US retail sales in record monthly rebound

- Published

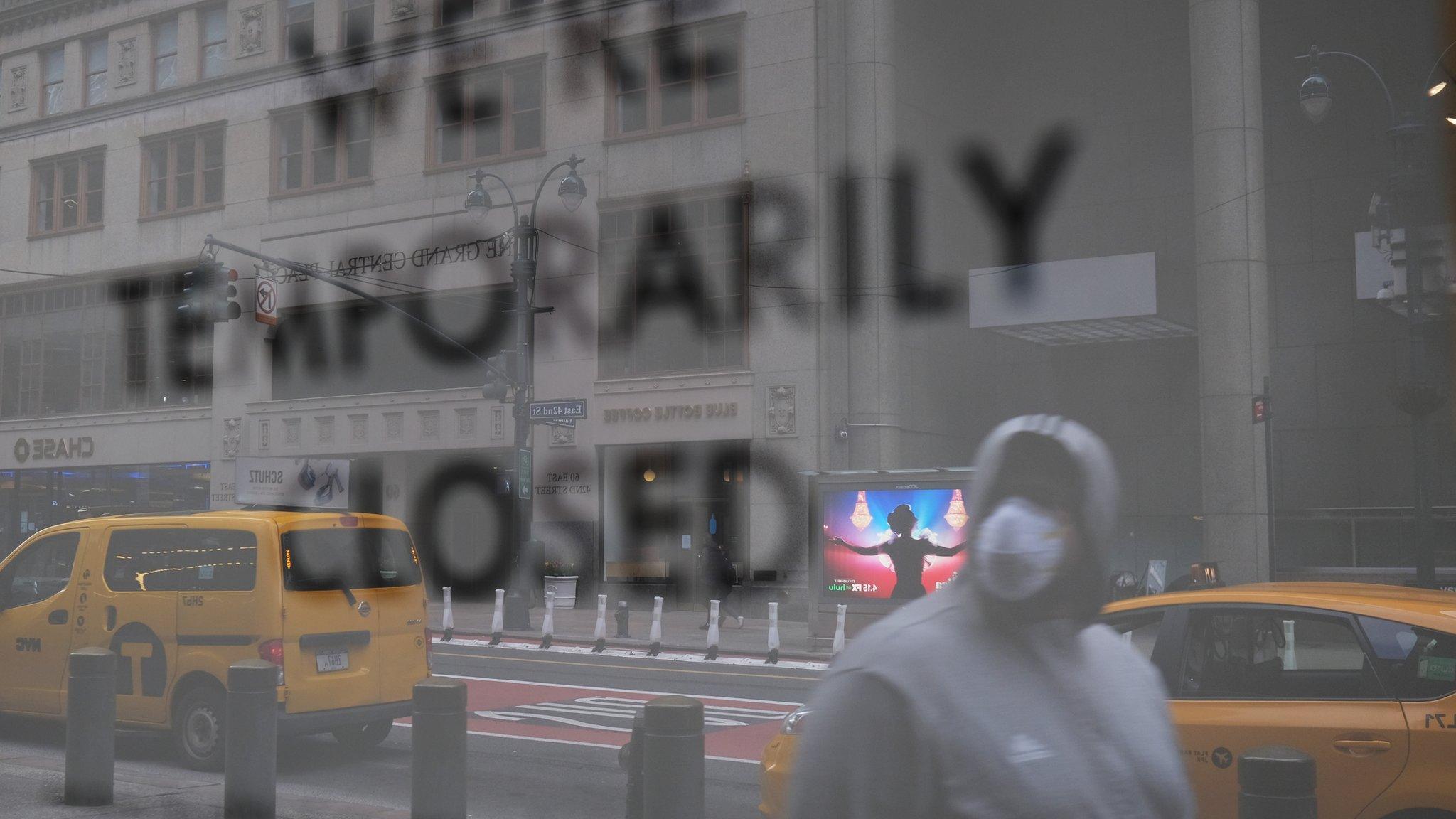

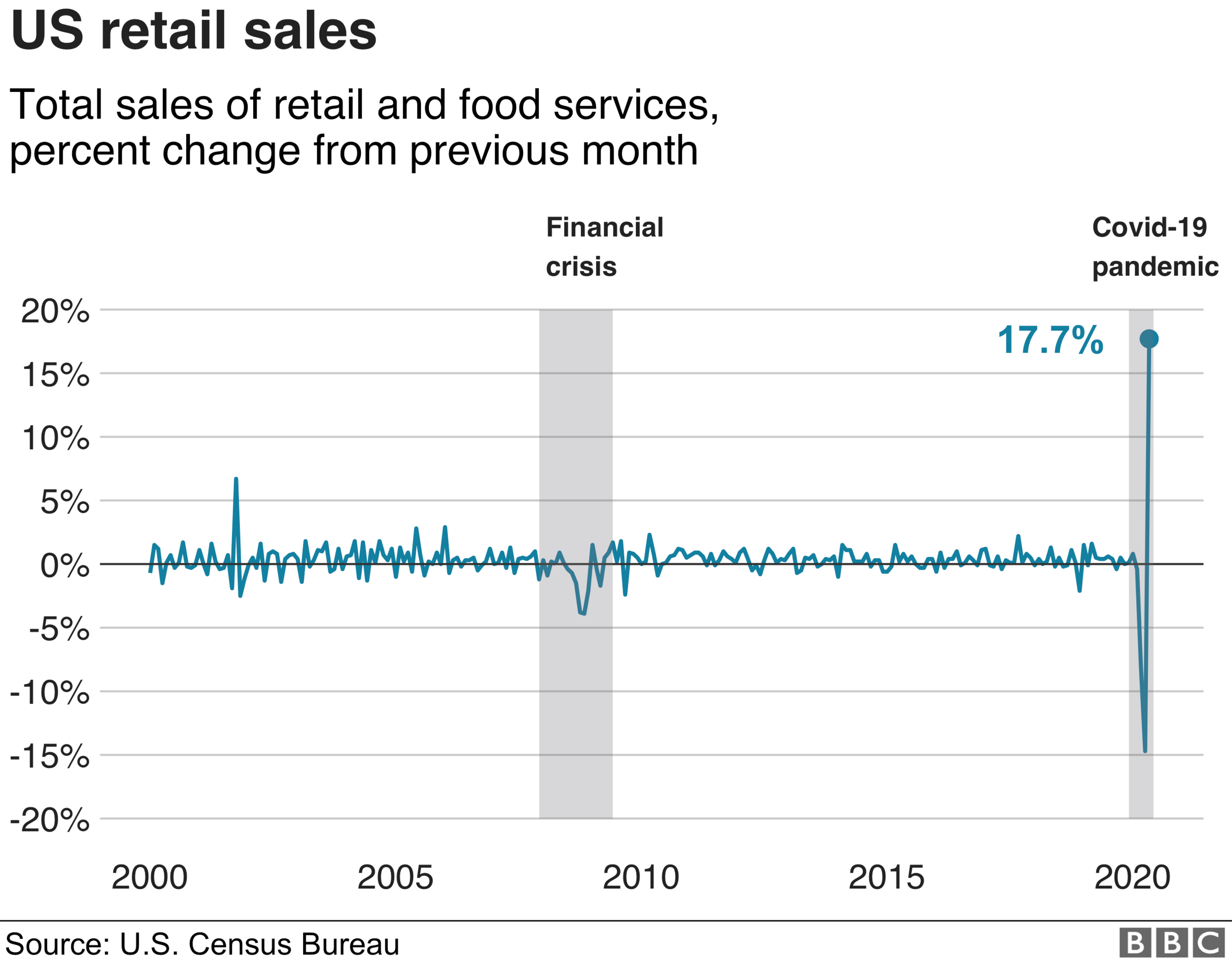

American shoppers returned in force in May, fuelling a record 17.7% monthly gain in retail spending after the lockdown triggered devastating declines in the previous months.

The rebound only partially made up for the losses, leaving spending down about 6% year-on-year.

And some sectors, such as clothing stores, have seen far steeper declines.

Still, the increase added to hopes that the economic recovery will be faster than predicted.

Last month, US employers also added a surprise 2.5 million jobs and the unemployment rate fell to 13.3%.

Capital Economics said it now expects the US economy to contract at an annual rate of 30% in the three months to July, compared to its previous more than 40% estimate.

But, senior economist Andrew Hunter warned: "There is still considerable uncertainty over whether spending will continue to recover at this pace over the coming months, particularly given the more recent upturn in new coronavirus cases in a number of states."

US share prices headed higher on the stronger-than-expected figures, rising more than 2% in opening trade.

Online companies benefited the most from the spending, with sales up more than 30% on the year. Building material and garden stores gained 16.4%.

Sales at clothing stores, however, remained more than 60% lower, while spending at restaurants and bars was nearly 40% down.

Speaking to Congress on Tuesday, Federal Reserve Chairman Jerome Powell acknowledged the signs of improvement but warned that "significant uncertainty remains about the timing and strength of the recovery".

"Much of that economic uncertainty comes from uncertainty about the path of the disease and the effect of measures to contain it," he said. "Until the public is confident that the disease is contained a full recovery is unlikely."

Mr Powell said a "significant number" of the more than 20 million people who have lost jobs in recent months are unlikely to return to work any time soon, especially in sectors - such as food and travel - hardest hit by the pandemic. And some of those jobs may never return, he said.

On Tuesday, the Hilton hotel group said it would cut 2,100 corporate jobs around the world, a move it said was needed to protect the business.

The company also extended previously announced furloughs, reduced hours, and corporate pay cuts for up to an additional three months.

"Never in Hilton's 101-year-history has our industry faced a global crisis that brings travel to a virtual standstill," chief executive Christopher Nassetta said.

- Published6 July 2018

- Published8 June 2020