New government Covid scheme to pay up to half of wages

- Published

- comments

Demand in pubs and restaurants has collapsed after bans on households mixing were introduced in many areas

The chancellor has unveiled increased support for jobs and workers hit by Covid restrictions after growing clamour from firms in tier two areas.

Rishi Sunak announced big changes to the Job Support Scheme (JSS) - set to replace furlough in November.

He told the Commons that even businesses not forced to shut were facing "profound economic uncertainty".

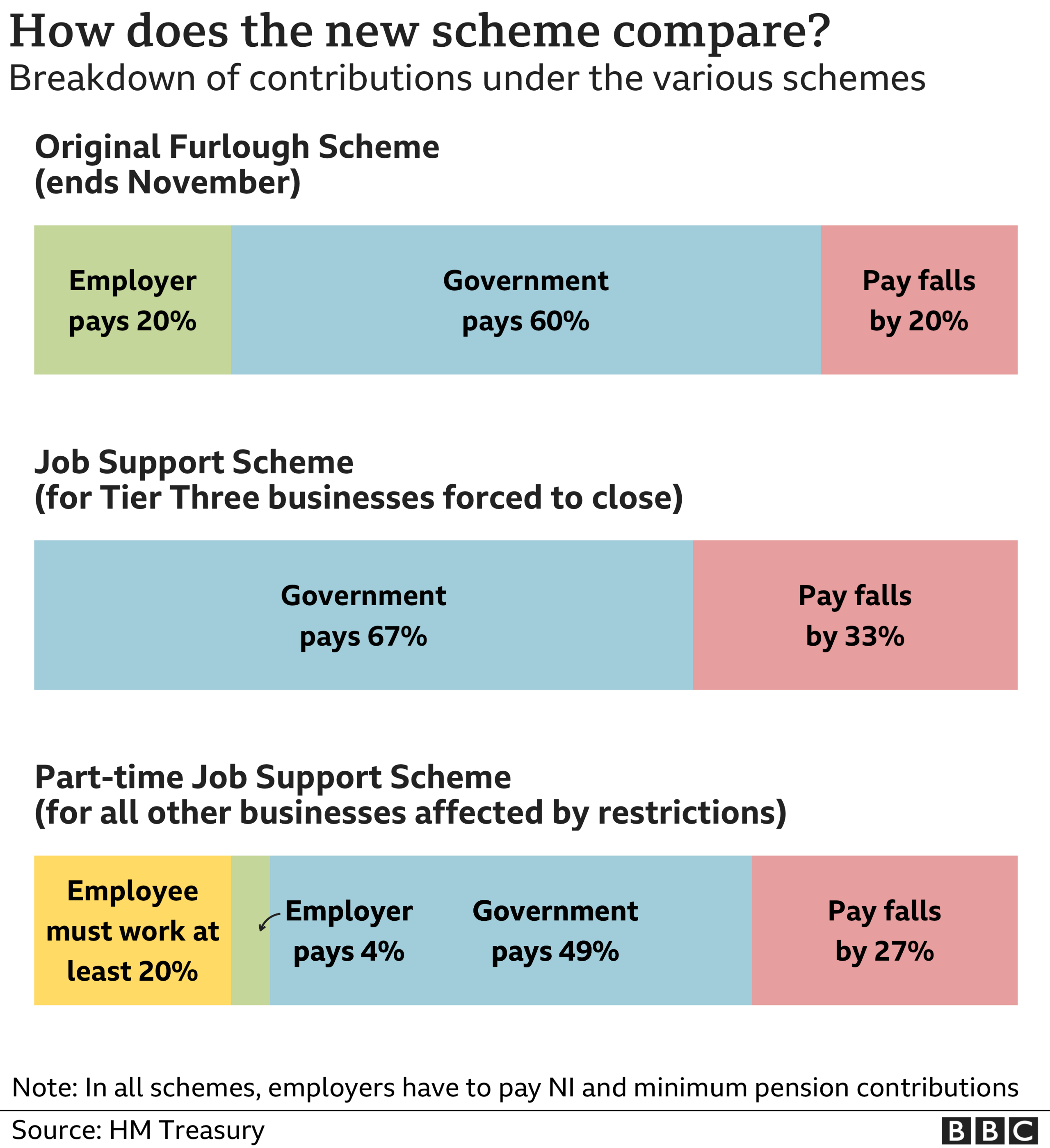

Under the revised scheme, employers will pay less and staff can work fewer hours before they qualify.

At the same time, the taxpayer subsidy has been doubled.

At an afternoon news conference, Prime Minister Boris Johnson thanked the chancellor for introducing measures that "will protect people's livelihoods".

But he warned that the UK would face "many thousands more deaths" if it put the economy before health.

Why is this happening?

Businesses in tier two areas, particularly in the hospitality sector, had complained that they would be better off if they were under tier three restrictions.

They argued that although they would be forced to close, they would benefit from greater government support.

One prominent chef, Yotam Ottolenghi, had said conditions for his restaurants were "terrible" since tier two restrictions were applied to London, adding: "We are on our knees now."

In response to such arguments, Mr Sunak has now changed the terms of the JSS. Referring to those businesses, he said: "It is clear that they require further economic support."

England Covid-19 tiers: Laura Foster explains the rules

How does the new plan work in detail?

Instead of a minimum requirement of paying 55% of wages for a third of hours, as announced last month at the launch of the Winter Economic Plan, employers will have to pay for a minimum of 20% of usual hours worked, and 5% of hours not worked.

The government will now fund 62% of the wages for hours not worked. This more than doubles the maximum payment to £1,541.75 a month. In the most generous case, the taxpayer will now go from funding 22% of wages to just under half.

The scheme will, as before, be open to all small businesses and larger businesses that can show an impact on revenues.

It is aimed at addressing the gap in support for businesses in tier two restrictions, such as London and Birmingham, but is not explicitly tied to that status, and is available across the UK.

Are all small firms pleased?

Noel Hutchinson, director of Poole-based powerboat experience firm Get Lost Sailing, is one small businessman who is feeling overlooked by the new measures.

His firm is in a tier one area and so is not receiving any support, but he is seeing far fewer customers as a result of the virus.

"Whether or not businesses are in tier one, two or three, they are all being massively affected by the virus," he says.

"A hospitality and tourism business such as ours depends on out-of-town visitors and these people are no longer travelling. Our bookings have slowed massively."

Mr Hutchinson feels that a national lockdown would serve him better, since any government support would then be distributed across the country.

"It would be better for our industry if the whole country was locked down at once and every business in receipt of a fair proportion of the support packages."

How will it work outside England?

The scheme is UK-wide. However, the system of tiered restrictions in England, which gave rise to the government's newly increased economic support, is not.

While England has a three-tier system, Scotland is due to bring in a five-tier system of virus alert levels from 2 November.

The middle three will be "broadly equivalent" to the English three, but the Scottish system will add an extra tier at the bottom and one at the top.

Wales is about to enter a two-week national lockdown from 18:00 BST on Friday, while Northern Ireland began a four-week lockdown last Friday.

All the devolved nations have been promised extra central government funding so they can award grants at a local level.

What's the background to this decision?

Almost as soon as the heads of the CBI and the TUC appeared on the steps of Number 11 Downing Street to endorse last month's Winter Economic Plan, there were some doubts about its effectiveness.

Business and union leaders were happy that some support for part-time working had been announced - itself a revolution for the UK - but the levels of support fell well short of German-style schemes. In particular, employers faced a hurdle of having to pay at least half of workers' wages.

This was not a bug in the system - it was the strategy. The Treasury wanted the scheme to lean into a process of economic restructuring to a post-Covid "new normal" and not seek to prevent those changes.

But all that was predicated on the pandemic being on the wane and the recovery assured. That has not proven to be the case, and indeed some had spotted that, even at the time of the original plan. This is an acknowledgement of gaps in that scheme and that large swathes of the economy are in survival, not restructure mode.

For the chancellor, this is a sign that he will offer the right support at the right time. Others will say that the data was going in this direction a month ago, and that some jobs have unnecessarily been lost. Hospitality businesses gathered at a south London pizza restaurant also told the chancellor of their need for help with rents from landlords - something the Treasury thinks is far more tricky than, for example, mortgage holidays.

In Greater Manchester, they will wonder why this wasn't offered to areas that were under strong social restrictions earlier. But this is a significant package worth several billion pounds, recognising the economy clearly needs support now before some inevitable fundamental changes.

How did it play out politically?

"I've always said that we must be ready to adapt our financial support as the situation evolves, and that is what we are doing today. These changes mean that our support will reach many more people and protect many more jobs," Mr Sunak said.

"I know that the introduction of further restrictions has left many people worried for themselves, their families and communities. I hope the government's stepped-up support can be part of the country pulling together in the coming months."

Responding to his statement, shadow chancellor Anneliese Dodds criticised the government for what she said was a "patchwork of poor ideas, rushed out at the last minute".

She said its approach to support for areas entering tier three had been "nothing short of shambolic".

In other political reaction, Greater Manchester mayor Andy Burnham tweeted that the new measures had not been "put on the table" during negotiations with the government this week that failed to agree a £65m package of support.

"Honestly, can barely believe what I'm reading here," he said.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

Were there any other new measures?

The chancellor also announced specific help for hospitality and leisure businesses in tier two areas.

English councils will be funded to give monthly grants of up to £2,100 to 150,000 hotels, restaurants and B&Bs. Devolved nations will be given the equivalent funding for other nations, under the Barnett Formula.

The generosity of the self-employment scheme has also been doubled from 20% to 40% of profits, with a maximum grant now of £3,750 over a three-month period.

Can your finances cope?

Furlough and redundancy are cutting incomes - and millions of people's finances are not in a position to cope.

Some 12 million people in UK have low financial resilience - meaning they find it hard to pay bills or make loan repayments, according to research by the City regulator, the Financial Conduct Authority.

It found that those from a black and minority ethnic background have been more likely than most to be affected by Covid-related falls in income, with 37% of those surveyed taking a hit.

Also, people aged between 25 and 34 were the most likely, by far, to have had a change in employment as a result of the pandemic.

That has led thousands of people to take payment "holidays" - deferrals on household bills such as rent or energy bills.

From 31 October, anyone who arranges a break on repayments of mortgages, loans and credit cards will see their credit record marked - potentially making it harder to borrow more from then on.

What have other people said?

Business leaders welcomed the changes, with the CBI employers' group calling it a "big step towards a more standardised approach".

UK Hospitality chief executive Kate Nicholls described it as "a hugely generous package of support and very welcome news just when we needed it".

She said the changes to the scheme would "help to safeguard hundreds of thousands of jobs" and give firms "a much-enhanced chance of being able to overcome the challenges and survive into 2021".

Adam Marshall from the British Chambers of Commerce said it was a "significant improvement" for many struggling businesses.

But he added: "The true test of these reforms will be whether they help businesses on the ground get through the difficult months ahead."

Torsten Bell, head of the Resolution Foundation think tank, which works to improve the standard of living of low-paid workers, said Mr Sunak had done the right thing by expanding help for companies.

"Doing it earlier, given the obvious flaws, would have saved more jobs, but at least we've got to the right place 10 days ahead of the Job Support Scheme coming into effect," he said.

- Published30 September 2021

- Published22 June 2021

- Published14 December 2020

- Published9 October 2020

- Published13 October 2020

- Published24 September 2020