Coronavirus: Barclays customers struggle to get 'vital' loans

- Published

- comments

Nicky New runs Rascals Childcare in Essex

Customers of Barclays Bank have been struggling to get emergency money from the Bounce Back Loan scheme which launched on Monday.

Some said they were in despair about being told repeatedly to try again later.

The loans are 100% guaranteed by the government and designed to keep small businesses alive.

Barclays said the vast majority of customers were managing to apply online.

But Nicky New, who runs Rascals Childcare in Essex, has been trying to get a loan since yesterday morning.

"It's absolutely vital. Without this loan we can't cover any of our overheads," she said. "We can't survive - I'll be potentially laying off people."

Firms can apply for between £2,000 and £50,000 to be credited to bank accounts within 24 hours.

There are no interest payments or charges for the first year and interest is fixed at 2.5% for the rest of the term of up to six years.

More than 100,000 businesses applied to the major banks for Bounce Back Loans on Monday, with NatWest and RBS processing 58,000 applications and Lloyds more than 32,000. HSBC has processed nearly 32,500.

Barclays said it had approved more than 32,000 of the loans as of 16:00 on Tuesday.

Mental health

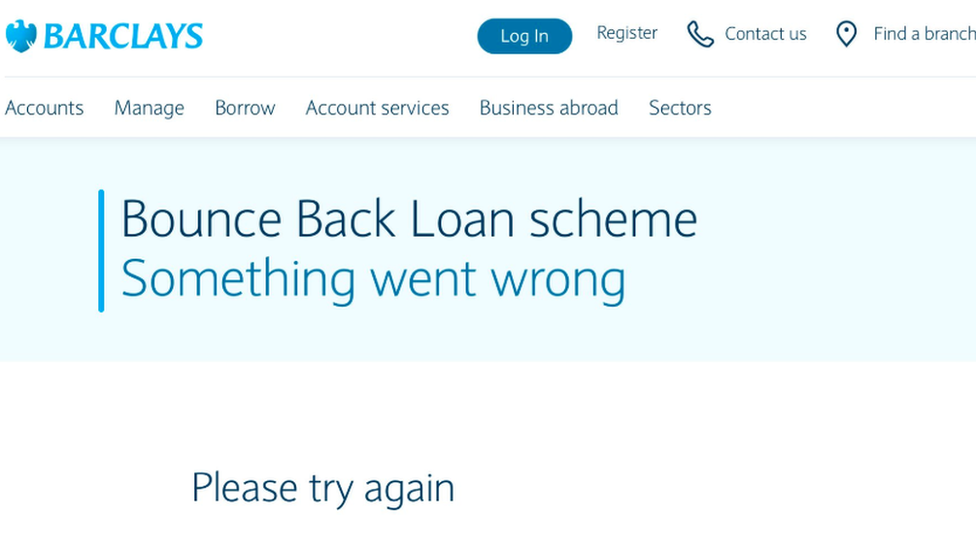

Another customer, Nick, who runs an oil and gas technology consultancy in Berkshire, started trying to apply for a Barclays loan at 8am on Monday but has repeatedly had the message "something went wrong" flash up on his screen.

"I feel incredibly pressured. I have people crying their eyes out," he said. "The bulk of my people are at home. There are serious mental health issues with the worry about livelihoods and food."

Some customers are reporting difficulties in applying for so-called Bounce Back loans

Nick is an expert in IT systems and believes that Barclays systems are completely overloaded.

He wants to apply for a £42,000 loan to tide his business over the next few months.

Barclays customers have been complaining in large numbers on Twitter and other social media.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Barclays UK chief executive, Matt Hammerstein, told MPs on the Treasury Select Committee on Monday that his systems were "definitely not down" but that "some who wanted immediate access may not have been able to."

He said Barclays would "throttle up access" but problems with the online applications have persisted.

A spokesperson for Barclays said: "Over the last 24 hours we have approved thousands of Bounce Back Loans to get hundreds of millions of pounds into the hands of small businesses.

"Since we went live yesterday, the vast majority of our customers have been able to apply online and get same-day approval so that we will have the funds in their account by tomorrow at the latest.

"There are some exceptions where customers will need to confirm additional details and we're reaching out to them shortly to confirm next steps."

- Published4 May 2020

- Published30 April 2020