Mortgage prisoners: Key workers in 'financial nightmare'

- Published

Key workers Kevin and Melissa Antwhistle are stuck in "a financial nightmare" because of their mortgage

MPs are calling on the government to step in and help more than 170,000 "mortgage prisoners" who are trapped on high interest rates.

Thousands of frontline workers, including nurses and hospital workers, are forced to pay double the interest they would on a competitive mortgage.

Strict affordability rules prevent them from re-mortgaging to a cheaper deal.

MPs now want the government to order regulators to investigate capping the profits firms make from the borrowers.

They are asking for the Competition and Markets Authority (CMA) and the Financial Conduct Authority (FCA) to undertake a joint consultation and introduce a cap on standard variable rates.

The Treasury said it sympathises with the situation of borrowers who cannot switch mortgages if, for example, their loan is too high against the value of their home or because they are now too old to re-mortgage.

Last October, the FCA reformed the affordability rules to allow lenders to help mortgage prisoners with cheaper home loans.

But so far not a single lender has done so.

Some key workers, who are also mortgage prisoners, say the financial pressure caused by paying far more than other homeowners is worsening the considerable stress of being on the frontline during the coronavirus pandemic.

'Financial nightmare'

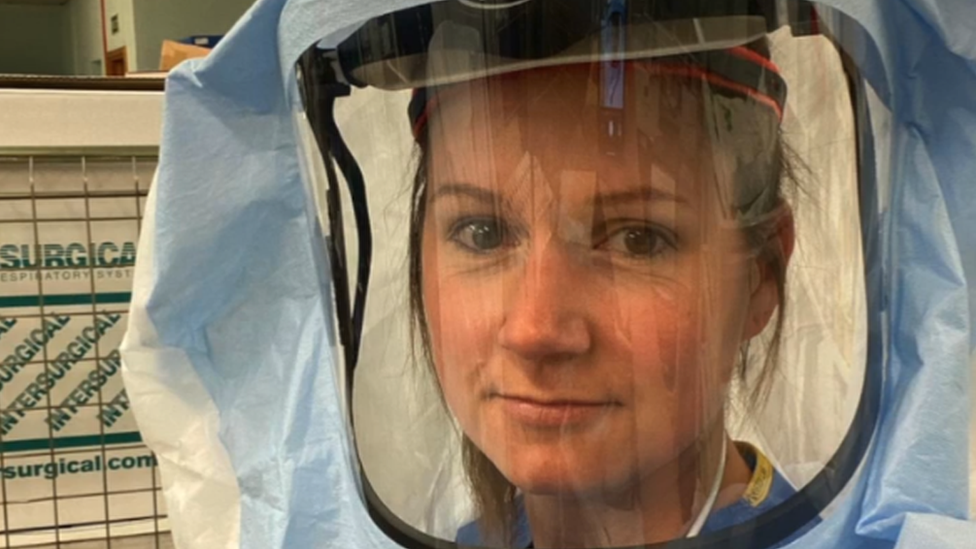

Melissa Antwhistle has been dressing in protective equipment every day for round-the-clock shifts on the frontline at Scunthorpe general hospital, including in the intensive care unit.

But financially, she feels far from supported.

Speaking between shifts, she said: "Many mortgage prisoners are key workers like my husband and me. Doing this job with all the stress of Covid and also looking after our children aged one and three, we could do without the extra stress and anxiety of this financial nightmare.

Melissa Antwhistle is a frontline NHS worker

"While the nation clapped for key workers every Thursday evening in admiration, in fact we have been risking everything not just to fulfil our vocations but also because we were forced to work round the clock just to keep a roof over our heads."

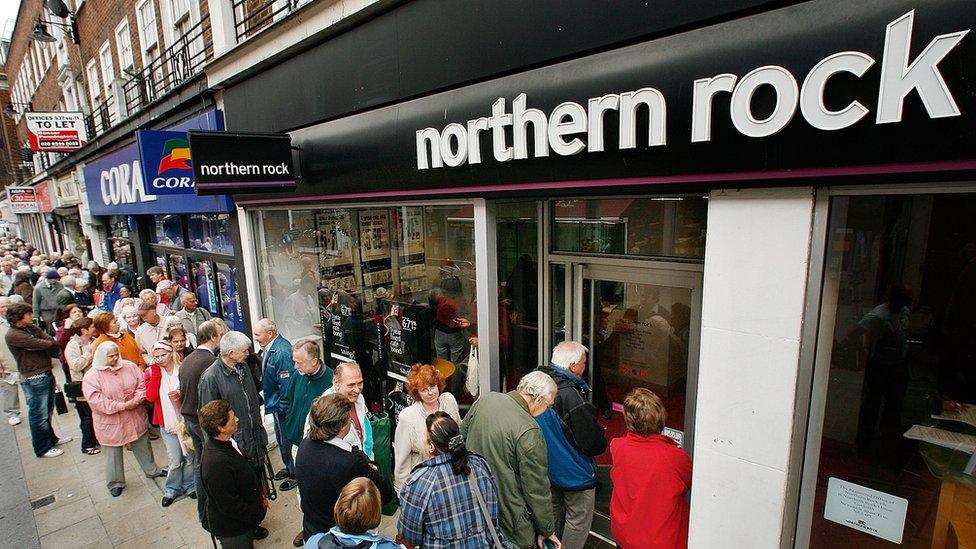

Her husband Kevin - also a key worker who runs and maintains a power station on the south Humber bank - bought his £120,000 house with a mortgage from Northern Rock and an unsecured loan on top in 2007.

Northern Rock's "Together" mortgage was approved at the time by regulators under the oversight of the Treasury.

But it's a decision he has had 13 years to regret.

After it was nationalised, the Treasury put his loan along with hundreds of thousands of others into a new entity called Northern Rock Asset Management (NRAM).

The Treasury then allowed NRAM to make bigger profit margins on standard variable rate mortgages, preparing the way for the sale of a portfolio of mortgages to private investors who could make large profits from the repayments Kevin and Melissa were making.

His loan was then sold in 2014 as part of a £13bn portfolio of loans to private investors whose mortgage interest rates were outside the regulation of the FCA.

Northern Rock collapsed in September 2007 before being nationalised

It was the biggest privatisation in UK history, meeting the Treasury's long-cherished goal of re-privatising the mortgage assets nationalised in the 2008 financial crisis.

However, the investors purchasing the loans were typically 'inactive' lenders, meaning they were not willing or able to offer competitive new deals to existing borrowers.

It meant that when their initial fixed-rate interest rate deals expired, Kevin and Melissa could not re-mortgage to a cheaper deal with their existing lender.

Instead they moved on to the high standard variable rate where they paid interest rates of between 6% and 9%, compared to loans of less than 3% had they been able to re-mortgage.

Melissa and Kevin have been paying £780 a month on their Northern Rock loan, compared to £420 or less if they could re-mortgage. But because they borrowed more than the value of the property, the regulators' affordability rules now say they can't re-mortgage.

The rules, in other words, say they can't afford to pay less.

"Watching the widespread financial support during the current crisis has been a bitter pill to swallow. For many years we've been blamed for being ill-prepared and told that buying a mortgage is the risk you take," Kevin says.

"Yet whilst we're asked to risk our lives and take risks with our families' health, making huge sacrifices, we continue to be financially exploited without any choice. Our job is vocational but also necessary to pay the crippling interest rates."

'Immediate action'

Rachel Neale of the UK Mortgage Prisoners campaign said appeals to the Treasury to help key workers and others trapped on high-interest loans haven't helped a single mortgage prisoner.

"Families are being crippled by these high interest rates and aren't able to live properly because of it. We need action immediately before things get even worse and drive people into further arrears or cause repossessions."

In a letter to the Competition and Markets Authority, the all-party parliamentary group on mortgage prisoners says even during this period of record-low official rates, mortgage prisoners are typically paying 4.4%, two and half times the most competitive rates of 1.8% or less.

Campaigner Rachel Neale says families are being "crippled" by high interest rates

"Mortgage prisoners are being exploited, by both fully regulated lenders and unregulated vulture funds by being held on high standard variable rates, "says the letter, signed by LibDem, Conservative and Labour MPs.

"We believe that the only way mortgage prisoners will see the vital improvements they need within an acceptable timescale will be for the CMA and the FCA to conduct a joint consultation and introduce a cap on standard variable rates."

A spokesman for the Treasury said: "We know that being unable to switch your mortgage can be stressful.

"That's why we've introduced rules that will make it easier for some customers to change provider, which we now expect to be in place by the end of the year.

"The Financial Conduct Authority has also reiterated to lenders that customers on variable rate mortgages must be treated fairly, and that lenders should be actively reviewing their rates."

- Published3 July 2020

- Published18 December 2019