Nationwide: UK house prices continue to surge in November

- Published

- comments

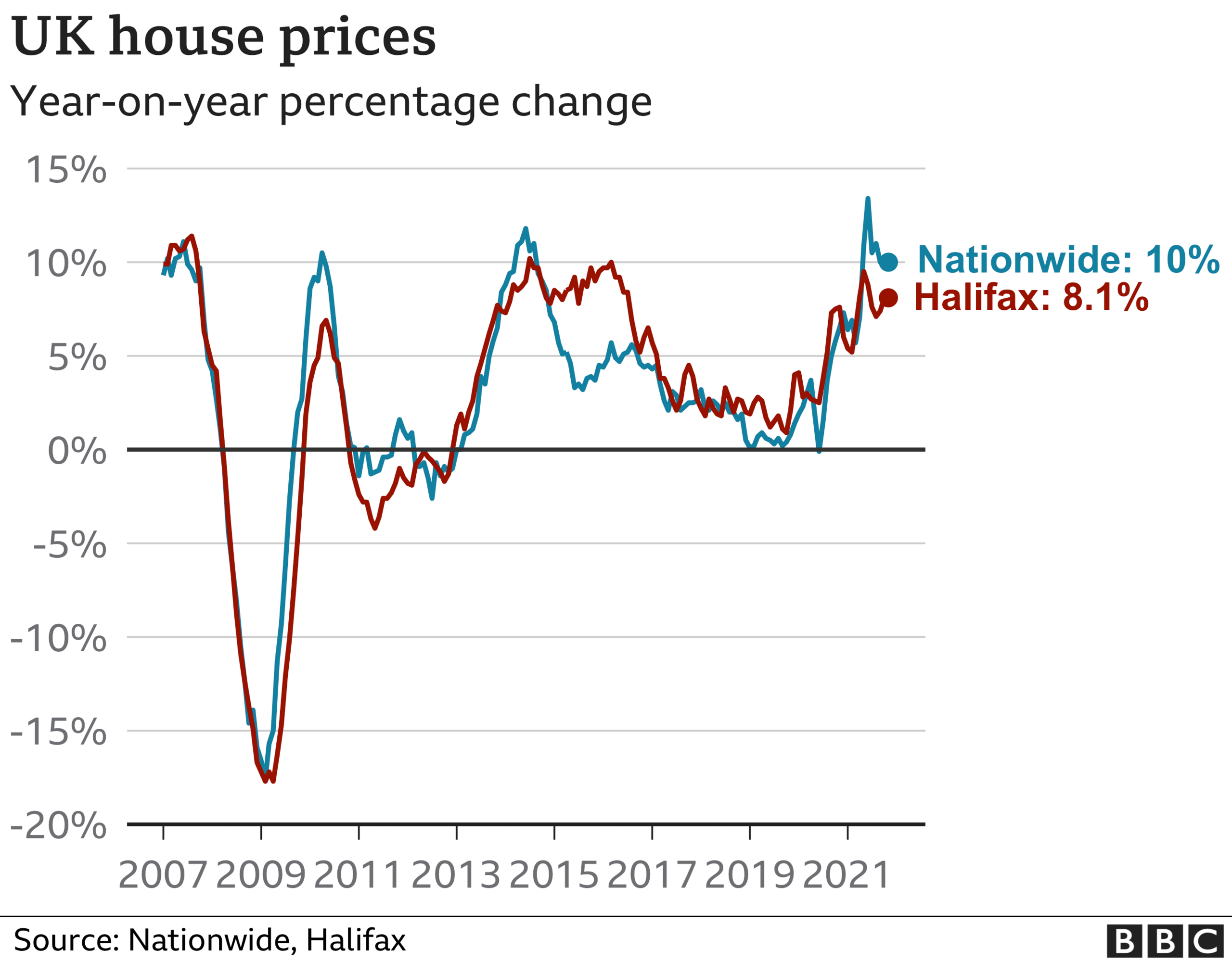

House prices in the UK have returned to double-digit growth following a slowdown in the market after the stamp duty holiday came to an end.

Annual house price growth hit 10% in November, according to the Nationwide Building Society.

That was an increase from the 9.9% growth seen the month before.

But Nationwide's chief economist Robert Gardner said it was still unclear what impact the new Omicron variant would have on a "buoyant" housing market.

The average price of a UK house was £252,687 in November - nearly 15% higher than March 2020, when the coronavirus crisis started.

Mr Gardner said: "There have been some signs of cooling in housing market activity in recent months; for example, the number of housing transactions were down almost 30% year on year in October."

"But this was almost inevitable, given the expiry of the stamp duty holiday [in England and Northern Ireland] at the end of September, which gave buyers a strong incentive to bring forward their purchase to avoid additional tax."

He added that fewer people being made redundant than expected after the end of the furlough scheme could provide a further boost to the market.

Cost of living

Consumer confidence, however, has been dented by a sharp increase in everyday prices since the economy reopened, Nationwide suggested.

The increase in the cost of living surged at its fastest pace in almost 10 years, hitting 4.2% in the year to October, according to the Office for National Statistics.

The Bank of England has said it may have to raise interest rates in the "coming months" to tackle soaring costs.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, suggested linked mortgage rates could also head upwards as a result.

"Households can lengthen mortgage terms to offset the hit to monthly repayments from higher rates," he said.

"In addition, the proportion of incomes that households are prepared to devote to housing might have risen permanently due to the pandemic and the long-term shift to working from home."

But he still expects that house prices will stagnate in the first half of 2022, and only rise slowly in the second half if mortgage rates rise enough over the coming months.

Martin Beck, senior economic adviser to the EY Item Club, said that a recent decline in mortgage approvals "bodes well for the housing market avoiding a significant correction now that stamp duty has returned to its normal level".

He also pointed out a shift in working patterns during the pandemic meant home-buyers were looking for bigger properties, prompting a "race for space".

That demand has been boosted by savings that some households have managed to accumulate during the pandemic, as well as a "little-damaged" jobs market emerging from the pandemic, he said.

- Published23 November 2021

- Published22 November 2021