Covid: 'My business could close because of insurance payout delays'

- Published

Sonia Rishi's wellbeing clinic closed at the start of lockdown last March.

Sonia Rishi fears her business could close because of delays in Covid-insurance pay-outs.

The Supreme Court ruled last month that insurers must pay out on business interruption insurance policies for the first national lockdown.

But with no sign that she will be paid any time soon, Ms Rishi is getting desperate. "While insurers delay the claim process, small businesses like ours will close," she told the BBC.

More than 60 insurers, including Arch, Argenta, MS Amlin, Hiscox, QBE and RSA, offered business interruption policies, but many refused to pay out during the first lockdown.

They argued that only the most specialist policies had cover for such unprecedented restrictions.

As a result, a test case was brought by the Financial Conduct Authority which eventually led to the Supreme Court ruling.

It covered issues such as disease clauses, whether business were denied access to the properties, and the timing of lost earnings, but the ruling was complex.

Because of that it may take time to process firms' claims. The Association of British Insurers advises: "Business interruption claims can, in general, be complex to assess and determine quantification."

It's that process that insurers are now going through which is, in some cases, leading to a frustrating wait for customers.

Ms Rishi runs the Skin & Sanctuary wellbeing clinic, in east London, which was forced to close at the start of the first lockdown in March 2020.

"We submitted a claim on the basis of the terms of the business interruption clause in the insurance policy sold to us," she said.

"But ten months later, and after a High Court ruling and Supreme Court Appeal ruling, both of which basically confirmed what we had cited in March, we were told by our insurer Hiscox that we effectively had to provide details again."

The insurer told Ms Rishi: "So that we can assess your eligibility for cover, we invite you to progress your claim by entering your details onto our business interruption claims portal."

But she said: "This is insulting. There is no reason why payment for the claim submitted in March 2020 should be further delayed."

She has been told by her broker that Hiscox said they will deal with only 20 cases per day. She told the BBC: "If that is the case this will delay things sufficiently for businesses like ours to have to close.

"I really do not have anything left and have already borrowed £50,000 to keep things going."

'Stalling tactic'

Hiscox refused to comment on the 20 cases a day claim, but told the BBC: "We have contacted all customers who have made a claim.

"We have asked for more information where necessary and have begun settling claims as quickly as possible in line with the judgment."

Anna Smart also fears her business could be forced to shut.

She runs a photography studio in Oxfordshire with husband Robin, but when her claim for business interruption insurance was turned down she was forced to make her one member of staff redundant and move out of their premises.

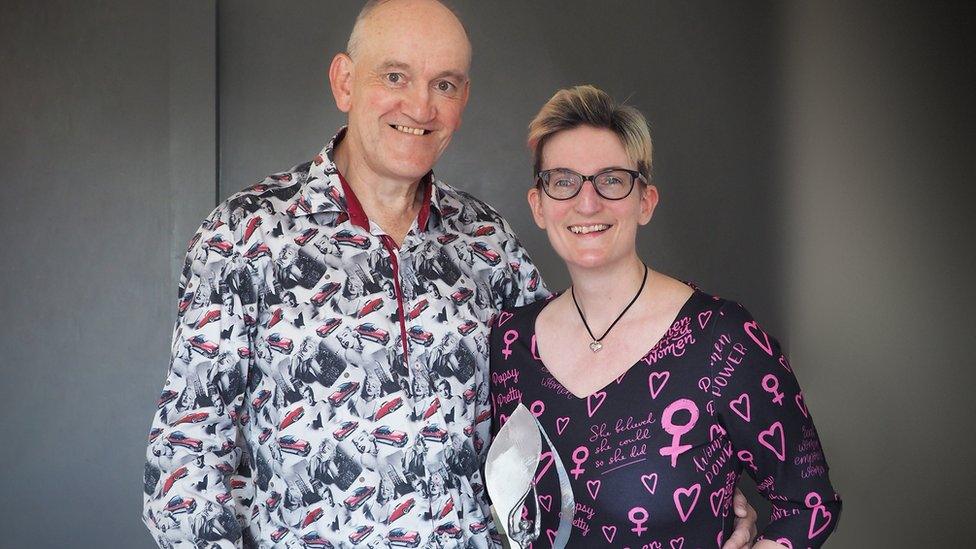

Robin and Anna Smart think insurers are just stalling.

After last month's Supreme Court judgment she expected a payout, but instead received a another claim rejection email from Hiscox.

The insurer said: "Based on the information that you have provided, we believe that your business was not subject to mandatory closure due to the relevant government restrictions.

Time running out

"If we have misunderstood the nature of your business activities and you were subject to mandatory closure, or if you consider that the impact on your business was one of those rare circumstances where an inability to use can be established, please contact us so that we can consider the specifics of your situation."

Ms Smart said: "This is clearly very wrong. It is a stalling tactic. I believe there is a scandal brewing, not least as the insurers continue to try and 'thin the herd' to reduce claims."

On Wednesday, she put in a new claim, but told the BBC time is running out: "The business will run out of cash by the end of March."

Related topics

- Published15 January 2021

- Published15 September 2020

- Published20 July 2020