What did the BBC investigation into homelessness in the face of repossessions find?published at 15:21 GMT

Jonathan Fagg

BBC England Data Unit

About three-quarters of councils who responded reported a rise

Let’s dig into the freedom of information requests.

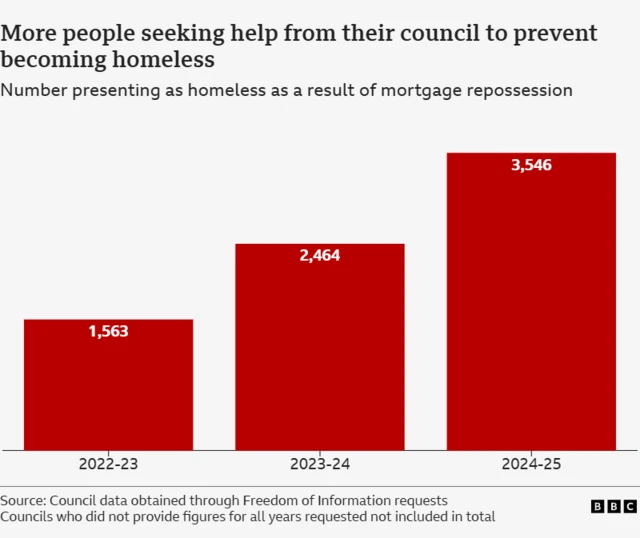

The BBC got usable figures from 244 local authorities across England on how many people are seeking help from their council because they’re at risk of becoming homeless.

The responses show that, across those councils, the number of people asking for help is going up – from 1,563 in 2022-23 to 3,546 in 2024-25. About three-quarters of councils who responded reported a rise.

Bury, in the North West, had 177 people seeking help in 2024-25, the most of any council that responded.

Somerset, in the South West, saw the largest change over the period: 150 people sought help in 2024-25, up from just one in 2022-23.

If we factor in population, we can work out which local authority has the highest rate of people asking for help. In 2024-25 that’s Broxbourne in Hertfordshire, where 95 out of 100,000 people were seeking help to prevent becoming homeless.