US central bank payment system down for 'hours'

- Published

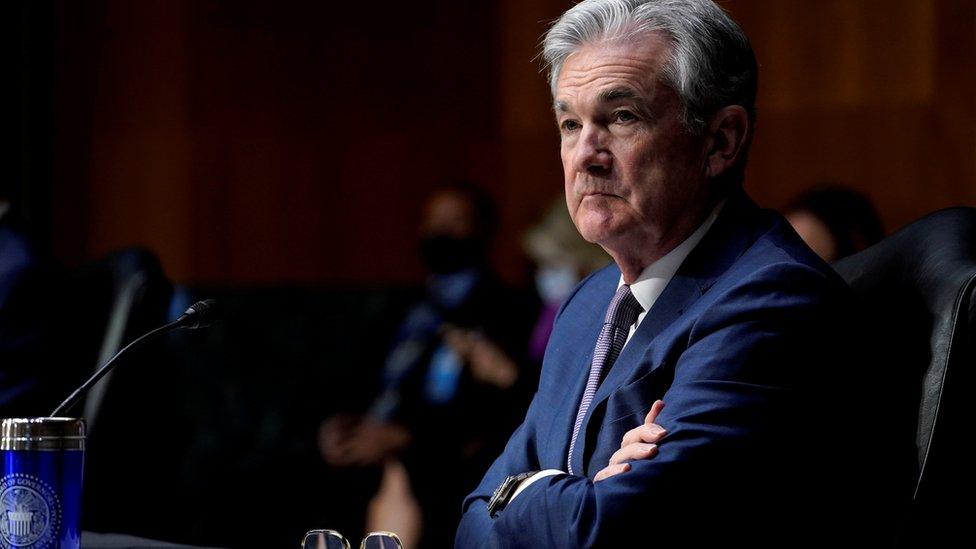

Fed Chair Jerome Powell has called exploring a digital dollar a "high priority project"

The system the US central bank uses to process more than $3tn (£2.1tn) each day crashed on Wednesday.

The Federal Reserve said the disruption was caused by an "operational error". It started restoring services within hours.

The Fed handled over 184 million transactions last year, from bank transfers to electronic payroll deposits.

The crash adds to pressure the bank is facing to keep up with tech disruptors.

"Let's work together to ensure we have a faster, more reliable way to send payments," Senator Cynthia Lummis wrote on Twitter.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

At hearings in Washington this week, Federal Reserve Chair Jerome Powell was also pressed on the bank's plans to explore digital currencies, pointing to steps by central banks in China and elsewhere, as well as Bitcoin and other private payment systems.

The project is "vital to American competitiveness", Congressman Patrick McHenry said.

Digital dollar

Mr Powell said the bank planned to spend this year doing extensive research and public outreach about the idea of a digital dollar, describing it as a "high priority project".

But he added that the bank was also wary of doing anything that might have unintended negative consequences for the existing system.

"We have a responsibility to do this right," he said. "We don't have to be the first."

The Fed said Wednesday's crash started at about 11:00 Eastern time. Services started to be restored about three hours later, but some continued to remain dark, including its Fedwire Funds system.

On social media, cryptocurrency advocates were quick to highlight the problems.

Allow X content?

This article contains content provided by X. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read X’s cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

They have been on the defensive amid warnings from regulators around the world, including US Treasury Secretary Janet Yellen, a former Fed chair, who this week called Bitcoin an "extremely inefficient" way to conduct transactions.

"The legacy financial system is horrible," Yan Pritzker, co-founder of Bitcoin-buying site Swan Bitcoin wrote on Twitter.

Related topics

- Published25 September 2020

- Published23 February 2021