Price rises speed up again as economy unlocks

- Published

- comments

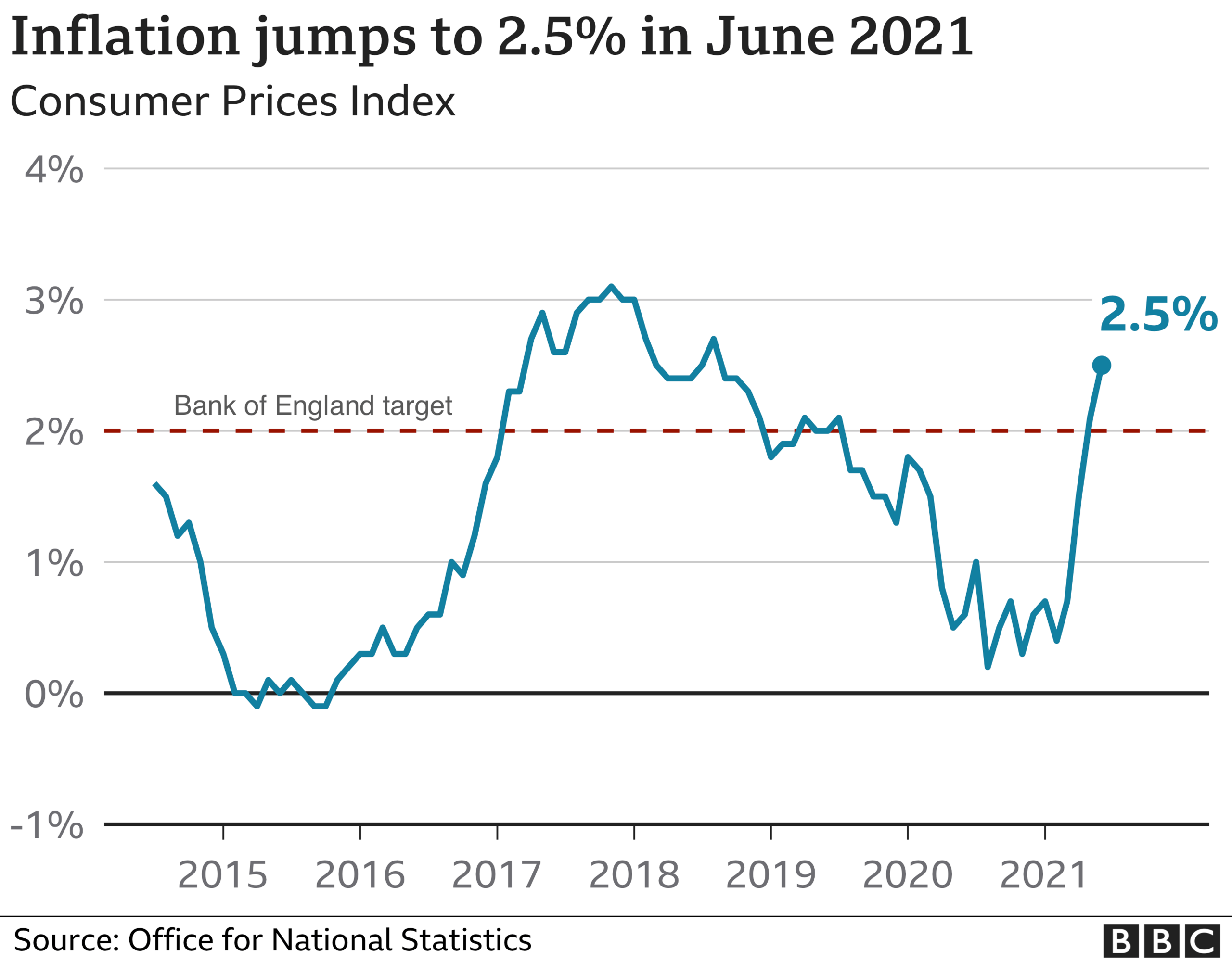

The UK inflation rate hit 2.5% in the year to June, the highest for nearly three years, as the unlocking of the UK economy continued.

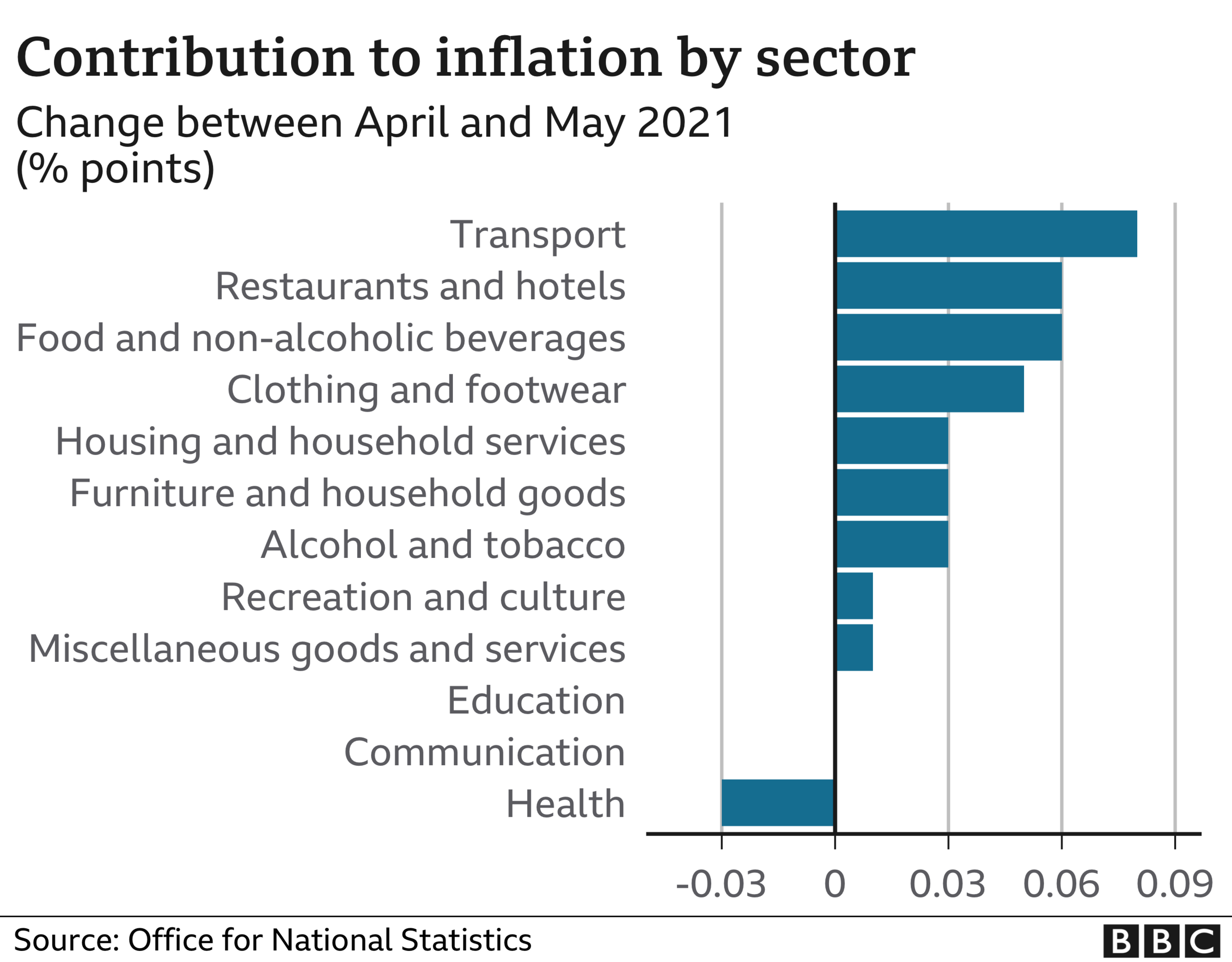

The Consumer Prices Index measure of inflation rose from 2.1% in May, the Office for National Statistics said, driven by higher food and fuel costs.

The rate is higher than the Bank of England's 2% inflation target for a second month.

That will fuel the debate about whether interest rates need to go up.

What is inflation?

Simply put, inflation is the rate at which prices are rising - if the cost of a £1 jar of jam rises by 5p, then jam inflation is 5%.

It applies to services too, like having your nails done or getting your car valeted.

You may not notice low levels of inflation from month to month, but in the long term, these price rises can have a big impact on how much you can buy with your money.

As well as food from shops, eating and drinking out also cost more, while clothing and footwear, usually cheaper at this time of year, went up in price instead.

Second-hand car prices rose between May and June this year, whereas in recent years, they have fallen between these months, the ONS said.

Some buyers were reported to have turned to the used car market as a result of delays in the supply of new cars caused by the shortage of semiconductor chips used in their production.

June's reading was above most economists' forecasts of an increase of about 2.2%.

ONS deputy national statistician for economic statistics Jonathan Athow said: "The rise was widespread, for example coming from price increases for food and for second-hand cars, where there are reports of increased demand.

"Some of the increase is from temporary effects, for example, rising fuel prices which continue to increase inflation, but much of this is due to prices recovering from lows earlier in the pandemic.

"An increase in prices for clothing and footwear, compared with the normal seasonal pattern of summer sales, also added to the upward pressure this month."

Retail Prices Index (RPI) inflation, an older measure that is still used to calculate certain cost-of-living increases, rose to 3.9% in June, from 3.3% in May.

The latest rise in the inflation rate will add to pressure on the Bank of England to consider increasing interest rates to cool the economy.

The Bank's rate-setting Monetary Policy Committee (MPC) has taken the view that the current inflation surge is "transitory" and will fall back after peaking at 3%.

But the Bank's departing chief economist, Andy Haldane, warned last month that the risk of high inflation was "rising fast" and could reach nearly 4% this year.

Inflation is up again, above target, with prices rising faster than expected across the board in June. Much of this is the result of comparisons with prices that were falling a year ago at the height of the lockdown. Bottlenecks in supply are also driving prices up. For example, car producers can not find microchips, so cannot build enough new cars, so used car prices went up 4.4% in a month. During the pandemic, the microchip market diverted its supply to electronics amid a slump in car sales.

There are plenty of examples like this, and the net result is that inflation is heading above 3% in the coming months. This is sufficiently above target to trigger a letter of explanation from the governor of the Bank of England to the chancellor, but don't expect immediate rises in interest rates.

Inflation should peak at this level before falling back to normal, as the economy further reopens. It is, right now, high and rising, but hardly out of control. And the reasons for this global rise are pretty clear: demand rebounding quickly after the pandemic, while supply is taking a little longer to ramp back up.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, sided with the MPC majority view that inflation was likely to reach 3%, but not much higher.

Interest rates would therefore remain at the current record low of 0.1% "throughout next year", he said.

Inflation would "ease quickly in 2022", returning to the Bank's 2% target "in the second half of next year", he forecast.

However, Ruth Gregory, UK economist at Capital Economics, took Mr Haldane's view that inflation could peak as high as 4% at the end of this year.

"We expect it to continue its upward trend over the summer," she told the BBC. "That's largely because of these global supply shortages which have become more acute.

"Of course, that's affected everything from semi-conductors to household appliances."

Traders in Willesden Market in north-west London interviewed by the BBC said they were feeling the effects of those supply shortages, with their wholesale costs going up sharply.

However, they added that they were finding it difficult to pass on those costs to their customers, who were unwilling or unable to pay more.

One trader said: "If you try to pass the costs on to the customers, they just don't buy it. Especially at the moment.

"No-one's got any money, everyone's skint, everyone's coming back out of lockdown, people have lost their jobs.

"I'm earning less, but I'm still going, so I can be thankful for that at the moment."

- Published14 July 2021

- Published13 July 2021

- Published9 July 2021