Budget 2021: Price rises could hit highest rate in 30 years, says forecaster

- Published

- comments

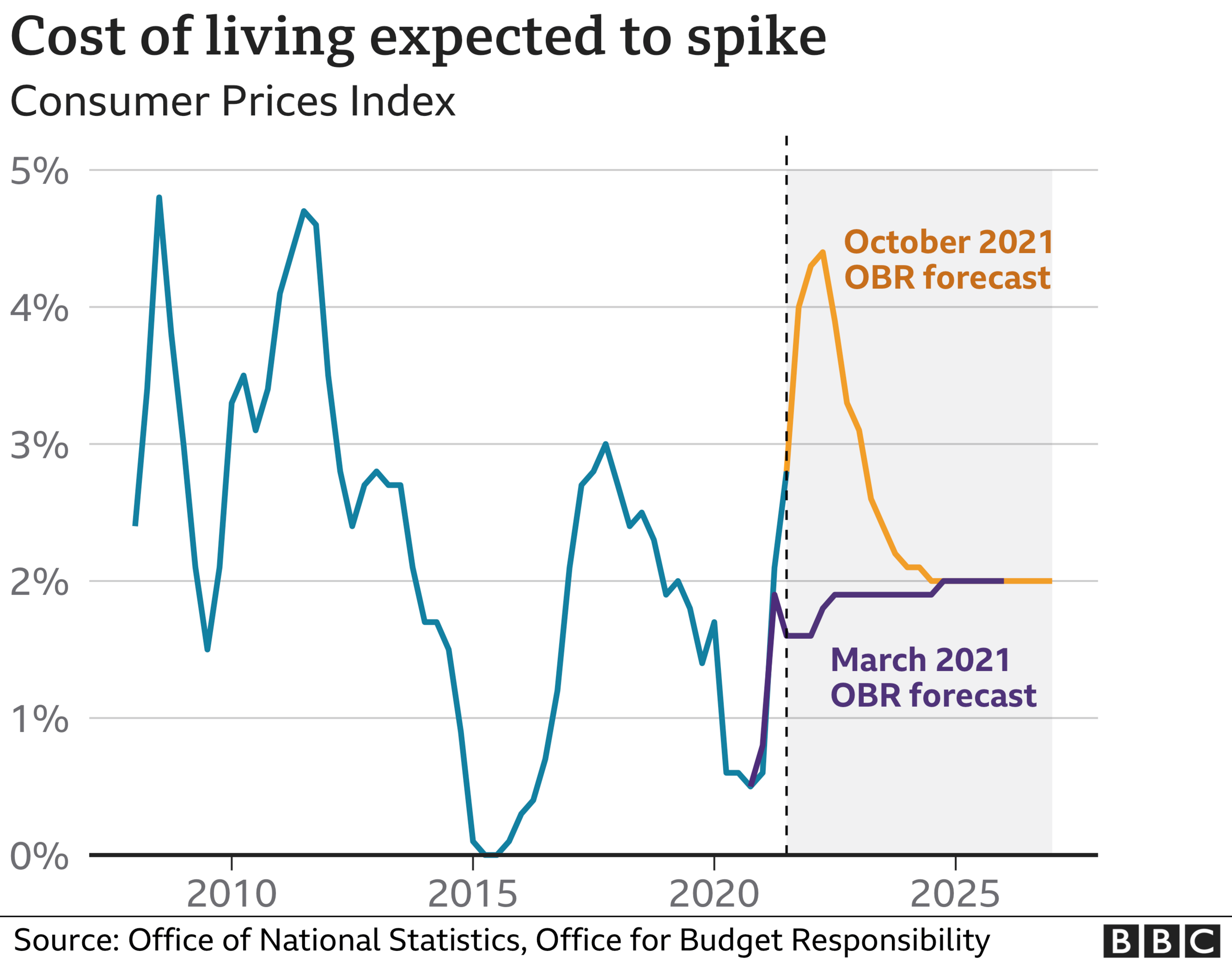

The cost of living could rise at its fastest rate for 30 years, the government's forecaster has warned.

Its latest forecast says inflation, which measures the change in the cost of living over time, is set to jump from 3.1% to an average of 4% in 2022.

However, the Office for Budget Responsibility (OBR) says figures released since its report was compiled suggest inflation could hit almost 5%.

The chancellor acknowledged that household budgets are strained.

Rishi Sunak described the overall economic picture as "strong" in the short term, with the OBR now expecting the economy to return to its pre-pandemic level six months earlier than it had forecast previously.

However, he acknowledged the inflation rate was "likely to rise further" from its 3.1% rate in September.

He said it was due to increased demand for energy and supply chain issues as economies and factories reopening following coronavirus lockdowns.

"The pressures caused by supply chains and energy prices will take months to ease," Mr Sunak said.

"It would be irresponsible for anyone to pretend that we can solve this overnight."

The UK's exit from the European Union (EU) has exacerbated supply chain problems such at hold-ups at ports or with deliveries, the OBR said in its latest report, external.

The OBR also said the fact that the energy price cap has risen was a big factor behind the rising cost of living. The cap sets the maximum price suppliers in England, Wales and Scotland can charge domestic customers on a standard - or default - tariff.

The independent forecaster suggested that had its figures been more up-to-date, its inflation forecasts would have painted a more bleak picture for consumers and businesses.

It previously said, external it had ended any updates to its forecast on 24 September, earlier than usual, and "in response to a request from the chancellor".

Richard Hughes, chairman of the OBR, told BBC News that if inflation started feeding into wages, rather than just products in the shops, the problem could persist for longer.

Covid recovery

But the OBR lifted its prediction for economic growth in 2021 to 6.5%, up from its previous forecast of 4%. It has also reduced its estimate of the long-term "scarring" effect of Covid-19 on the economy from 3% to 2%.

The effectiveness of Covid vaccines and the adaptability of consumers and businesses had sped up the recovery, the OBR said.

But it forecast that economic growth would be lower next year than it previously thought, partly down to a better performance in 2021.

In 2022, gross domestic product (GDP), which measures all the activity of companies, governments and people in an economy, will increase by 6%, the OBR said, rather than the 7.3% it predicted in March.

Growth is forecast to be 2.1% in 2023, 1.3% in 2024 and 1.6% in 2025.

While the economy is in a stronger state than had been expected, whether in terms of growth, employment or the public finances - the official analysis makes clear the obstacle inflation poses to standards of living in the coming months.

The OBR reckons inflation will hit 4.4.%; it warns it may go as high as 5%. And, it makes clear that leaving the EU has heightened the UK's experience of the bottlenecks that are bumping up business costs, that in turn will lead to higher prices.

That higher cost of living, together with looming tax rises will dampen the effect of wage rises over the next couple of years.

Strip out inflation and the OBR reckons that household income after tax will only recover to pre-pandemic levels in mid-2023. And those lost years of prosperity increases could weigh on growth - and sentiment in the run up to the next election.

Big Covid bills remain

Higher inflation is also likely to put pressure on how much the chancellor is able to spend in the future.

But Mr Sunak has been offered some room for manoeuvre, as the improving economic picture and higher tax incomes means the government will not have to borrow as much.

Borrowing hit a record £319.9bn during the 2020 financial year as the government poured money into pandemic support schemes such as furlough.

It is now forecast to fall every year between 2021 and 2026.

Jane Mackay, head of tax at audit, tax, advisory and risk firm Crowe, said there was still a "huge" Covid bill to deal with, though.

"The Budget statement hasn't really given us clarity on who will pay that bill.

"The tax increases that were announced before the Budget, including corporation tax rising to 25%, and the NHS and social care levy additional NICs of 1.25%, might suggest the strategy will spread the burden as widely as possible, rather than to make the structural changes to our tax system that may be what is really needed."

A risk of rising inflation as well is that it will increase the amount of interest the government needs to pay back on what it has borrowed for pandemic spending.

Bank of England governor Andrew Bailey warned in September that it "will have to act" over rising inflation.

The Bank has already said UK inflation is set to exceed 4%, before falling back as the economy recovers from Covid.

The UK's central bank can raise interest rates in an attempt to tackle inflation if prices are rising quickly. In theory, when borrowing costs rise - which would make loans such as mortgages more expensive - people spend less and prices are driven down.

Mr Sunak said on Wednesday that he had written to the Bank to "reaffirm their remit to achieve low and stable inflation".

Investors are expecting interest rates to be raised later this year or early in 2022, in an effort to bring inflation back down to the Bank's 2% target.

However, he gave no suggestion of when the Bank might increase rates from the current record low of 0.1%.

The governor said that rising energy bills could push inflation higher for longer than previously thought.

- Published27 October 2021

- Published26 October 2021

- Published21 October 2021