Ex-Barclays bankers call female boss 'tart' and 'dolly bird'

- Published

A financier embroiled in a £1.6bn court battle with Barclays was referred to as a "tart" and "that dolly bird" by bank executives, a court has heard.

The comments about Amanda Staveley were made in phone calls in 2008 when the bank was trying to raise billions of pounds from Gulf states.

Ms Staveley was involved in talks with investors to help broker the deal.

But ex-Barclays boss Roger Jenkins told the court she was a "complete unknown" when it came to such transactions.

In a written witness statement, Mr Jenkins said that at the time Ms Staveley had received "some publicity" for her role in brokering an investment in Manchester City.

But he told Mr Justice Waksman that, as far as he knew, she had "no qualifications in finance".

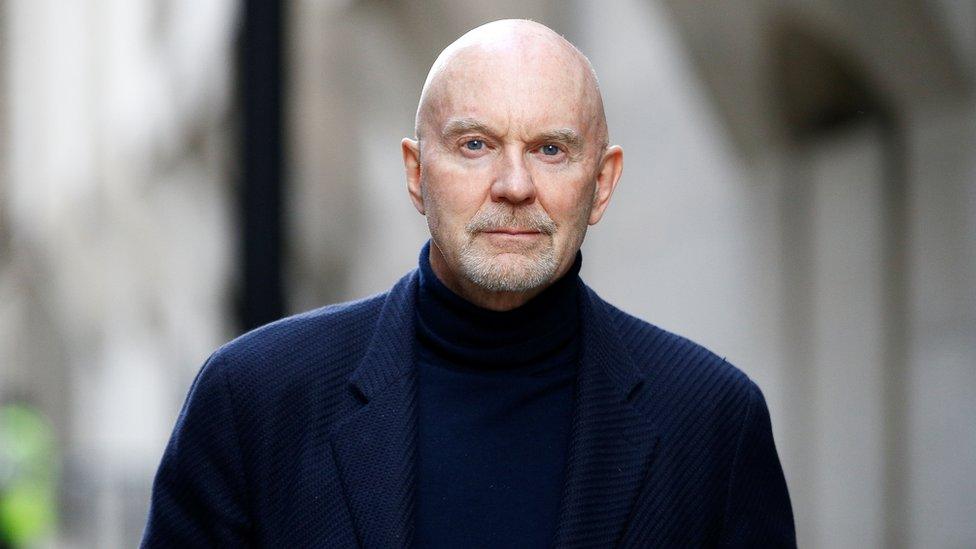

Former senior Barclays banker Roger Jenkins referred to financier Amanda Staveley as 'the tart'

The judge has heard that Mr Jenkins referred to Ms Staveley as "the tart" during an October 2008 telephone call with fellow Barclays boss Richard Boath.

Mr Boath referred to her as "that dolly bird" during the call.

Ms Staveley, 47, has made complaints about the behaviour of Barclays bosses when negotiating investment deals during the crisis 12 years ago.

She says Barclays agreed to provide an unsecured £2bn loan to Qatari investors, but the loan was "concealed" from the financial markets, shareholders and PCP Capital Partners, a private equity firm she runs.

PCP is suing the bank for up to £1.6bn in damages.

Ms Staveley, currently working on a deal which could see a Saudi consortium take control of Newcastle United football club, says PCP introduced Manchester City owner Sheikh Mansour to Barclays and he "subscribed" to invest £3.25bn.

She says PCP is owed money for the work it did. Barclays disputes PCP's claim and says it is made "of sand".

Mr Jenkins said: "Ms Staveley, as leader of PCP, had received some publicity by 2008 for her role in brokering the Abu Dhabi investment in a major English football club, but she was a complete unknown in terms of large, complex, public market transactions of the kind we were undertaking."

'Self-publicity'

At the time, he was Barclays executive chairman of Middle East business. "So far as I knew at the time, PCP did not employ experienced analysts familiar with the finance sector and Ms Staveley herself had no qualifications in finance."

He said he knew little about Ms Staveley's background in 2008. "I was aware that she had once owned a restaurant by a racecourse and that was how she had made connections with Middle Eastern individuals," he said.

"I knew that she had played a role in Sheikh Mansour's purchase of Manchester City."

He added: "My assumption and hope at the time was that Barclays would deal with Sheikh Mansour directly as the principal, not through advisers.

"I did not at any point understand PCP to be acting as a principal, or as a prospective investor in its own right."

Ex-Barclays senior banker Richard Boath called Amanda Stavely "that dolly bird"

Mr Jenkins said his impression was that Ms Staveley was seeking to use her involvement in the deal to "generate publicity for herself". He told how Ms Staveley arrived for one early-morning meeting accompanied by a photographer.

Lawyers representing PCP referred to the telephone conversation between Mr Boath and Ms Staveley early in the trial.

Detail of the words used emerged on Thursday, when Mr Jenkins began giving evidence and a transcript of the call was made available to journalists.

Mr Boath said, during the October 2008 call: "Yes. Now, that dolly bird that represents - is it - what's her name?", the transcript showed.

Mr Jenkins replied: "Amanda Staveley."

Later in the call, Mr Jenkins said: "Well I am - you know, I'm going to call the tart; I was going to call the tart."

Mr Boath asked: "Who's the tart?" Mr Jenkins replied: "Amanda."

In February, Mr Jenkins, Mr Boath, and another former Barclays boss, Thomas Kalaris, were cleared of fraud over a £4bn investment deal with Qatar at the height of the banking crisis.

The Serious Fraud Office had alleged that lucrative terms given to Qatar were hidden from the market and other investors through bogus advisory service agreements.

But the three men were acquitted by jurors following a five-month trial at the Old Bailey.

- Published16 June 2020

- Published28 February 2020