Coronavirus: 'More normal' shopping habits are back, says Ocado

- Published

Ocado says "more normal" shopping habits are back after a huge jump in demand amid the coronavirus lockdown.

Its customers are now purchasing fewer items than at the peak of demand, with the balance between fresh and long-life food returning to normal.

The online grocer has made changes to increase the delivery slots available, including suspending the delivery of mineral water.

Its revenues in April were up more than 40% from a year earlier.

"At the beginning of the outbreak demand increased significantly, almost overnight," the retailer said.

It limited the number of items on sale initially in order to stop customers from panic buying.

Ocado said these limits have since been rolled back as the number of items shoppers are putting in their baskets "appears to have passed its peak but remains high".

Coronavirus 'challenges'

Tim Steiner, chief executive of the Ocado group, said: "We are facing quite a different challenge to many, as we scale up Ocado.com to play its part in feeding the nation."

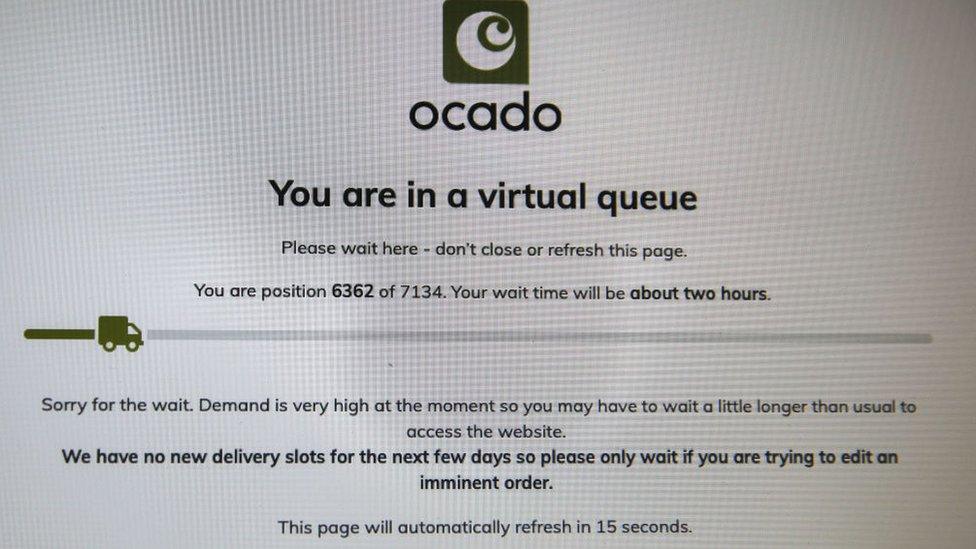

The supermarket has drawn criticism on social media as customers faced being one of thousands in a virtual queue to place a food order.

It was previously forced to suspend its entire service briefly, and temporarily took down its app due to the spike in orders.

Currently, new customers are not able to place orders with the retailer due to a lack of available delivery slots.

On its website, the firm says it is focusing, external on delivering food to vulnerable, as well as its longest-standing customers.

Mr Steiner added: "Ocado remains in a strong position and we should be grateful that our current challenges are around growth, expansion and increased demand."

However, the company suspended its revenue forecasts due to the uncertainty over how shoppers will react in the long run.

"Although we expect the long-term shift towards online grocery to accelerate post-crisis, there remain many uncertainties about the length of the crisis, customer reaction immediately post and its long-term impact on customers' disposable incomes."

'Well placed' for lockdown

John Moore, senior investment manager at Brewin Dolphin, said that Ocado has had a very different experience of the coronavirus lockdown to most businesses.

"While the wider market has dropped, its shares have surged more than 50% in the year to date in anticipation of the business being well placed in the lockdown," he said.

"Ocado was becoming the UK's stock market's most prominent and, arguably, important technology company before the crisis - that status has only accelerated over the past couple of months."

Sophie Lund-Yates, equity analyst at Hargreaves Lansdown also suggested that the business is in a good position as shoppers shift to online.

M&S announced last year that it would go into partnership with Ocado from September this year, replacing the online grocer's existing deal with Waitrose.

Under the deal, M&S is buying a 50% share of Ocado's retail business for £750m. Ocado will also continue to supply its own-label products and big-name branded goods.

"For now, the indicators suggest more deals could be on the cards in the near future," Ms Lund-Yates said.

Pay row

Ahead of the firm's annual general meeting, one investor said that it would vote against Ocado's pay policies, despite its recent performance.

Group chief executive Tim Steiner received £58.7m in total pay in 2019. He got the windfall after an incentive scheme tied to the firm's share price paid out.

Royal London, which has a small stake in Ocado, said it would oppose Mr Steiner's payout, calling it "excessive".

Several other firms posted trading updates on Wednesday which detailed how they had been affected by the coronavirus pandemic.

ITV reported a 42% slide in advertising revenues in April as firms cut back on marketing

Cycle and car repair firm Halfords said sales were 23% below last year in the four weeks to 1 May, although that was better performance than expected

Insurer Direct Line said that motor insurance claims fell by 70% last month, as people stayed indoors under lockdown. However, it also said it expected to take a £44m hit from travel insurance claims.

A SIMPLE GUIDE: How do I protect myself?

AVOIDING CONTACT: The rules on self-isolation and exercise

HOW A VIRUS SPREADS: An explanation

LOOK-UP TOOL: Check cases in your area

TESTING: Can I get tested for coronavirus?

- Published5 May 2020

- Published31 March 2020