Flybe: Government considers ownership stake in Flybe

- Published

- comments

The UK government is considering taking a stake in troubled airline Flybe.

The government is in talks with Flybe and the European Commission to ensure any rescue deal does not break state aid rules.

Officials say support given to Flybe so far, such as a pledge to cut tax on some domestic routes, are industry-wide measures.

However, the government is considering extending a loan of up to £100m to the loss-making airline.

Government officials insist that any such loan will be on commercial terms but sources at competitors ask how the government can really mean that if the airline finds commercial lenders unavailable.

Options

There are different ways of answering those potential objections.

First, charge an interest rate on a loan that fully reflects the risk that the government is taking with taxpayer money.

This is the government's preferred option.

Businesses with a loss-making track record should not be able to borrow at super-low interest rates when the risk of default is perceived as high.

However, a loan at high rates of interest could damage the airline's ability to nurse itself back to health because of the hefty repayments required on a high interest loan. You would merely be kicking the can down the road.

Another solution being floated - and described as "possible" by officials - is for the government to extend the loan but reserve the right to purchase shares at a pre arranged (low) price once the airline has returned to health.

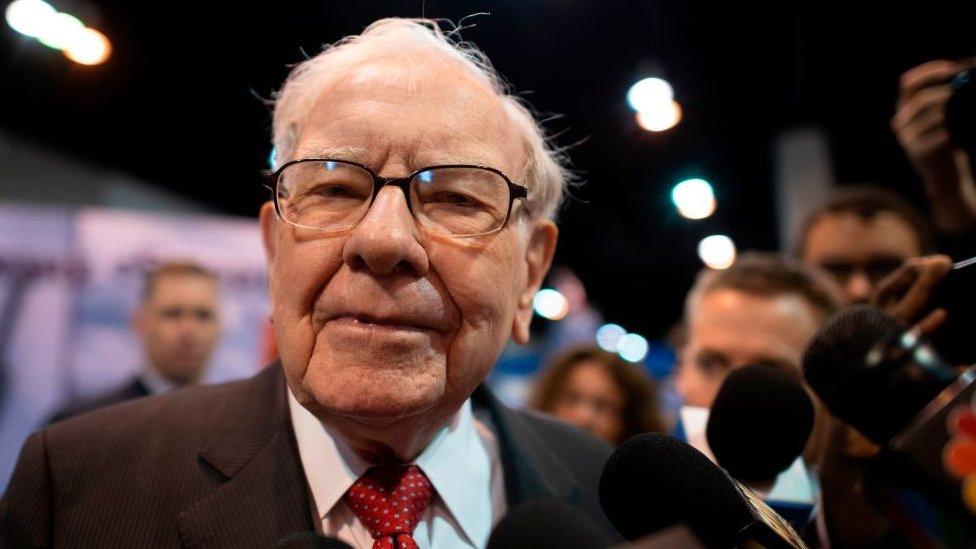

These rights, often described as "warrants", was the manner in which legendary investor Warren Buffett pumped money into investment bank Goldman Sachs during the financial crisis and there are few more commercially savvy financial first aid givers than he.

A government loan to Flybe may be similar to a deal Warren Buffett struck with Goldman Sachs

This approach makes it more likely the airline will be able to pay its debts, which in turn makes it more likely the airline will be worth more in the future, at which point UK taxpayers could reap rewards for the risk taken.

Hey presto - a commercial arrangement thath helps the company now and sees the taxpayer share in any future success.

Uncomfortable territory

To be clear, this is still uncomfortable territory for the government.

However, it has become increasingly clear that it is prepared to push the envelope of what is possible in order to deliver on election commitments to improve regional connectivity to "level-up" Britain. A commitment that might look hollow if Flybe were to collapse.

The EU has told the BBC it is in discussions with the government to ascertain whether financial assistance to Flybe provided to date or in the future could break EU competition rules.

A spokesperson for the European Commission told the BBC that it is the responsibility of member states to decide whether support needs to be notified as state aid - which the UK insists it does not - unless other parties complain that such support is illegal and the EU can then investigate.

British Airways' owner IAG and Ryanair have already done just that in letters to the European Commission over their concerns that the Flybe rescue announced in mid-January amounted to anti-competitive and therefore illegal support.

IAG lodged a Freedom of Information request with the government seeking more detail about the extent of the support package.

The deadline for the government to respond to that is this Thursday.

British Airways-owner IAG has complained to the EC about UK government support for Flybe

IAG boss Willie Walsh has pointed out that Flybe has wealthy owners including BA's arch-rival Virgin Airlines.

Virgin, along with the Stobart haulage group and New York-based hedge fund Cyrus Capital, have agreed to put in £30m to £40m of their own money but that is thought to be insufficient to secure the long-term future of the airline and without a loan to get through the lean winter months, it remains in danger.

Other things that have irritated rivals are Flybe's decision to switch its London-Newquay service from Heathrow to Gatwick - potentially freeing up a Heathrow slot for part owner Virgin Airlines and Flybe's expansion at Southend airport which just so happens to be owned by the Stobart group.

It is not clear how much of the financial support from Flybe's owners has already been exhausted.

The company said on Sunday that "the airline is being supported by its shareholders and leading suppliers, is managing its cash position carefully and currently has strong liquidity"

There are many industry sources who insist that Flybe's problems are more deep-seated. Its business model is broken and the government is risking both wasting taxpayers' money AND creating a dangerous precedent for assisting failing businesses.

As with many things being contemplated - the approval of HS2 despite ballooning costs, a potential mansion tax, prioritising fishing over finance, a raid on pension tax relief - we are dealing with a very different kind of Conservative government.

- Published3 February 2020

- Published15 January 2020

- Published17 December 2019