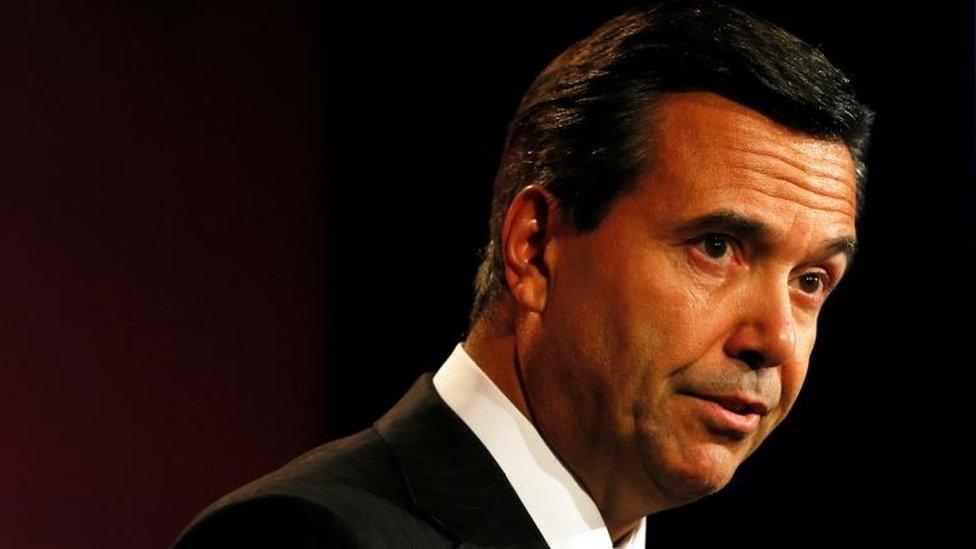

Lloyds boss António Horta-Osório to step down next year

- Published

Lloyds Banking Group chief executive António Horta-Osório will step down next year after spending a decade at the helm.

Mr Horta-Osório said he had "mixed emotions" about the decision, which the bank said would see him leave the role by the end of June 2021.

As part of the shake-up, Lloyds also appointed industry veteran Robin Budenberg as new chairman.

Last year, Lord Blackwell said he would retire as Lloyds chairman during 2020.

Lloyds said in a statement, external that the 12-month timeframe for the appointment of a replacement chief executive would allow a smooth transition.

Until then Mr Horta-Osório would remain focused on delivering the bank's current strategic plan, and steer the bank through some of the international effects of the coronavirus crisis, Lloyds said.

The Portuguese executive joined Lloyds in 2011, having been chief executive of Spanish-owned lender Santander UK. Since then he has overseen three strategic plans as the bank emerged from the global financial crisis and the UK government unwound its £21bn bailout stake in the lender. Lloyds returned fully to private hands in 2017.

Mr Horta-Osório was once the best paid chief executives in the FTSE 100, and his lucrative bonus scheme came in for strong criticism at the time when Lloyds was cutting jobs and branches.

He also hit the headlines soon after taking over a Lloyds when he took two months off work to deal with severe stress. He has since been a campaigner to improve mental health awareness.

Mr Horta-Osório said on Monday: "I have been honoured to play my part in the transformation of large parts of our business. I know that when I leave the group next year, it has the strategic, operational and management strength to build further on its leading market position".

Separately, Lloyds said Mr Budenberg would join the board in October and take over as chairman in early 2021 when Lord Blackwell steps down.

As well as having a long career in investment banking, Mr Budenberg worked closely with the UK government in 2008 as an adviser on the recapitalisation of the UK banking industry.

In 2009 he became chief executive, then chairman, of UK Financial Investments, with responsibility for managing the UK government's investment in UK banks, including Lloyds.

António Horta-Osório arrived at Lloyds when it was still trying to recover from the trauma of the credit crisis, when an ill-advised deal - the purchase of struggling rival Halifax Bank of Scotland (HBOS) - left it so financially weakened that it had to be bailed out by the government.

He set the bank back on its feet, despite it having to pay up billions of pounds in compensation to customers who had been mis-sold payment protection insurance. Critics might say that Lloyds' strong market share in retail and small-business banking meant recovery was an inevitability once the economy sprang back to life, but Mr Horta-Osório made sure it happened, and was handsomely rewarded.

His successor - and Lloyds' new chairman, the City veteran Robin Budenberg - will now have to wrestle with the strategic challenge that has confronted the leadership of the bank for the past three decades.

Lloyds' iron grip on the UK market is its strength, and a potential weakness, leaving it with little room to grow in the UK and particularly exposed to the ups and downs of the British economy. Mr Horta-Osório did broaden Lloyds' base with the purchase of a big credit card business, but the next question will be whether it should take the leap into an international acquisition.

Previous attempts have not gone well - but the issue of over-reliance on the UK will not go away.

- Published9 April 2020

- Published11 June 2020