Coronavirus 'will hasten the decline of cash'

- Published

- comments

Coronavirus will hasten the decline in the use of cash as people make a long-term switch to digital payments, experts say.

The lockdown has led to a 60% fall in the number of withdrawals from cash machines, although people are taking out bigger sums.

Payment card use has risen with online shopping, particularly for groceries.

Experts say the long-term future of cash could be at risk, before the UK is ready to cope with the change.

This could leave behind an estimated 20% of the population who rely on cash, they say.

About 11 million cash withdrawals are still being made each week, with £1bn taken out, according to Link, which oversees the UK's cash machine network.

Yet, with many shops as well as bars, cafes and restaurants closed, there is less demand for regular cash withdrawals. People are going out less, but potentially hoarding more cash.

The average ATM withdrawal has risen from £65 last year, to £82 now.

'We can process cash in a couple of seconds'

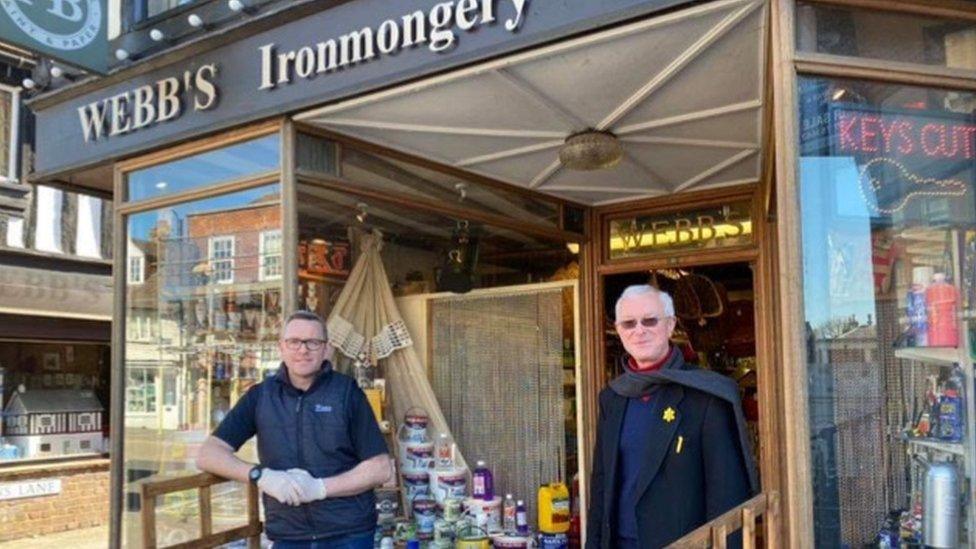

Webb's Ironmongery Store is serving customers outside

Established more than 100 years ago, Webb's Ironmongery Store has seen locals through many a crisis.

In the current emergency the hardware shop at Tenterden, Kent, is serving items such as garden and home equipment, and paint, from a counter set up in the doorway of the shop.

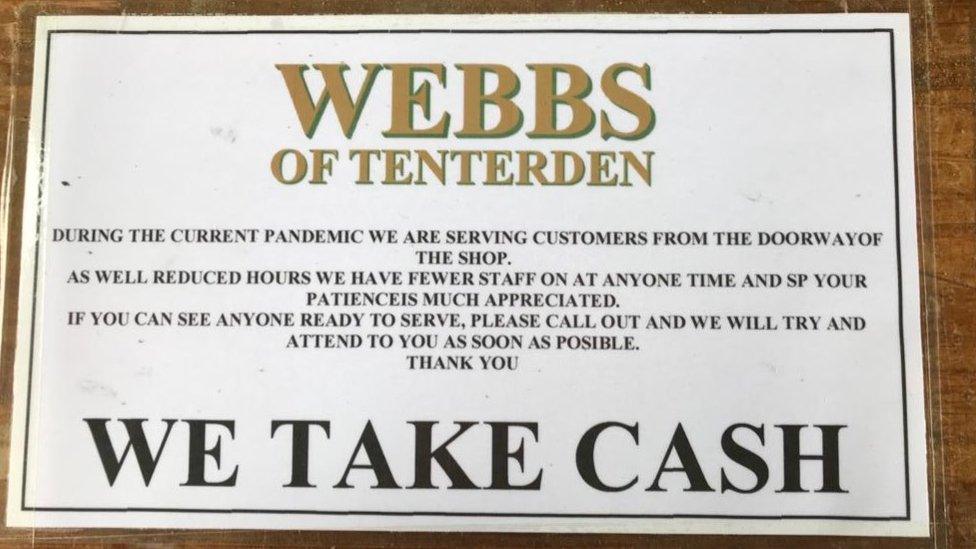

In order to ensure customers do not have to wait, given social distancing, it has put a sign up pointing out that cash is still accepted.

Sign at Webb's saying they take cash

"We are trying to serve as many people as possible, so they can get it done and we can send them on their way," said co-owner Nigel Webb.

"We take cards, but they may have to wait for the machine. We can process cash in a couple of seconds."

Cash use falling

Following a survey of consumers, Link suggested that 75% of people were using less cash, and 54% of those asked said they were avoiding cash.

There were reports early in the coronavirus outbreak about the spread of the virus on banknotes and coins. However, the Bank of England and World Health Organization have stressed that the risk is no greater than on any other items, and repeated the advice on regular hand washing.

Some 76% of people asked in the survey said they expected to use cash less and move instead to other forms of payment, or online shopping more in the next six months.

Natalie Ceeney, who authored a major report on access to cash,, external said that an estimated 30% of UK residents liked having cash as an option but, as a result of lockdown, may now be comfortable using other methods of payment. She described this as a "sticky habit", which they could stay with in the future.

With 50% of the population already operating predominantly cashless, that left only 20% who relied on notes and coins, many of whom were vulnerable.

Their demand risked being insufficient for the providers of cash infrastructure, such as delivery and ATM services, to be profitable enough to survive. "The cash infrastructure could collapse before we are ready," she said.

But Martin Smith, from cash in transit company Pivotal, said: "It will be hard to judge the true impact of Covid-19 until businesses have reopened. The pandemic has certainly has not changed many of the key reasons why people use cash, including convenience and lack of access to bank accounts."

Will this be seen in future years as the crisis which finally ended our love affair with cash? Many shoppers are suspicious of handling it, worried about anything another person might have touched.

Traders who used to wince if you showed them your plastic are happily bringing out their card readers from the back of the stall. These findings do also show that in uncertain times some cling to their notes and coins even more tightly.

And they may be struggling to get hold of cash because they can't leave their homes. But right now there seems little doubt the virus is speeding up the switch to electronic payments.

A SIMPLE GUIDE: How do I protect myself?

AVOIDING CONTACT: The rules on self-isolation and exercise

HOPE AND LOSS: Your coronavirus stories

LOOK-UP TOOL: Check cases in your area

VIDEO: The 20-second hand wash

What questions do you have about your money?

In some cases your question will be published, displaying your name, age and location as you provide it, unless you state otherwise. Your contact details will never be published. Please ensure you have read our terms & conditions and privacy policy.

Use this form to ask your question:

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or send them via email to YourQuestions@bbc.co.uk, external. Please include your name, age and location with any question you send in.

- Published22 April 2020

- Published13 April 2020

- Published19 December 2018

- Published1 May 2019