LVMH and Tiffany kiss and make up over takeover dispute

- Published

Luxury brand LVMH has ended a bitter dispute with Tiffany over its deal to buy the US jeweller.

The French brand will pay about $425m (£326m) less to acquire Tiffany and salvage the deal.

The dispute was triggered after LVMH got cold feet, claiming Tiffany was no longer the business it agreed to buy last November before the pandemic.

Tiffany then sued the luxury goods giant to try to force the deal to go forward.

The new deal brings to an end an acrimonious war of words between the two luxury firms.

The initial deal ran into trouble last month when Louis Vuitton owner LVMH said it could no longer complete the transaction by a 24 November deadline, and would therefore not be buying Tiffany.

The jeweller then sued, saying LVMH had "unclean hands".

In return LVMH counter-sued, saying the jeweller had a "dismal" performance during the coronavirus crisis, and also cited a request by the French government to delay the deal until 6 January due to a threat of new US tariffs on French products.

However, the two firms struck a more conciliatory tone on Thursday, having reached a rapprochement.

Tiffany chairman Roger N. Farah said "it was in the best interests of all of our stakeholders to achieve certainty of closing".

LVMH chief executive Bernard Arnault said: "We are as convinced as ever of the formidable potential of the Tiffany brand and believe that LVMH is the right home for Tiffany and its employees during this exciting next chapter."

The new takeover price was set at $131.5 a share, down from $135 in the original deal, the companies said, bringing the total price tag to about $15.8bn.

"Tiffany and LVMH have also agreed to settle their pending litigation in the Delaware Chancery Court," the firms added.

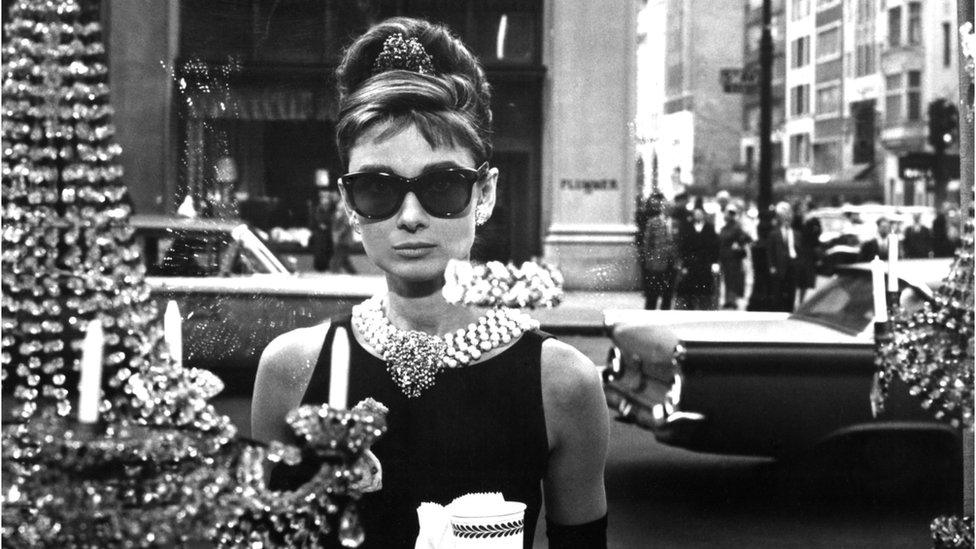

'Breakfast at Tiffany's' starring Audrey Hepburn helped to make the brand famous

The Tiffany brand name hit global fame following the 1961 Audrey Hepburn film Breakfast at Tiffany's.

Billionaire Mr Arnault had wanted to snap it up for a long time.

In November 2019, he agreed to pay $135 a share, promising to polish up the jeweller's brand, which had been losing lustre for younger buyers.

But questions about the economic impact of the coronavirus crisis - which has severely hit revenue in the luxury sector and prompted a 36% drop in Tiffany sales, external in the first half of the year - had made the deal look shaky.

But with the deal back on, both sides now will be "licking their wounds", said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

"What was meant to be a crowning achievement ended up more like handbags at dawn in a Delaware courtroom but now both sides have agreed to settle all pending legal action," she said.

"Although LVHM still has an unrivalled wardrobe of brands and a loyal customer base, the collapse of the international travel market continues to depress sales and with any benefit of the Tiffany acquisition uncertain for now, the group is still in a state of flux," she said.

- Published29 September 2020

- Published9 September 2020