good chance the company will go into administration - potentially wiping out their investments.

The firm says £4bn Woodsmith project, its biggest, could potentially create 4,000 jobs, external in a region with the highest unemployment rate in England and Wales.

It mines polyhalite, a mineral used in fertilising crops, from underneath the North York Moors National Park.

The company has 85,000 individual shareholders. About 10,000 of these are located in areas surrounding the Teesside project, where people may have invested for the regenerative benefits for the North East.

The Woodsmith mine site near Whitby

Mr Lightowler said that while free access to stock markets is "utterly fantastic", he feels that it should be harder for people to put large chunks of their money in very risky investments. like mining stocks.

"It has to have a set of checks and balances and controls and it seems entirely lacking."

'Successful project'

Rupert Clewley, a financial consultant in Kent, invested in the company alongside about 30-40 others. He invested about £5,000 and will lose about three quarters of it, he said. But the trick is to pick more winners than losers, he added, and has been stock-watching for 20 years.

"I thought it was quite risky but I'd put some money towards it," he said.

"It's one of those things. It was speculative. It was one of those where you would get nothing, a little bit back, or five or ten times your investment."

Polyhalite can be used as a fertiliser for crops

The situation is "a bit unfortunate as I do think they will be a successful project in a long term," he said.

Anglo American boss Mark Cutifani agrees.

"We look everywhere for projects and we were pleasantly surprised to find something in Yorkshire," Mr Cutifani told the Today programme on Radio 4. He thinks it's got long-term prospects, if only for the most basic of reasons.

"In the future people will continue to eat," he said. "We will need to see more productivity from the agricultural sector and the fertiliser they produce does help the productivity of agriculture."

Mr Cleweley said the bid looks "opportunistic, but probably the only route out of it for shareholders at this point in time."

- Published20 September 2019

- Published18 September 2019

- Published17 September 2019