Budget 2021: Five things to look out for

- Published

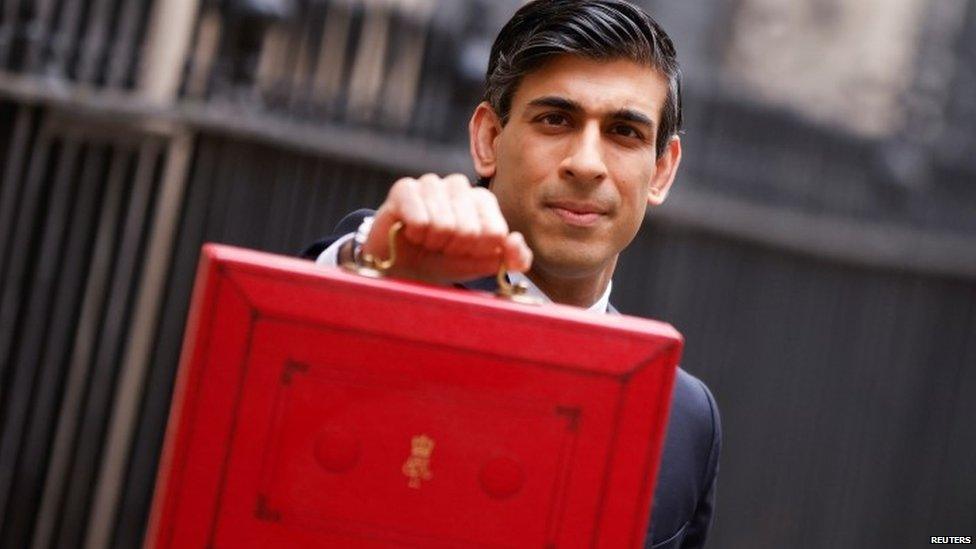

Rishi Sunak has had a year-and-a-half as a high spending chancellor during a once-in-a-century crisis.

Chancellor Rishi Sunak will unveil the government's tax and spending plans on Wednesday. Here are five things to look out for.

1. The state of the economy

The forecasts will reflect an economy that has rebounded faster than the 4% predicted for this year at the last Budget in March. That means significantly lower borrowing.

The forecast peak for unemployment will again be further lowered, reflecting the success of the furlough scheme.

However, much of this is already old news, and some of those who predicted a "boom" are now scaling back their estimates.

What matters now is the immediate implications for the economy of supply chain problems, worker shortages, rising prices and interest rates. The chancellor's speech, along with accompanying forecasts from the Office for Budget Responsibility, should have some pointers.

2. Wage rises

An immediate test of the Downing Street rhetoric on wage rises will take place with the announcements on public sector pay, largely frozen last year, and the National Living Wage (NLW).

The NLW is earmarked for a 5% rise to £9.42 an hour from April, as part of a pathway to £10 an hour by 2024, which could be brought forward by a year.

But could that, in fact, widen what has been significant wage rises in shortage sectors, such as haulage, to a more general and therefore inflationary economy-wide phenomenon?

3. New rules on borrowing

Rishi Sunak has had a year-and-a-half as a high spending emergency chancellor, racking up debts for a once-in-a-century crisis, expanding the state, and taking taxes to post war highs.

This will be his chance to re-establish his fiscally conservative free market credentials. His method for doing so will be a set of new fiscal rules to bring both annual borrowing under control and the debt down.

These rules have been routinely broken by previous chancellors. But how strictly he decides to set these restraints on his power to borrow, will determine room for manoeuvre for extra spending and possible tax cuts.

Just how ambitious the government is on net zero will be seen in black and white in the numbers.

4. Catch-up funding

The chancellor will tout this as the first full multi-year post austerity spending review. Spending will rise more than one of the Gordon Brown Spending Reviews. But two-thirds of the funding decisions - for health, schools, defence and aid, are already baked in the cake.

What remains, are important areas of spending, such as courts, prisons, and, crucially, local Government, which are on course for another two-year spending squeeze, before spending goes up.

Even more importantly, little cash has been so far allocated for permanent post pandemic legacy spending in health, care, and schools. If that happens, the immediate squeeze elsewhere will be even tighter. This will have consequences for services, and potentially council tax bills.

5. Just how serious is Downing Street about levelling up and net zero?

Local council spending cuts will be difficult to reconcile with promises made to regions outside the big cities. But this spending review really is show time for Downing Street to reveal the substance behind their promise to "level up" Britain.

The phrase originated in promises to equalise per-pupil spending across England. Transport spending is hugely skewed in the UK - with regions such as the North East of England missing out. Will this Spending Review fundamentally change that pattern, even if it would never seek to equalise such spending with, say, London?

The answer to that question will start to be seen in the capital funding allocations in the review.

Likewise, net zero: Tens of billions of investment will be required to rewire the economy away from burning carbon. Most of that will come from the private sector, but a huge amount will need to come from the public sector too.

Again just how ambitious and serious the government is here will be seen in black and white in the numbers allocated in the review.

Related topics

- Published26 October 2021

- Published22 October 2021