Budget removed uncertainty for house buyers, says the Halifax

- Published

- comments

The UK's largest mortgage lender has said the extension of the stamp duty holiday has "removed uncertainty" for those completing house purchases.

The Halifax, part of Lloyds Banking Group, said the housing market had been at a crossroads before the Budget.

Stamp duty relief in England, Northern Ireland, and the equivalent in Wales, have all been extended.

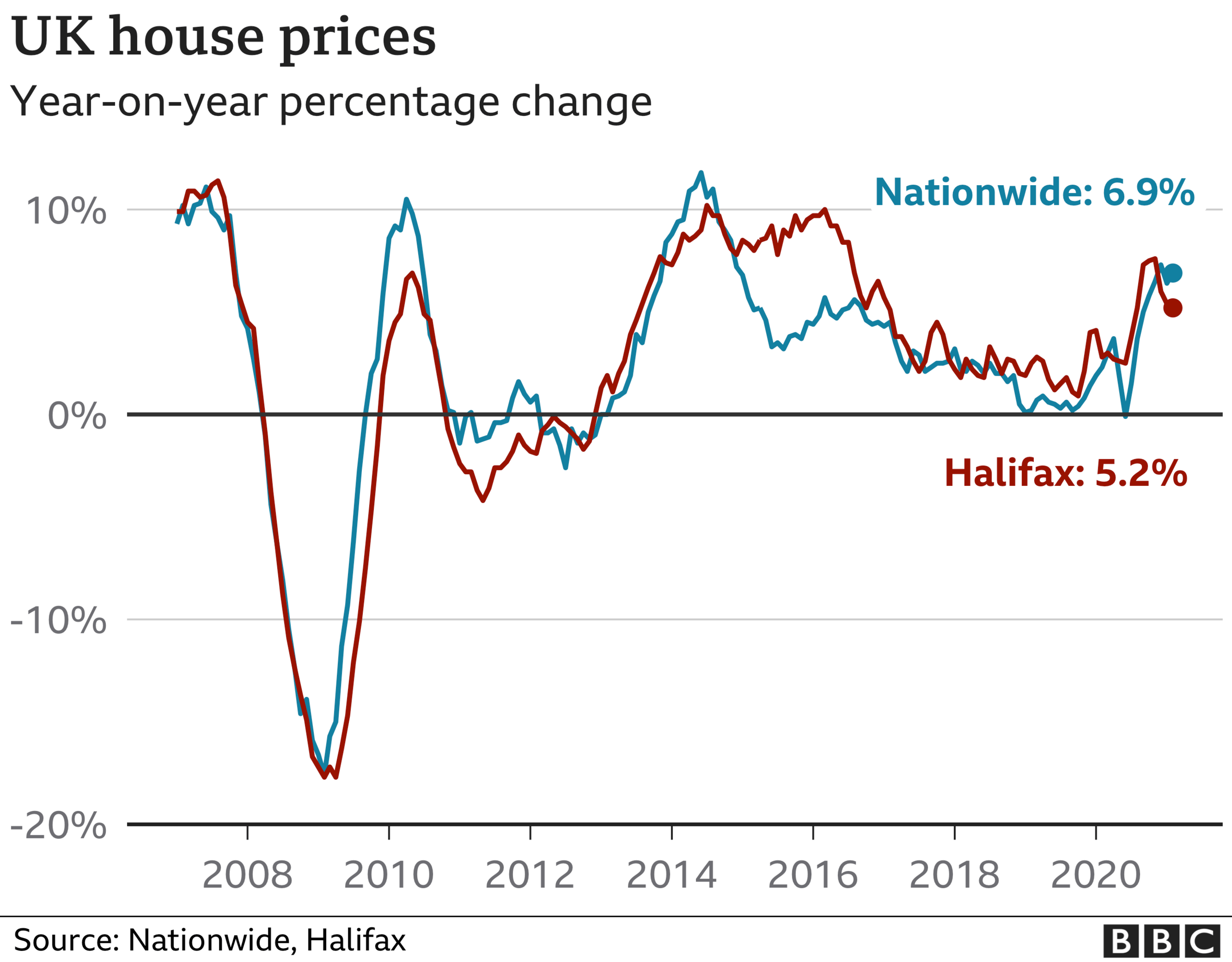

The Halifax said UK house prices in February were 5.2% higher than a year earlier, averaging £251,697.

The month-on-month change showed the housing market had "softened" in February, falling by 0.1%.

Russell Galley, managing director at the Halifax, said: "The government's decision to extend the stamp duty holiday - one of the main drivers of demand from home movers during the pandemic - has removed a great deal of uncertainty for buyers with transactions yet to complete.

"The new mortgage guarantee scheme is another welcome development from this week's Budget. Whilst mortgage approvals have reached record highs in recent months, hitting levels not seen since before the financial crisis of 2008, raising a deposit continues to be the single biggest hurdle for first-time buyers to overcome."

At the Budget, Chancellor Rishi Sunak confirmed that a government guarantee means first-time buyers should get a wider choice of mortgages that require a deposit of just 5% of the loan. This will be available when buying properties worth up to £600,000.

However, critics say the policies could artificially push up house prices, making the prospect of buying a home even more of a distant one for some young people in the future.

Related topics

- Published3 March 2021

- Published4 March 2021

- Published5 March 2021