Spending Review: Council tax likely to rise, says think-tank

- Published

- comments

Rishi Sunak: "I think it's a reasonable and proportionate response given the context"

Households face a rise in council tax after Chancellor Rishi Sunak cut support for local authorities in his Spending Review, experts say.

In its analysis of Wednesday's review the Institute of Fiscal Studies (IFS) said tax bills may have to increase by £70 per household on average.

The chancellor has given authorities the ability to raise council tax by 5%, IFS director Paul Johnson said.

"This was actually a tax-raising Spending Review," he said.

"The chancellor has chosen to reduce support to local authorities and has given them the ability to raise Council Tax by 5% instead.

"If they do, and they'll mostly probably need to, that will increase annual tax bills by an average of around £70 per household."

The Spending Review set out the cost to the UK economy so far of dealing with the coronavirus pandemic.

Mr Johnson said the review will feel like a return to austerity for many people.

The chancellor has imposed a "pause" in pay rises for at least 1.3 million public sector workers, telling the BBC that UK faced "tough choices".

But Mr Johnson said it was a "pretty austere" Spending Review and means "a tougher time for some public services than expected".

Speaking to BBC Breakfast on Thursday, Mr Sunak said: "I've had to make some tough choices and what I couldn't do is justify an across-the-board rise in public sector pay."

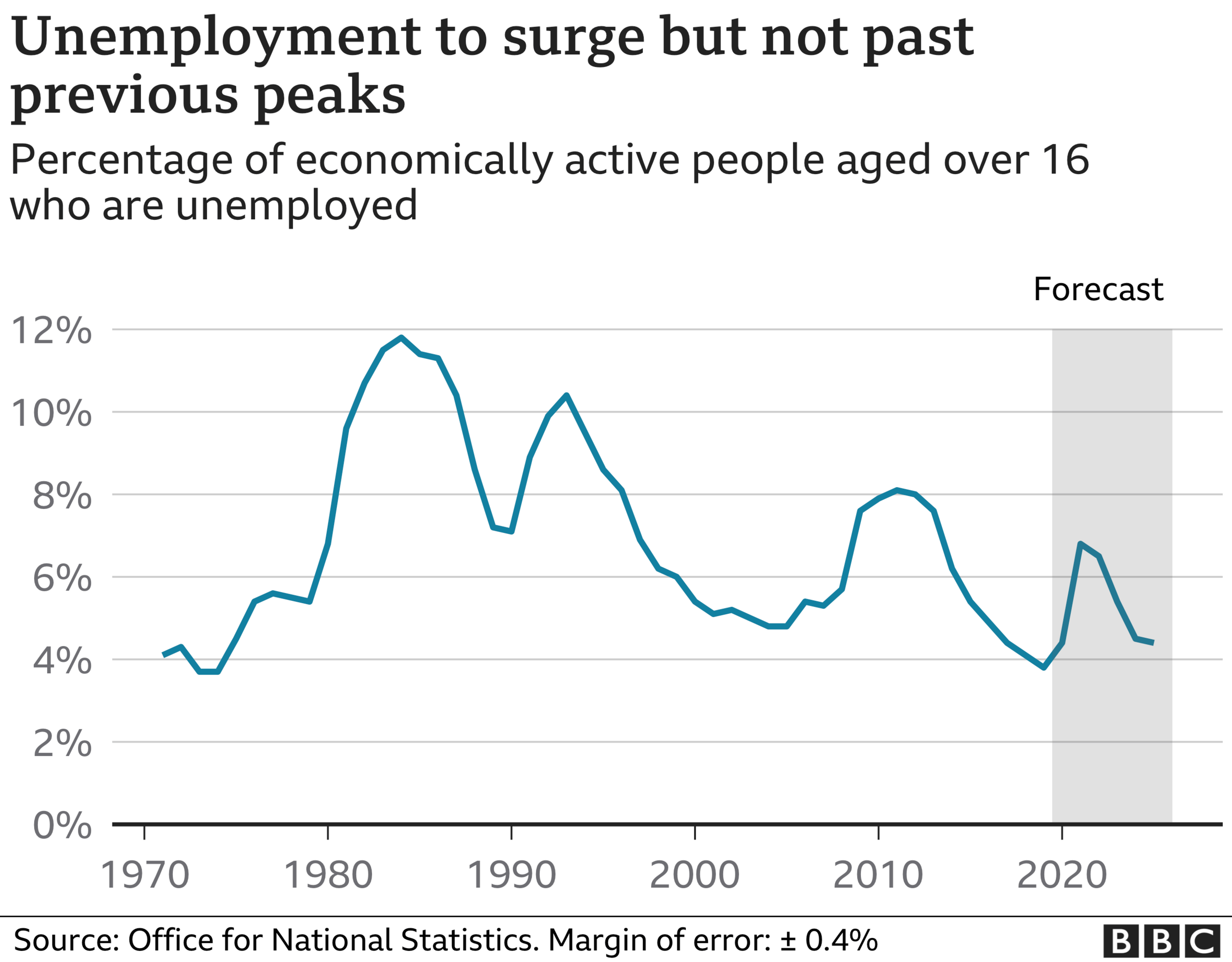

Private sector wages have fallen as jobs have been lost, hours have been cut and workers have been furloughed, he said. And he warned that unemployment could rise to 2.6 million by the middle of next year.

Public sector staff on less than £24,000 and some frontline NHS workers will get a wage rise.

But Mr Johnson questioned why the government was imposing a pay freeze on much of the public service as the financial benefits would be relatively low.

"There has been no top-up to NHS spending plans after next year," he said. "This may not quite be a return to austerity, but for some public services it may not feel much different."

Mr Johnson said the chancellor appeared to be picking a fight with public sector workers over not very much money

On Wednesday, union leaders expressed fury at the pay, warning they would take industrial action to ensure members did not lose out.

Mr Johnson said the chancellor had picked a big fight over "not very much money" by freezing pay for public sector employees who did not work in the NHS, or who earned less than £24,000 a year.

He said: "The decision to freeze public sector pay for some will probably save only between £1 and £2bn next year. The chancellor has perhaps picked a big fight over not very much money.

"And, as ever, in the public sector the decisions look driven by politics not by economics or the need to spend money either equitably or efficiently."

'Unsustainable'

Meanwhile, the Resolution Foundation think-tank has warned that the Covid-crisis could dent average pay packets by £1,200.

"I am determined to protect jobs and this will help me protect jobs," said Mr Sunak.

He would not be drawn when asked about tax rises, only saying that the current level of spending was "unsustainable".

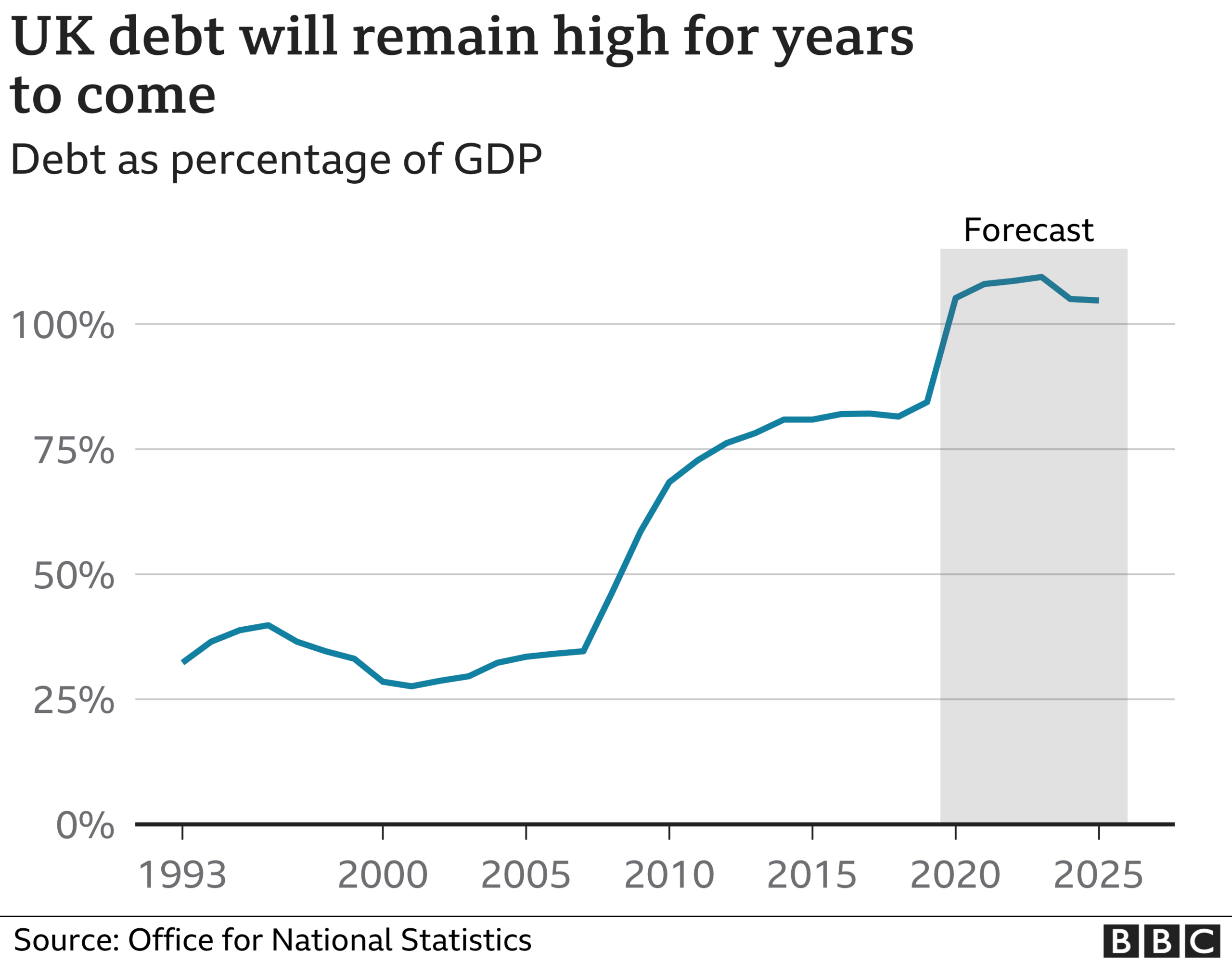

So far, the government has spent £280bn to support the economy through the pandemic, and is expected to spend a further £55bn next year.

But the UK economy is expected to shrink by 11.3% this year, the sharpest decline in 300 years, according to the government's independent forecaster, the Office for Budget Responsibility (OBR).

It is not expected to return to its pre-crisis size until the end of 2022.

Despite being able to borrow at record-low rates, Mr Sunak told the BBC's Today programme he would aim to rein in debt.

"Once we get through this and have more certainty over the outlook we should look to restore our public finances to a strong position," he said.

"I want to make sure that when the next difficult thing comes along the government can respond."

Spending

Mr Sunak defended the government's decision to increase defence spending while cutting international aid from 0.7% of GDP to 0.5%, a move that prompted a junior minister to resign.

"We believe defence and security is important to this country," he said, adding that the law allows the aid budget to be cut under economic decline, despite the target being a Tory manifesto promise.

"We do intend to return to it. It's not a permanent change," he said.

Shadow chancellor Anneliese Dodds says there will have to be higher taxes and spending cuts in the future if interest rates rise, making government borrowing more expensive.

But she said that the current focus must be on keeping people in work.

"I think government should be concentrated on protecting people's jobs right now, making sure that new jobs are created," she told the Today programme.

"We've got far, far lower ambitions around that than, for example, France and Germany. That's what government should be focused on right now because that economic damage will ultimately affect the size of our tax base as well as, of course, people's living standards."

Richard Hughes, the chairman of the OBR, told the Today programme that this was "a very serious moment" for the UK and "the biggest shock we've faced in three centuries and the biggest shock the global economy has faced in peacetime".

The impact from the coronavirus is twice the size of the financial crisis in terms of its impact on the economy and the public purse, he said.

"It's something few people have faced in their lifetimes."

One of the longer-lasting effects on the economy is that people are out of work and aren't building their skills, a loss "we don't get back when this crisis is over," Mr Hughes said.

The Resolution Foundation has warned that the bulk of the government's extra spending to deal with the "economic emergency" will need to come from tax rises.

That is "a matter for the government", Mr Hughes said.

- Published26 November 2020

- Published25 November 2020

- Published25 November 2020

- Published25 November 2020

- Published25 November 2020