Chinese ride-hailing giant Didi faces probe ahead of market debut, says report

- Published

Chinese ride-hailing giant Didi Chuxing is being probed by the country's market watchdog, according to a Reuters report.

The State Administration for Market Regulation (SAMR), is said to be investigating whether Didi has been unfairly squeezing out smaller rivals.

It comes as Didi readies for what could be this year's biggest US market debut.

Beijing has been increasingly reining in China's tech giants, including Alibaba and Tencent.

The SAMR is also examining whether the pricing mechanism used by the firm's core ride-hailing business is transparent enough, said Reuters quoting people familiar with the matter.

"We do not comment on unsubstantiated speculation from unnamed sources," a Didi spokesperson told the BBC.

The SAMR has not yet responded to requests for comment from the BBC.

Mega market debut plan

Last week, Didi filed papers to list its shares in the United States, in what could be the biggest initial public offering this year.

Didi is backed by some of Asia's largest technology investment firms, including Softbank, Alibaba and Tencent.

The amount of shares to be offered and the pricing was not revealed.

However, the company could raise around $10bn (£7.15bn) and seek a valuation of close to $100bn, according to reports.

That would make it the biggest share offering in the United States by a Chinese company since 2014, when e-commerce giant Alibaba raised $25bn (£15bn).

Didi says it is the world's largest mobility-technology platform, operates in 15 countries and counts over 493 million annual active users globally.

It reached its dominant position in the online ride-hailing business in China after years-long subsidy wars with Alibaba-backed Kuaidi and Silicon Valley-based Uber's China unit.

Both units have now merged into Didi after investors grew tired of burning cash and demanded profits.

As well as ride-sharing, Didi operates different businesses involved in mobility, including electric vehicle charging networks, fleet management, car manufacturing and autonomous driving.

How a little Ant became a financial giant

Beijing crackdown

In recent months Chinese authorities have been clamping down on the country's internet giants, which have been seen to wield too much power.

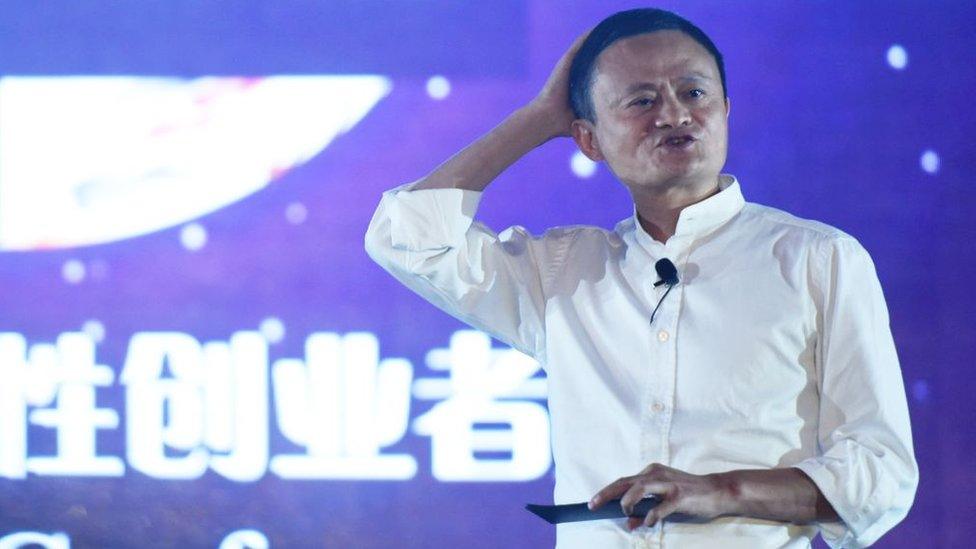

Earlier this year, regulators set their sights on technology giant Alibaba and its former chairman Jack Ma.

In April, the SAMR fined the firm a record $2.75bn, saying it had abused its market position for years.

Mr Ma had been set to become China's richest man yet again following the dual stock market debut of his digital payments company Ant Group - an affiliate of Alibaba - in Hong Kong and Shanghai, which was worth about $34.4bn.

What was meant to be the world's biggest initial public offering was halted at the eleventh hour and the prospects for the plan remain unclear.

- Published15 June 2021

- Published11 June 2021

- Published15 April 2021