Budget 2021: What do you want to change?

- Published

Ruby Torry wants the minimum wage to rise or national insurance to go down

Chancellor Rishi Sunak will deliver his Budget and Spending Review to the House of Commons next week, setting out the government's spending and financial strategy.

Changes to the national minimum wage could be announced, as those earners have been badly hit by the economic downturn.

New climate measures and changes to company taxes are also expected.

We asked six people across the UK what they want to see from this Budget.

'I want the minimum wage to go up'

Ruby Torry, a 23-year-old waitress at Zizzi's restaurant in the Meadowhall shopping centre in Sheffield, lives in Rotherham with her mother and earns the minimum wage.

"I'm careful with my bills and don't go silly with shopping, but I want to see the minimum wage go up or national insurance tax come down," she told the BBC.

Zizzi's had put Ms Torry on furlough, but she said she couldn't cover her bills, so she worked for Asos in the firm's Barnsley warehouse during the pandemic. She says she would also like to see more incentives for apprenticeships.

"I wanted to do an engineering apprenticeship, but wouldn't have been able to live on £800 a month wages - I couldn't even pay for my car on that," she explains.

"Minimum wage needs to go up, I don't know how the government thinks we can do anything on that little."

'Universal Credit needs to keep up with higher bills'

Michelle and her daughter Charlize

Michelle Wilson is a single mother from Glenrothes in Scotland and has already felt challenges after the £20 weekly uplift in Universal Credit was ended on 6 October.

"It's a real worry because the uplift was almost £100 a month, which is my main shop gone now, so it's another big stress," she told the BBC.

She added that she would like to see increases in Universal Credit and the minimum wage to reflect the rise in household costs from inflation.

"My kids have been eating healthier with that uplift and it's been a big drop when I'm worried about my gas and fuel bills," she says.

Ms Wilson used to work as a support officer for Fife council, but one of the reasons she left the job was because she struggled with the cost of childcare as a lone parent.

She said it would be "helpful" for the Budget to encourage more flexible hours for working and finding childcare, as she is limited to 09:00 to 15:00.

Ms Wilson would support government measures to help with the sharp rise in energy bills, which she said she is "struggling to keep up" with, as rising costs are making life "harder and harder" for her.

'It should be easier to hire overseas workers'

Nick Grey founded Gtech, which makes floor cleaning and garden products and has a turnover of £70m. The firm employs 200 people across the UK and sells more than 22 million products in 19 countries.

Mr Grey says the Budget should not make it more difficult for firms to employ overseas workers, which he thinks would be a "backwards step" amid the labour shortages.

Another of his requests is that a rise in corporation tax should be avoided, as he says it "risks businesses setting up headquarters elsewhere and less bureaucracy would be better for attracting investment in the UK".

Raising tax on high earners also "risks lowering the overall tax income for the country", he adds.

'Higher earners should pay more tax'

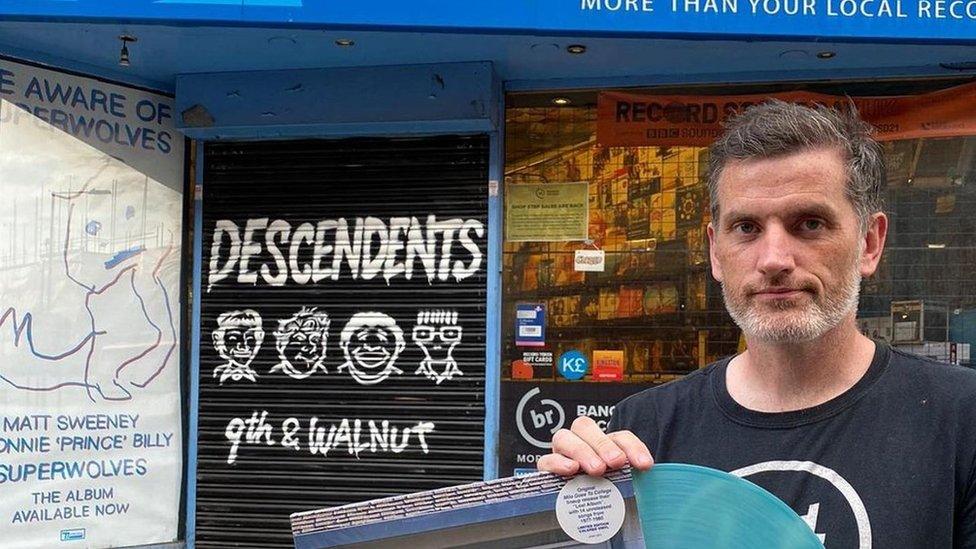

Jon Tolley runs independent record shop Banquet Records in Kingston, Surrey. He believes the fairest way to pay for the pandemic is through increased tax for people and businesses that earn the most, rather than a rise in everyone's National Insurance tax.

"I want customers and my employees to have disposable income and cash in their pockets, so they can spend it on the High Streets," he adds.

Mr Tolley explains the business has had an "OK" year and received a cash grant of £25,000 , externaltwice from the government for having had to close the shop - action that he says was "welcome and effective".

But he adds that he would like to "see something changed about business rates".

"We're in competition with online stores who don't have to pay the same rates and High Street rents, so that playing field needs to be levelled."

The business pays the standard 20% VAT on products and Mr Tolley doesn't want to see this increase.

"We haven't had 'just-in-time' stock control at all, because of delivery delays, but we're fortunate to have storage capacity and have ordered well ahead for Christmas."

'Encourage greener technologies'

Hollie Whittles, digital strategy specialist and HR director at Purple Frog Systems, says she wants to see a review of the business rates system.

She says small businesses often "lack the time to understand" tax and rates.

Ms Whittles says it is "crucial" to make sure taxes designed for large organisations are not avoided or passed "further down the chain to their small business customers".

On climate measures, she commends grant schemes such as the Low Carbon Opportunities Programme (LOCOP) and the Business Energy Efficiency Programme (BEEP), which encourage businesses to adopt greener technologies.

"It is vital that the government supports small businesses' journey to net zero, especially with small businesses making up more than 99% of all private sector enterprises," she adds.

Hollie Whittles

On changes to apprenticeship schemes and student loans, Ms Whittles, who works with 14 staff, says she would welcome more support for small businesses wanting to train and upskill staff in new technologies that help benefit long-term careers and the local economy.

Ms Whittles says there have been "considerable challenges" in accessing the government's Kickstart scheme, which creates new jobs for 16 to 24-year-olds on Universal Credit.

The government should also support schemes and skills investment for older people wanting to change careers, in her view.

'The state pension should rise'

Lynne Turner

Lynne Turner is 71 years old and would like to see her basic government pension of £137.60 per week increased.

"It's absolutely not enough. I'm frugal, but couldn't survive with a decent lifestyle if I only had my pension," Ms Turner explains.

Ms Turner says she could not afford to pay into a private pension in the past because of childcare costs. Without an inherited cottage in Wales, the rent from which supplements her pension, she "wouldn't be able to manage", she says.

She adds that she would support a beer levy, which "wouldn't bother her at all", but says that because so many small businesses have struggled during the pandemic, she would be against making them pay more taxes.

Are you affected by issues covered in this story? Share your experiences by emailing haveyoursay@bbc.co.uk, external.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

WhatsApp: +44 7756 165803

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

If you are reading this page and can't see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk, external. Please include your name, age and location with any submission.

- Published22 October 2021