Government borrowing eases in May

- Published

- comments

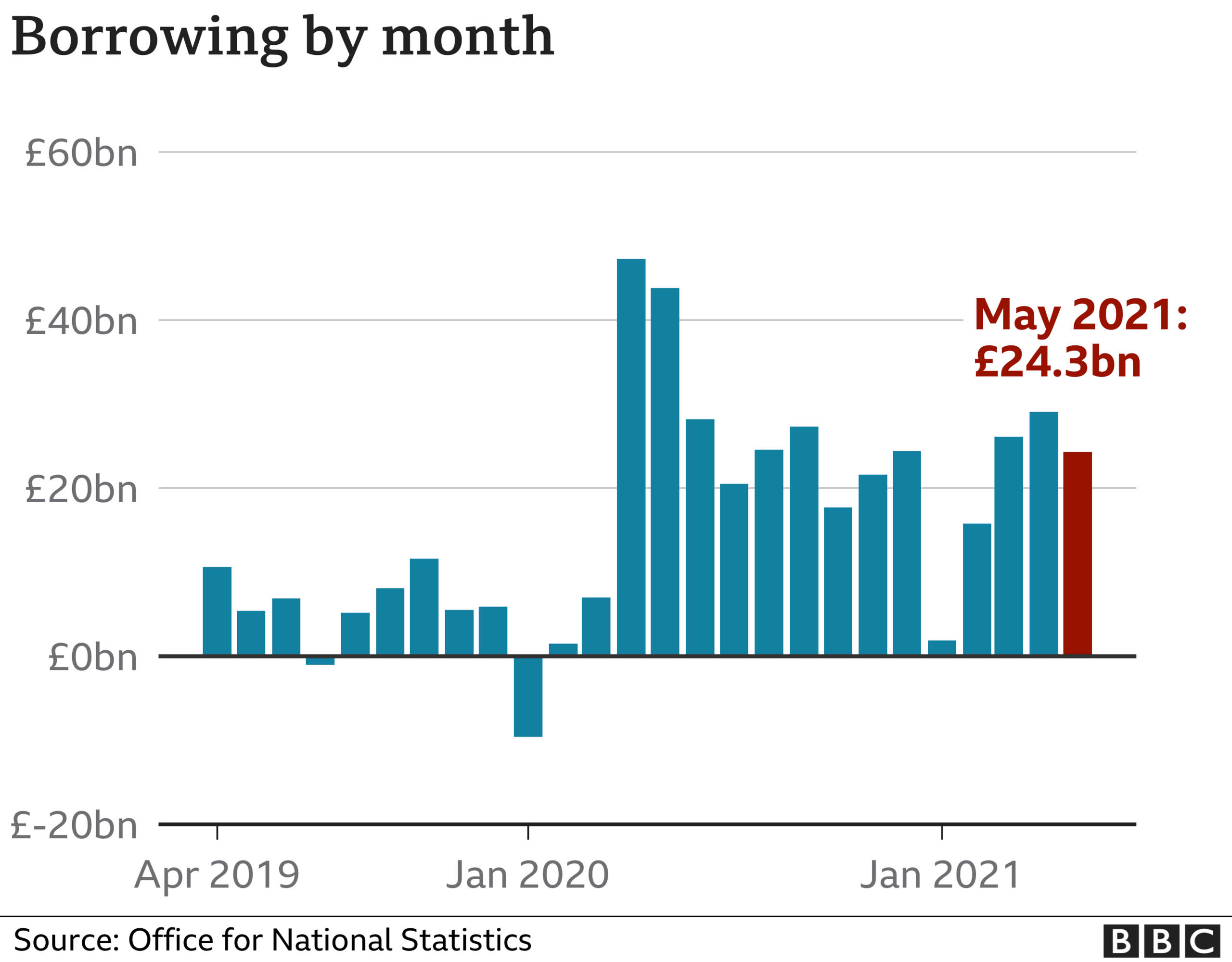

Government borrowing fell in May compared with the same month last year, with the economy in recovery mode after lockdown measures eased.

Borrowing - the difference between spending and tax income - was £24.3bn, official figures show, which was £19.4bn lower than May last year.

However, the figure was the second-highest for May since records began.

Borrowing has been hitting record levels, with billions being spent on measures such as furlough payments.

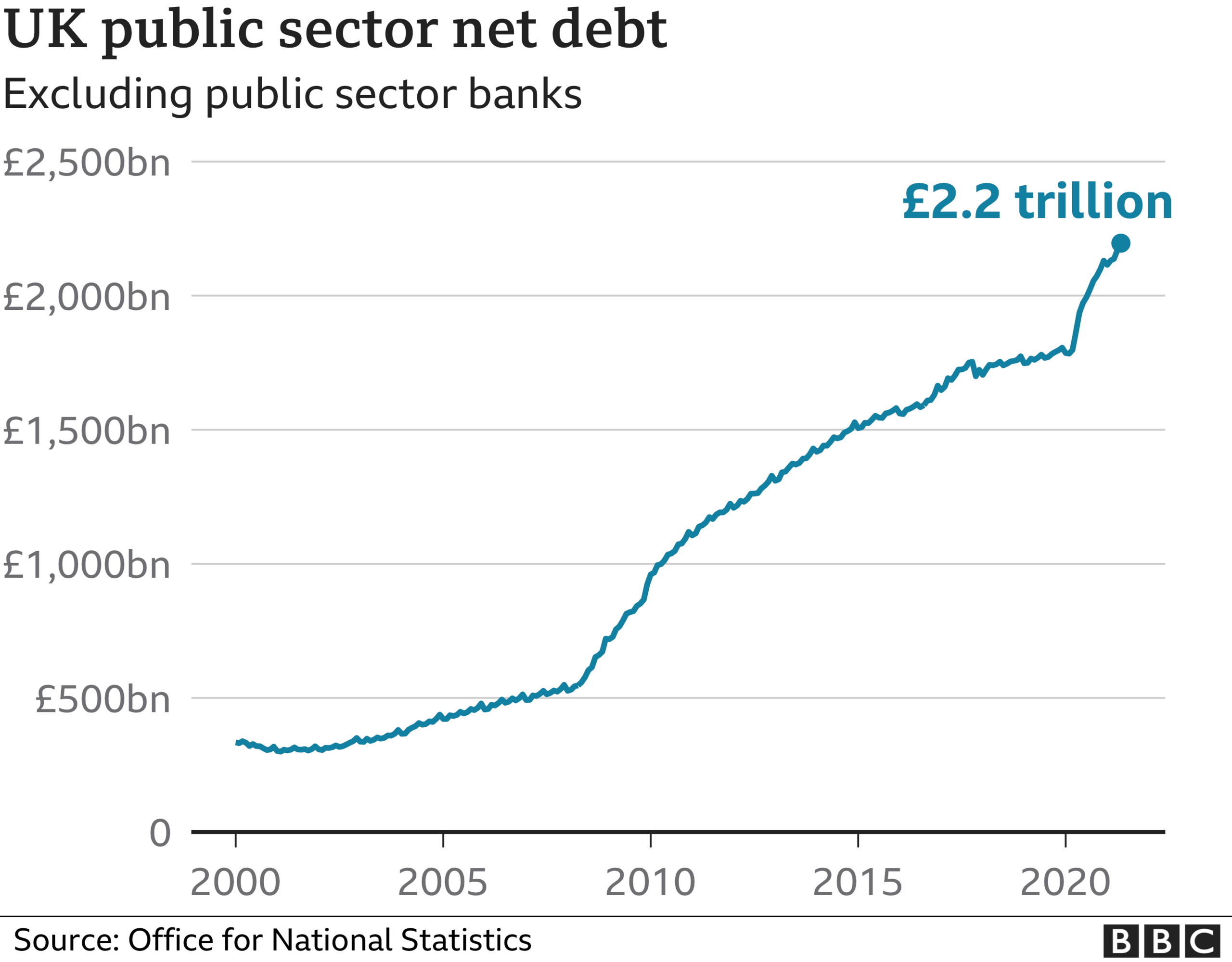

The huge amount of borrowing over the past year has now pushed government debt up to nearly £2.2 trillion, or about 99.2% of GDP - a rate not seen since the early 1960s.

The Office for National Statistics, external (ONS) now estimates that the government borrowed a total of £299.2bn in the financial year to March.

While that was down by £1.1bn from its previous estimate, it remains the highest level since the end of World War Two.

The ONS said the cost of measures to support individuals and businesses during the pandemic meant that day-to-day spending by the government rose by £204.2bn to £942.6bn last year.

These figures show how rapidly borrowing can fall, even as the government spends more, not less - and keeps taxes down to help boost the recovery. Because restrictions in May were lighter than the same month a year before, the amount of tax coming in jumped by 15% and central government spending dropped by 12%.

So far this financial year, the government is estimated to have spent £53bn more than its income from taxes. While that has meant the second-highest borrowing on record, it's £38bn less than in the same period last year and less than most economists expected.

The latest revisions for the year to March 2021 confirm what we already knew - that the government spent more than it has before in peacetime. It is now estimated to have had to borrow £299bn to plug the gap between its income and its spending in the pandemic's worst year. But it's also worth noting that this is £28bn less than was officially forecast in the Budget.

While debt is high at £2.2 trillion, that's slightly less than the size of the economy (compared to more than twice the size of the economy in World War Two). And the cost of interest on central government debt - £4.3bn in May - is comfortably manageable. As the pandemic restrictions have eased, so too has the pressure on the public finances.

BBC Reality Check looks at what countries can do about their pandemic debt

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said public borrowing was continuing to decline more rapidly than had been expected by the spending watchdog, the Office for Budget Responsibility (OBR).

"The stronger-than-expected economy meant that central government receipts came in at £56.9bn in May, above the OBR's £55.2bn forecast," he pointed out.

"Public borrowing will continue to undershoot the OBR's Budget forecast, given that GDP in 2021 likely will be about 3% higher than it expected this year," he added.

"That windfall will be offset only partially by higher-than-expected interest payments, due to rising RPI inflation, and the likelihood that the government will extend Covid-19 related health spending into next winter."

Thomas Pugh, UK economist at Capital Economics, agreed that a strong economic recovery was starting to feed through into lower government borrowing.

"The trend in tax receipts should continue to improve over the rest of the year, as stronger GDP growth than anticipated by the OBR boosts the public coffers," he said.

"That means the Chancellor [Rishi Sunak] may be spared having to implement his proposed tax hikes/spending cuts before the 2024 general election."

In a statement, Mr Sunak said the government was "continuing to support people and businesses to get back on their feet" as the country emerged from the pandemic.

However, he added that it was "also important over the medium term to get the public finances on a sustainable footing".

Related topics

- Published11 June 2021