Easter egg sales 'soar by almost 50%'

- Published

- comments

Consumers have been splashing out ahead of Easter as people prepare for weekend celebrations amid eased lockdown restrictions, research suggests.

Easter egg sales have climbed £48m, soaring almost 50% to £153m compared with last year, according to figures from analysts Kantar.

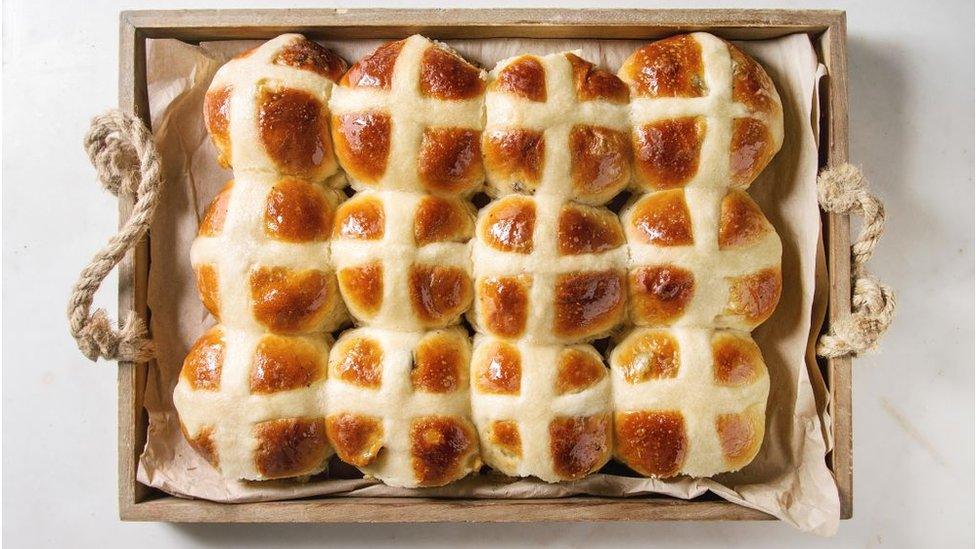

Meanwhile shoppers have already spent £37m on hot cross buns.

M&S, Asda and Thorntons are among those reporting a big rise in demand.

"There are signs of people making a special, even symbolic, effort this year," said Fraser McKevitt, head of retail and consumer insight at Kantar.

"Grandparents might be showing up with additional treats after 12 months of restrictions."

M&S said sales of its enlarged range of online Easter gifts are up 3,000%, while Easter egg sales are up 86%.

Meanwhile an Asda spokesman said: "We've seen many customers choosing to buy their Easter eggs early and buying more than they would normally - the average number of eggs bought ranging between three-five eggs per person.

"As a result, we're predicting sales of over 19 million Easter eggs together with 33 million individual hot cross buns as Brits prepare for what looks to be their biggest Easter yet."

Thorntons said it had seen 200% rise in sales online compared to 2019, before the pandemic began.

It said consumers were purchasing "extra special" treats for loved ones, such as handcrafted Easter eggs, while "more people than ever" are using its icing service to share personal messages on eggs.

Sales of hot cross buns are also up

Eating outdoors

According to Kantar's survey, 61% of people are looking forward to socialising with friends again this Easter, and 23% of households are planning to dust off the barbecue over the weekend if the weather allows.

Research from Sainsbury's published last week suggested three out of five people plan to host Easter lunch outside, while four out of five said if there was wet weather it would not stop them going ahead with their outdoor plans.

Meanwhile more than half of households said they will swap an Easter roast for a less traditional lunch this weekend, to make the most of the rule of six, which allows families and friends to celebrate in their garden.

A third are planning barbecues, according to Sainsbury's, while a quarter will order takeaways and a fifth will have picnics.

Many are planning barbecues

Grocery sales slip

Beyond the Easter boost, grocery sales rose 7.4% in the 12 weeks to 21 March compared with a year earlier, although that was a marked slowdown compared with previous months.

In fact sales slipped 3% in the four weeks to 21 March compared with a year earlier.

But that marked the first national lockdown when concerned shoppers stripped supermarket shelves bare at the start of the pandemic.

"This time last year, Brits were adjusting to schools and offices closing and making extra trips to the supermarket to fill their cupboards for lockdown," pointed out Mr McKevitt.

"To put that into context, shoppers made 117 million fewer trips to the supermarket this month compared with those fraught weeks in March 2020."

He said for the bigger picture it was important to look at the numbers in relation to two-year growth figures.

"While grocery growth has slowed against 2020, sales are still much higher than the same 12 weeks in 2019 - up by 15.6%," he said.

"As restrictions on dining out continue, the average household spent an extra £134 on take-home groceries compared with this period two years ago."

Supermarket performance

Iceland saw the strongest growth during the period - excluding online-only Ocado - with a jump in sales of 14.3%.

Aldi was the worst performer with growth of just 1.5% in the 12-week period.

Tesco increased sales by 8.5% and gained share to capture 27.1% of the market, up by 0.3 percentage points year.

Asda inched up its market share from 15.0% to 15.1%.

Ocado's sales surge saw its growth climb 33.9%, but online grocery sales slowed in the past four weeks, with signs that shoppers are returning to physical stores.

Kantar's figures suggest shoppers made 13 million additional trips to supermarkets this month compared with February.

It said confidence had returned particularly among the over-65s, with the age group making 143,000 fewer online orders.

Related topics

- Published28 March 2021

- Published26 March 2021

- Published24 March 2021