Ride hailing app Grab falls in $40bn market debut

- Published

Grab - the Uber of South East Asia - has made its stock market debut on New York's Nasdaq trading platform.

Shares initially rose in the Singapore-based operator of the ride-hailing and payments app, before falling sharply.

The share sale valued Grab at more than $40bn (£30bn), making it the largest ever US listing by a South East Asian firm.

Instead of a conventional share sale, Grab went public using a shell company designed to make the process cheaper.

Using a special purpose acquisition company (Spac) has become an increasingly popular strategy with start-ups, as it offers more flexibility around voting rights, as well as lower costs.

Minutes into their market debut, the shares rose by 21%, but ended the day more than 20% below their launch value.

Grab's business is growing, but the firm is yet to make a profit and it doesn't expect to do so until 2023.

However, Grab chief executive Anthony Tan told the BBC the firm's profit margins were "industry leading" and that he was focused on growing the business in a cost-disciplined way.

"You look at our food delivery business, a majority of our markets have already broken even, so we know how to get there as a clear path of profitability," he said.

Grab co-founder Anthony Tan has pushed his ride-hailing firm into new areas such as insurance

To address criticism that it is avoiding public scrutiny over its financial performance by choosing a Spac listing, Grab has reported its earnings for the last three quarters even though it didn't need to.

"Grab needs to demonstrate to investors its growth potential," said Professor Howard Yu of IMD Business school. "This is why Grab is trying hard to enter finance because that is one sector really high in terms of profitability."

Grab's existing investors include Japan's Softbank, China's Didi and Uber.

The flotation is being seen as a test for South East Asian financial technology and could encourage other start-ups in the region - like Grab's Indonesian rival Gojek which merged with Tokopedia - to follow suit.

What is Grab?

Less than a decade ago, Grab was a simple taxi company, founded by Anthony Tan and Tan Hooi Ling in Malaysia.

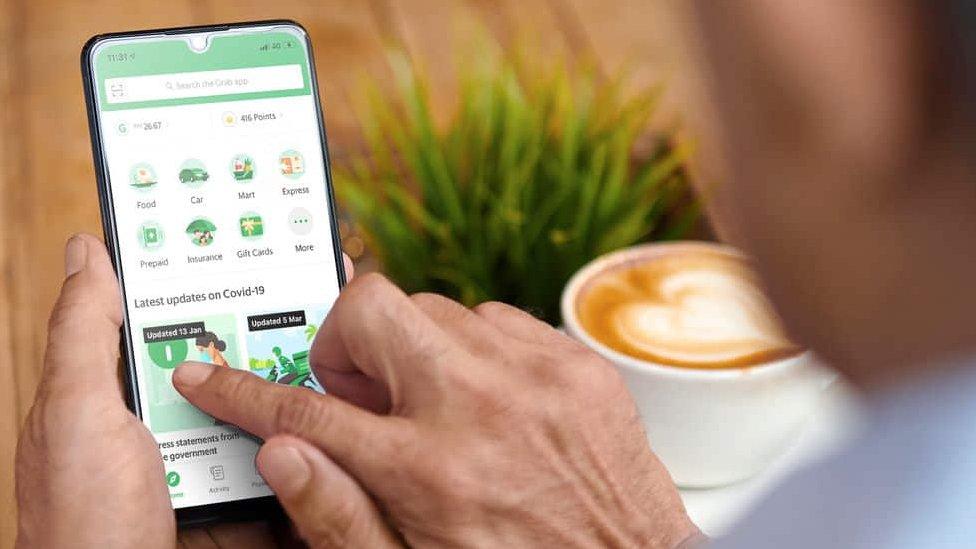

Now it is one of the most popular apps in Asia, offering rides, food delivery and now, financial services, including loans, insurance, payments and investments - all accessed through a mobile phone app.

In 2018, it pushed Uber out of South East Asia and operates in 465 cities across eight countries.

Grab has become a "powerful flywheel combining ride-hailing, delivery and payments" that has "demonstrated durable growth even during the pandemic and is playing a foundational role in the digitisation of South East Asia", said Brad Gerstner, the chief executive of its Spac partner Altimeter.

What are Spacs?

Spacs, which became a major story in the US stock market at the start of this year, are shell companies that are set up with the sole purpose of merging with a private firm to take it public. They are also known as "blank cheque companies".

For start-ups like Grab, it is a quicker and cheaper way to list on a stock market, with fewer regulatory hurdles.

A conventional initial public offering (IPO) costs about $1m, according to Michael Lints, partner at Golden Gate Ventures. But with a Spac, a company can go public for as little as half that amount.

"From a start-up's perspective, Spac is an extreme arrangement because it is even more founder-friendly than a traditional IPO," said Professor Yu. "Even after the company is listed, the voting rights can be geared to favour the founder and they remain in absolute control."

Grab is a case in point: Mr Tan has secured 60.4% of the voting rights even though he owns just 2.2% of the company's ordinary shares. This arrangement could have come under scrutiny if Grab had listed in the conventional way.

For investors though, Spacs can be more risky and they have not been a mainstream investment instrument until fairly recently.

"They were viewed as a shady way of getting a company listed," said Mr Lints. However, when brand name companies like DraftKings, a fantasy sports and betting operator, chose to go public with a Spac in 2019, the market took notice.

Why have Spacs taken off?

Thanks to the Covid-19 pandemic, trillions of dollars of economic stimulus have been poured into the global economy, flooding the market with cheap money and investors looking for new opportunities.

After a record number of Spac listings in the first three months of this year, however, the US stock market regulator - the Securities and Exchange Commission (SEC) - issued guidance on Spacs. Its new accounting rules have resulted in the number of Spac IPOs falling sharply.

"Investors started to realise that some of them weren't even generating revenues," said Mr Lints, adding that there are signs people remain more cautious about Spacs.

But as the regulatory filing backlog clears, Spacs are making a comeback. Spac mergers of WeWork, social networking app Nextdoor and Grab have all been approved in the last few months.

The explosive growth of Spacs in the US is also spreading to the rest of the world, with the stock exchanges in London and Singapore allowing them and Hong Kong considering it.

"With a lot of appetite to invest, other countries are trying to relax regulations to encourage Spac listings so that they can bring these high-flying tech companies to list in their local markets," said Prof Yu. "It's almost like a race to the bottom, just like the taxation regime."

- Published3 May 2021

- Published13 April 2021