Lidl to ramp up UK store openings with 1,100 stores by 2025

- Published

- comments

German discounter Lidl has announced plans to increase the number of its UK stores to 1,100 by 2025, up from 880 now.

The move will create 4,000 new jobs, the supermarket chain said.

Its latest UK accounts published on Wednesday morning showed revenues climbed 12% to £7.7bn in the 12 months to the end of February.

That helped it post a pre-tax profit of £9.8m, compared with a £25m pre-tax loss in the previous year.

It said that despite the challenges posed by the pandemic, it opened 55 new UK stores in the year which left it on track to reach its previously stated aim of having 1,000 stores by the end of 2023.

It said the improved results "can be attributed to the business' ambitious expansion plans and prudent investments in Great Britain".

"We delivered an impressive trading performance in the period which was supported by our continued investment in new and existing stores, product innovation and our people," said boss Christian Härtnagel.

He said the company remained confident in its strategy and its stores-first approach.

Mr Härtnagel told the BBC that supply chain problems at the grocery chain have eased in recent weeks.

"The kinds of empty shelves that we undoubtedly had a couple of weeks ago or a month ago, they have gone," he said.

That's because the supermarket has overcome "systematic issues" such as the CO2 crisis in the summer.

A shortage of the carbon dioxide - which is used to carbonate drinks as well as in packaging for meats, baby foods, fresh foods and baked products - had on knock on effect on other products.

But he added that fresh problems are being thrown up "every single day".

"We're still fighting challenges daily such as with our workforce, in IT or labour challenges in our own warehouse, but we are in a much better place on availability."

As a result he warned that Christmas will be the most challenging ever in the UK for the chain: "It's much harder work for our teams to deliver Christmas than it has ever been before."

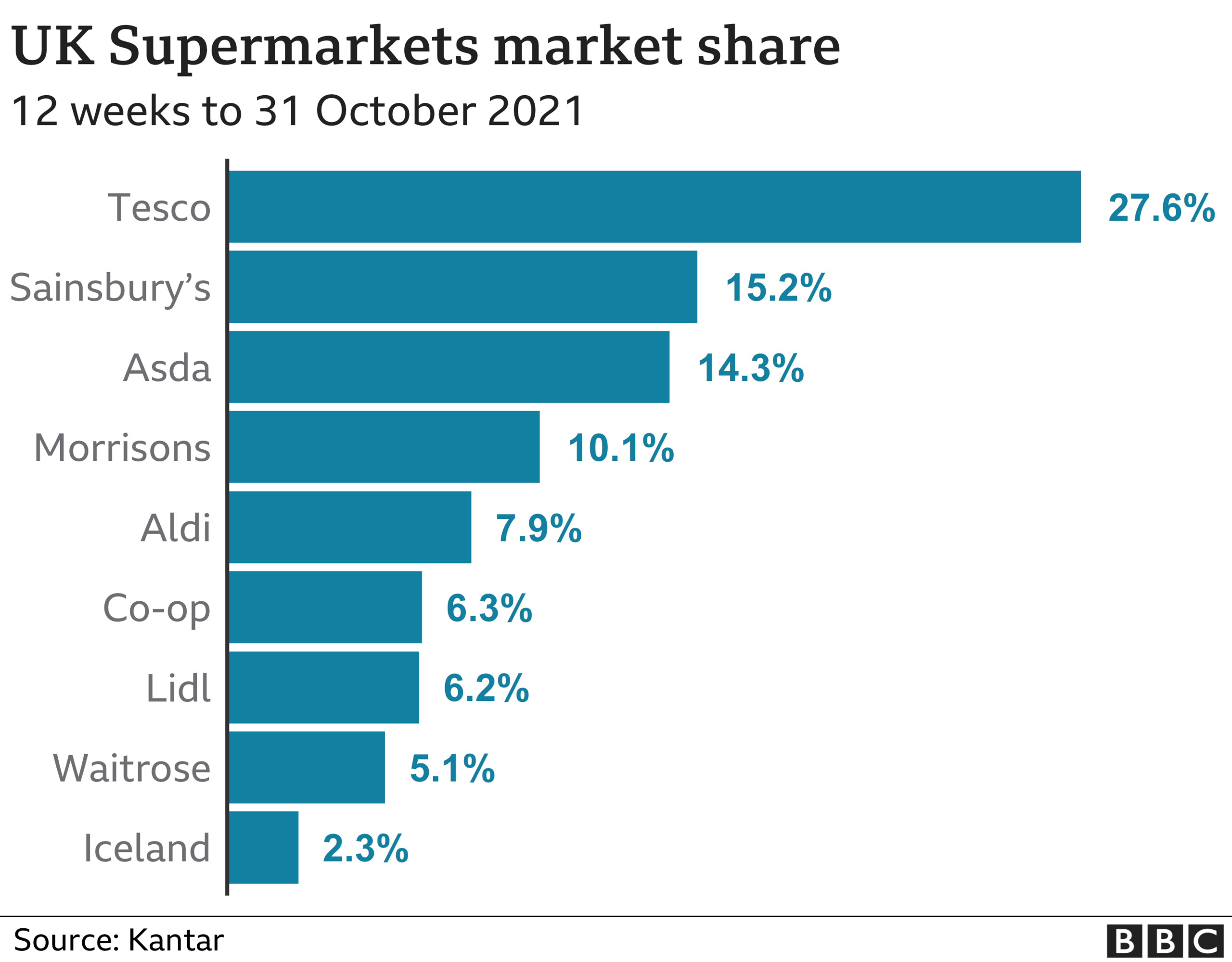

Lidl has a 6.2% share of the UK grocery market, and currently has more than 880 stores, more than 26,000 employees, and 13 distribution centres in England, Scotland and Wales.

It still lags behind bigger rivals. Market leader Tesco has a 27.6% share with some 3,400 branches, although the majority are convenience stores.

Sainsbury's is second-largest with market share of 15.2%, according to the latest figures from analysts Kantar which were published at the end of October. It has about 1,400 stores.

Asda has about 600 stores but a 14.3% market share while Morrisons has a 10% market with about 500 branches.

Aldi is currently the fifth-largest supermarket in terms of market share with 7.9% and 930 stores. Earlier in November, it announced plans to open 100 new stores over the next two years.

It's followed by the Co-op which is sixth-biggest with 6.3% market share and has about 2,600 stores.

Brexit impact

In its results, Lidl UK warned that changes it had been forced to make because of Brexit could "put pressure on the company's resources and capacity, leading to severe disruption to the supply chain".

It listed the key impacts which included the increased administration involved in importing and exporting into and out of the UK.

It also mentioned additional certification and licensing as well as additional border checks by health authorities.

It said customs agents' capability and capacity have been "stretched to a maximum" which had "limited their ability to process goods more efficiently".

It also revealed that government deadlines for some shipping lines had been missed, leading to delays at the UK border because of "mistakes being made during manifestation of incoming goods".

There have also been additional costs due to customs duties and import costs, it said.

Related topics

- Published24 November 2021

- Published17 November 2021

- Published25 May 2021