Will we be getting our cash from shops, not ATMs?

- Published

- comments

People will be able to ask for cash from local shops - even if they do not buy anything, under government plans.

The Treasury proposals come amid growing concern over cash deserts, when local communities have little access to notes and coins owing, in part, to the closure of bank branches and ATMs.

It also wants the Financial Conduct Authority (FCA) to take control of securing the future of cash.

A major report recently criticised the "fragmented" response to the issue.

Virus effect

As the UK moves towards greater use of digital payments, the use of cash is predicted to decline. Ten years ago, cash was used in six out of 10 transactions but by 2019 it was used in fewer than three in 10 purchases.

Coronavirus is expected to have hastened a further decline.

Experts say this is likely to put the infrastructure of cash delivery and processing at risk, leaving people in some areas - particularly in rural locations - unable to deposit or access cash easily.

Two reviews have said that older and lower-income consumers who tended to use cash more would be put at risk if nobody took responsibility for stopping the slide in cash access. One said the UK was "sleepwalking" into becoming a cashless society.

Now the Treasury has launched a six-week "call for evidence", external, inviting views on how to ensure withdrawing and depositing cash would still be possible, as well as asking how to improve cashback, what affects cash acceptance, and where regulatory responsibility should sit.

It said it had no plans to demand that shops must accept cash, but that cashback from stores of all sizes without the need to make a purchase could play an important role in the future.

The Treasury said EU law made it difficult for businesses to offer cashback when people were not paying for things, meaning it was not widely adopted. It was considering scrapping these rules.

In contrast, last year, shoppers received £3.8bn of cashback when paying for items at a till, making it the second most used method for withdrawing cash in the UK behind ATMs.

John Glen, economic secretary to the Treasury, said: "We want to harness the same creative thinking that has driven innovation in digital payments to maintain the UK's cash system and make sure people can easily access cash in their local area."

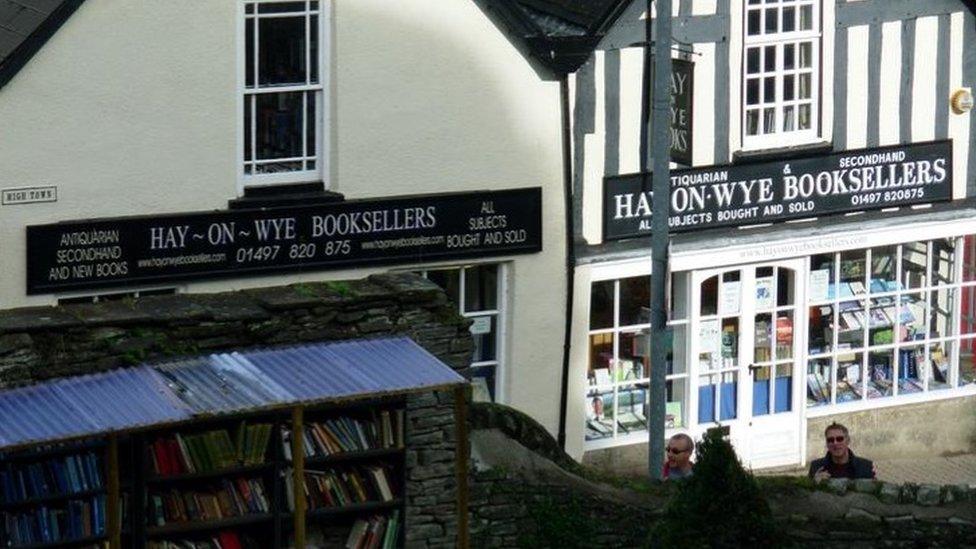

Hay-on-Wye, home of a major book festival, is one area that will hold a trial

The timing of the review may be considered as curious - coming shortly after eight trials were announced to test ways to help solve problems with access to cash.

The trials - including tests of no-purchase cashback - have months to run before drawing any conclusions. A Treasury spokeswoman said the call for evidence was "compatible and complementary" with the trials.

The Treasury also wants views on putting the Financial Conduct Authority in charge of ensuring that the cash system benefits consumers as well as small and medium-sized businesses.

In September the National Audit Office said it could not currently see a clear link between the government's aim to protect access to cash and which of the various public bodies involved in overseeing the cash network could actually make it happen.

Natalie Ceeney, who led the Access to Cash Review which revealed eight million people were at risk in the UK from the demise of cash, said: "This [Treasury consultation] is increasingly urgent. Last year we warned that the UK was sleepwalking into a cashless society. Covid-19 has placed even greater strains on the whole system.

"The devil will be in the detail and I look forward to seeing the government's proposal in full."

- Published23 September 2020

- Published18 September 2020

- Published6 March 2019

- Published19 February 2020