Metro Bank scales back expansion after heavy loss

- Published

Metro Bank has reported a bruising pre-tax loss of £130.8m for 2019 after an accounting scandal, down from profits of £40.6m the previous year.

It said it planned to cut costs and more than halve branch openings.

The struggling High Street bank will slash new branch openings to 24 over the next three years from a planned 71.

It said there would be no redundancies from the cuts and added that it would offer affected staff the opportunity to relocate to new back-office sites.

Metro Bank's new boss, Dan Frumkin, has described 2019 as a "challenging year", which is somewhat of an understatement.

Last year, it was also the subject of two regulatory inquiries, plus a class action lawsuit. Its share price crashed 90% while deposits shrank and it had to offer new investors a very expensive 9% return to put in the money it needed just to survive.

On Wednesday, Mr Frumkin laid out a new, more modest strategy for growth at a bank that many think is unlikely to emerge as an independent business.

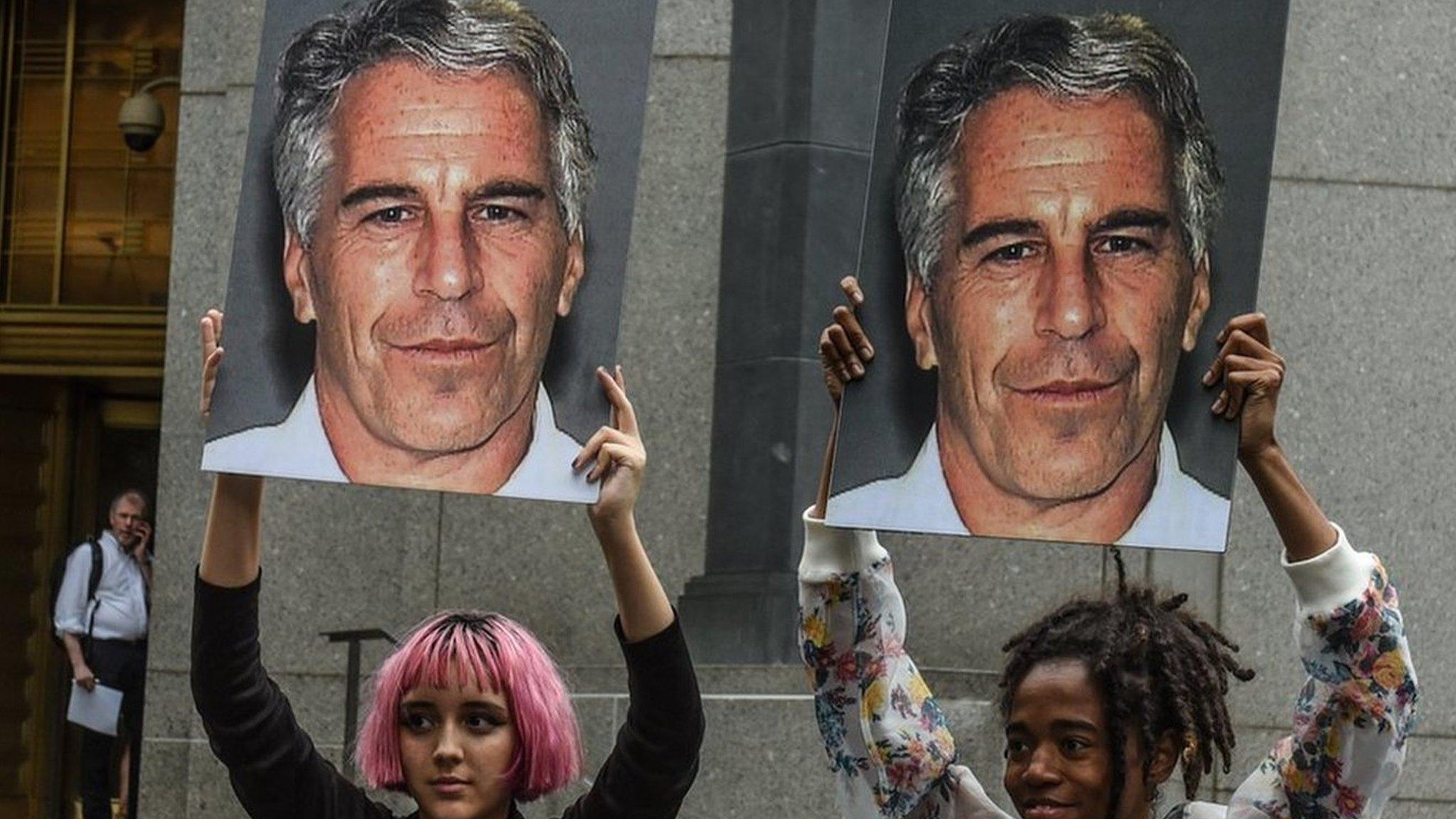

Mr Frumkin says the bank had a "challenging" 2019

While not cutting any stores or jobs, Metro Bank is "putting their foot on the ball" in terms of new branch openings.

As a result, the bank will be giving back some of the £120m it took from a £750m fund that RBS was forced to provide to increase competition in the sector.

The good news is that Metro Bank continues to prove popular with retail customers - whose number grew by almost 25% last year - and, it insists, with small businesses. Its capital ratio is also strong.

In addition, its branches are open seven days a week, something no one else does and lots of people like. But no other bank does it because they do not think it's a way to make money.

The problem is that when one-off costs are stripped out, Metro Bank is still losing money. It reported underlying pre-tax losses of £11.7m against profits of £50m in 2018.

The new boss said this morning that there is nothing wrong with the business plan - it is that the bank has failed to execute. He's making life tough for himself by essentially saying that if it doesn't work from here, then it's his fault.

Can Metro Bank survive on its own - or will it need the support of a bigger parent?

Mr Frumkin insists that "there is a path to Metro surviving as an independent business". Those don't feel like the words of someone who thinks that is the most likely outcome.

- Published13 February 2020