The 'insane' money in trading collectible cards

- Published

SuperDuperDani has been collecting Pokémon cards for 15 years

"It's hard to put a value on it... but I would say my collection is worth around a quarter of a million dollars."

Dani Sanchez, known to her fans as SuperDuperDani, is showing me two first-edition Charizard cards. She's a Pokémon YouTuber in Los Angeles, and every week thousands of people watch her unbox multi-packs of these colourful collectibles.

To many millennials, the first Pokémon craze of the late 90s and early 2000s is a defining part of their youth. Pictures of these Japanese anime monsters were traded in schools across the world and what started as a video game ended up appearing in movies, Happy Meals and cereal boxes.

For Dani, a childhood interest in Pokémon turned into a 15-year long collecting obsession, and eventually a career. Pokémon cards have seen an unprecedented rise in interest over the last 18 months, she says.

"Vintage cards have skyrocketed in value. A sealed box of Pokémon cards from the early 2000s or late 90s retailed at around $100. [That same box would cost] $20,000, $30,000 or even $50,000 (£35,000) today. It's insane."

The value of rare Pokémon cards has catapulted higher

As with other stay-at-home hobbies, demand for Pokémon cards increased when coronavirus hit. But Dani says the pandemic isn't the only reason why these collectibles have made a comeback.

"Celebrities [have been] getting involved in it. Logic bought a Pokémon card, Logan Paul got in, Shawn Mendes, Steve Aoki. But there's another side: the financial angle. There's a whole group of people out there pushing the market up in the hope of making a profit later," she says.

And profit they have. Auction site eBay says sales of Pokémon cards in the US shot up 574% between 2019 and 2020.

But that's just the tip of the iceberg. In the same year, trade in football cards grew by a staggering 1,586%.

Across all types of cards, sales in Europe have more than doubled, and in the UK they've tripled.

The most valuable cards sell for hundreds of thousands of pounds. But physical cards have new competition for the hearts of collectors.

NFTs, or non-fungible tokens, are digital tokens - you can think of them as certificates of ownership for virtual or physical assets.

Typically, for a video clip, an image or a gif, the ownership of an NFT can be traced and verified.

In the world of sports memorabilia, an NFT might be a highlight.

For example, in the US, basketball highlights are being made into NFTs known as Moments by NBA Top Shot, a joint venture between the National Basketball Association, the NBA Players Association and Dapper Labs.

If you want to see Zion Williamson make a hard-hitting block, you could head to YouTube.

But if you want to own one of his plays, in a way that no one else can, the league might just sell it to you for tens of thousands of dollars.

Jesse Schwarz spent more than $200,000 on a basketball NFT

Jesse Schwarz, the founder of Front Page, set a Top Shot record when he spent $208,000 on a LeBron James dunk. He says that the fact people can view or copy his NFT doesn't bother him. In fact, he's happy it's out there.

"Everyone knows there's one Mona Lisa. You can print out a picture of it, someone can paint you a fake one. But there's only ever one," he argues.

"When people are using the Mona Lisa, whether in a meme or a postcard, that just increases the value [of the original] because it popularises the image. It's the same thing here. The more people that watch this highlight the better. Everyone can see that I own this highlight," Jesse adds.

While the prices of some NFTs have soared, they should not be treated as an investment, according to Dr William Quinn, a lecturer in finance at Queen's University Belfast, and the co-author of Boom And Bust: A Global History of Financial Bubbles.

"As an investment there's nothing particularly appealing about them, apart from perhaps, the belief that you can sell them along to someone else for a higher price - which is the essence of a bubble," he says.

NBA Top Shot isn't the only firm capitalising on sports NFTs.

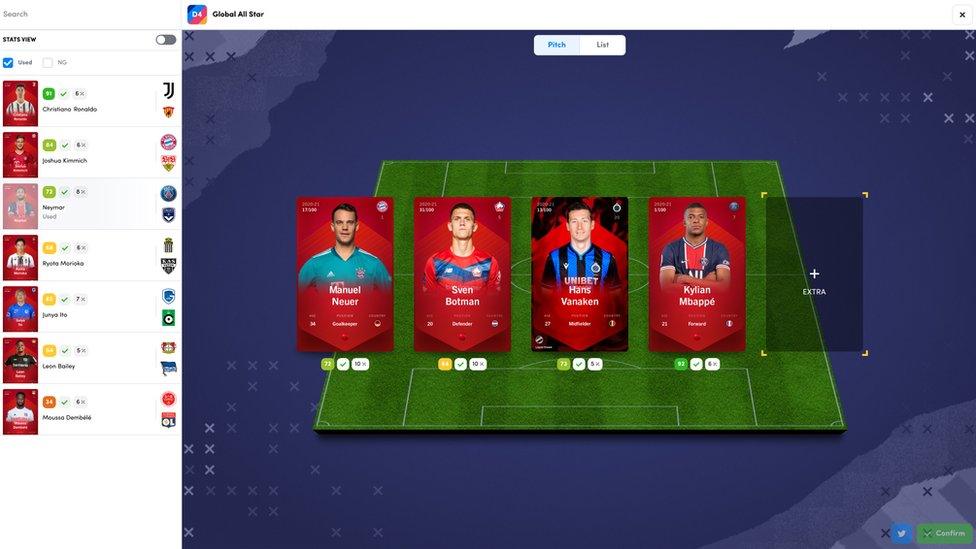

Sorare has a range of digitised trading cards

In France, the company Sorare is digitising football cards and has partnered with more than 125 clubs including Liverpool, Paris Saint-Germain and Bayern Munich.

You can spend eye-watering amounts on individual cards. A Cristiano Ronaldo card recently sold for more than €83,000 (£71,000; $99,000), although most cost far less.

Beyond their value as an asset, these cards can be used as part of a game. Sorare has developed a fantasy football league, in which owners compete for prizes.

Grant Anderson, who goes by the nickname Hibee, found the concept so engaging that he decided to start The Sorare Podcast, and now acts as a UK ambassador for the company. He has fond memories of trading football cards as a child but says the social side of collecting was lost along the way.

"I don't think that really exists in the eBay trading world. You spend a couple of hundred dollars and get sent a brown envelope [of cards]."

Sorare collectors can compete in a fantasy football league

And he's not the only fan to get involved.

In the space of a year, sales of Sorare collectibles have increased from $50,000 a month to around $6.5m.

The head of Sorare, Nicolas Julia, says that the sky's the limit for NFTs. But that doesn't mean that traditional cards will die out completely.

"They're going to co-exist. Some people value having something tangible. But at the same time, there's a lot of demand for owning something digital, scarce and secure too," Nicolas said,

Hibee won't be going back. For him, the social and gaming elements of digital collecting are a big improvement on traditional cards.

But experts from eBay reckon 2021 will be another great year for physical collectibles. They've even said that nostalgia for more normal times may boost the prices of rare ticket stubs beyond six figures.

As for Dani Sanchez, she will be sticking to her physical cards.

"None of my friends that are also into collecting dabble in NFTs. In my eyes it's more of an investment for someone who's into business. It seems like it's driven by money, rather than collection itself."