WeWork sues SoftBank after withdrawal of $3bn deal

- Published

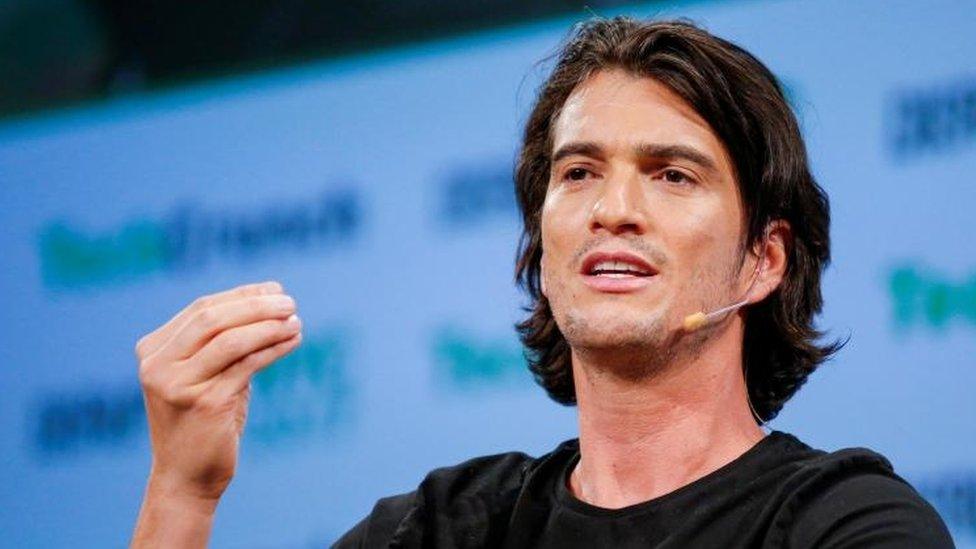

Softbank chief executive Masayoshi Son

WeWork has taken its biggest investor to court after the collapse of a key part of a multi-billion-dollar rescue deal for the troubled co-working firm.

In a lawsuit, WeWork accused SoftBank of putting "its own interests" first when it abandoned a plan to buy up to $3bn of shares from other investors.

SoftBank said last week it would not move forward with the share purchases, external.

The Japanese firm cited investigations into the US start-up and the impact of coronavirus.

Softbank also said it had failed to restructure its business in China, one of the conditions of the rescue deal.

A WeWork special committee, created last year to negotiate the rescue, on Tuesday accused Softbank of deliberately blocking the restructuring.

It said the Japanese investment giant's decision was a "clear breach" of its contractual obligations and called on SoftBank to complete the tender offer or pay alternative compensatory damages.

"The Special Committee regrets the fact that SoftBank continues to put its own interests ahead of those of WeWork's minority stockholders," it said in its announcement of the lawsuit, filed in Chancery Court in Delaware.

WeWork last year accepted a rescue deal from SoftBank, at the time the firm's biggest backer, which provided more than $5bn in financing and a pledge to purchase up to $3bn in shares from other investors.

It came after the collapse of WeWork's flotation plans amid questions about the firm's financial health.

However, the deal was criticised as too generous to ousted WeWork chief executive Adam Neumann, while SoftBank has also faced increased scrutiny over the chequered record of investments such as WeWork.

In November it reported its first quarterly loss in 14 years.

- Published6 November 2019

- Published23 October 2019