House prices at new high but pace of growth slows

- Published

- comments

House prices hit a record high in August, but the annual pace of growth in property values slowed, according to the UK's largest mortgage lender.

The Halifax said the cost of a typical home rose 0.7% last month to £262,954.

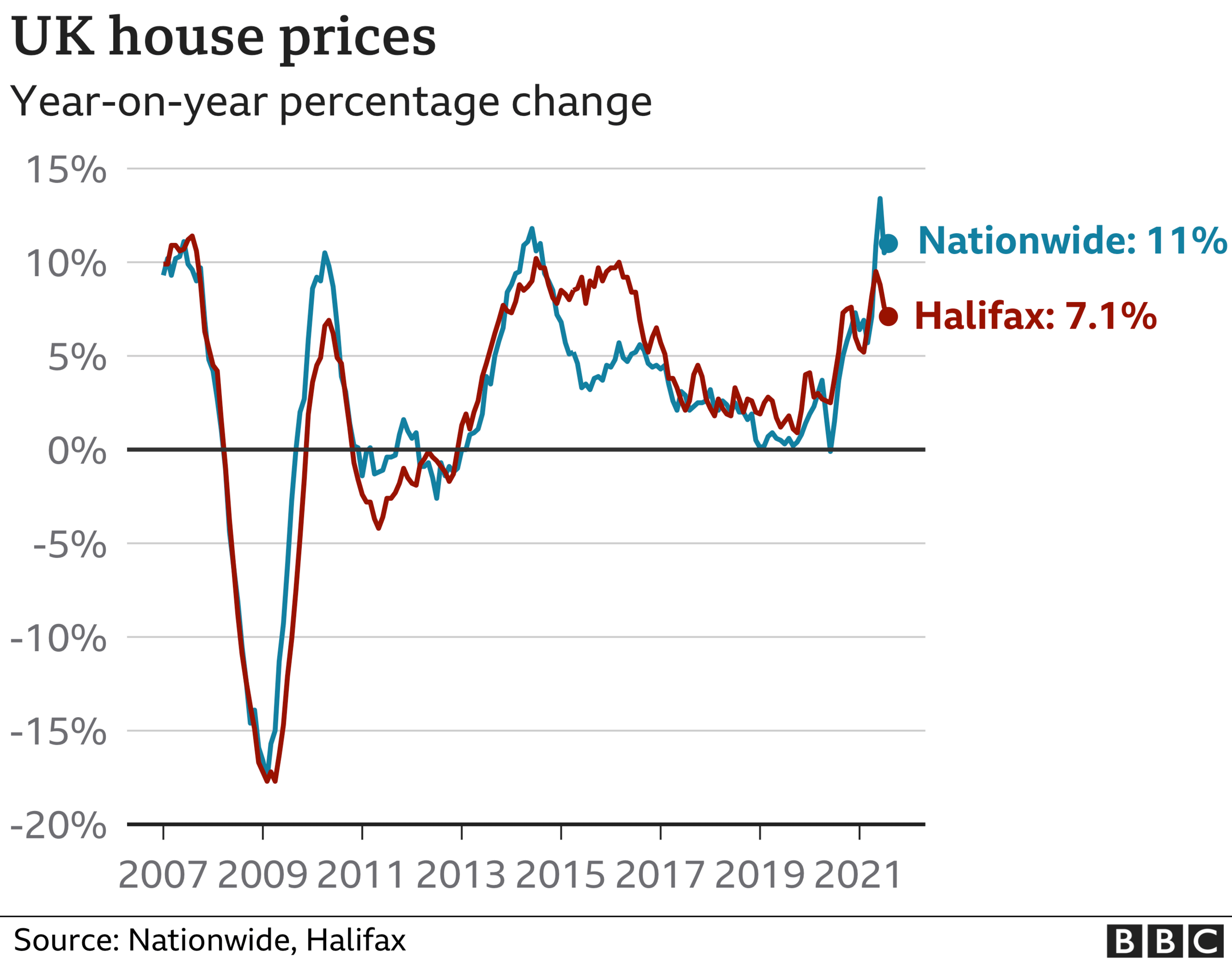

In the year to August, house prices rose 7.1%, it said, down from a rate of 7.6% in July.

But that figure masked big differences between the UK's nations and regions, reflecting buyers' interests in seeking more space and rural locations.

"Given the rapid gains seen over the past 12 months, August's rise was relatively modest and the annual rate of house price inflation continued to slow," said Russell Galley, managing director, Halifax, which is part of Lloyds Banking Group.

The broader economic environment was positive, with high job vacancies and consumer confidence returning, which benefited the housing market, he said.

But the stamp duty holiday, put in place at the start of the pandemic to support the housing market, runs out at the end of September, and was no longer having a significant impact on the market, Mr Galley added.

Instead, record levels of buyer activity were being driven by homebuyers' demand for more space as many continue to work from home.

"These trends look set to persist and the price gains made since the start of the pandemic are unlikely to be reversed once the remaining tax break comes to an end later this month," said Mr Galley.

Nationwide provided stronger housing market figures earlier this month, reporting that house prices had risen by 2.1% in August compared to the previous month, taking price rises over the last year to 11%.

The pace of price rises varied across the UK, the Halifax said. In Wales, annual house price inflation was 11.6% last month, while in the south west of England it was 9.6%.

Northern Ireland saw annual house price inflation of 9.3%, but in Scotland price growth slowed to 8.4%.

House prices in Greater London rose just 1.3% over the past year, the Halifax said. However at £508,503, a typical property in the capital was still much more expensive than elsewhere in the UK.

There were "plenty of props" currently for the housing market, said Martin Beck, senior economic adviser at the EY Item Club.

"Consumer confidence has remained high, the labour market is emerging from the crisis relatively unscathed and buyers have continued to benefit from ultra-low mortgage rates," said Mr Beck.

In addition, many households had managed to accumulate "substantial savings" during lockdowns.

Lucy Pendleton, from independent estate agents James Pendleton, said that while price rises in London had lagged other regions, there were signs that activity in the capital was picking up.

"By the end of the year we expect the narrative to have changed significantly, from one in which London has been the poor relation to a story of the traditional frontrunner regaining its crown, at least on relative terms.

"That's partly being powered by first-time buyers. Many young people and professionals still want to live in London, at least for a period, and the numbers of them beating a path to estate agents' doors has shot up in the past couple of months."

Related topics

- Published1 September 2021

- Published21 August 2021

- Published6 August 2021