Energy firms face stricter tests after collapses

- Published

- comments

Energy companies will face more robust financial checks from January after a host of companies failed owing to a wholesale price surge, the regulator Ofgem has announced.

Bosses of firms will also undergo more stringent vetting.

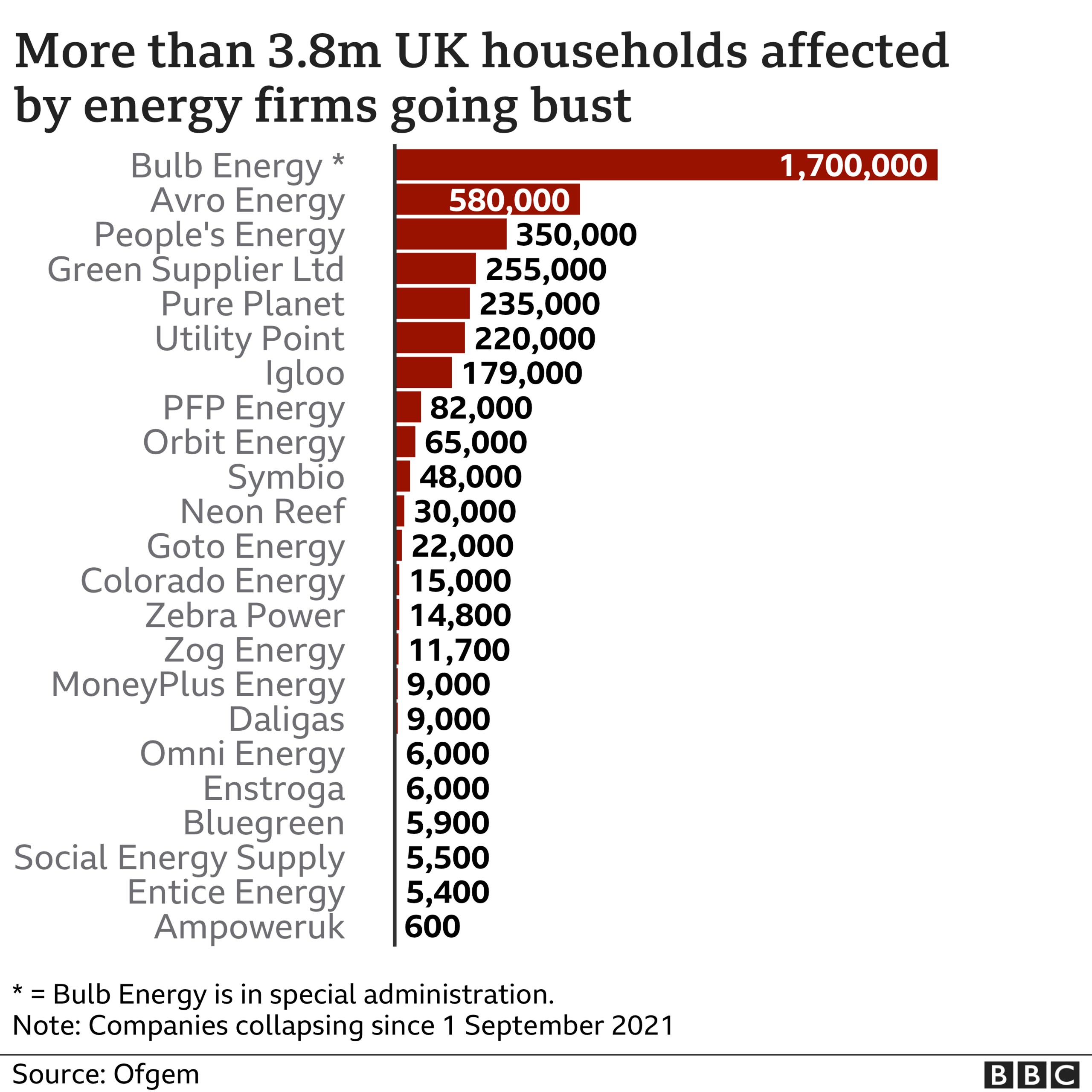

More than 20, mostly small, suppliers have collapsed following a spike in wholesale gas prices.

Nearly four million other households have seen their supplier fail since the start of the pandemic.

The regulator also said it was consulting on the future set up of the energy price cap, designed to protect customers who have not switched. It has been highlighted as part of the problem by some failed companies.

"I am setting out clear action so that we have robust stress testing for suppliers so they can't pass inappropriate risk to consumers," said Ofgem chief executive Jonathan Brearley.

"Our priority has been, and will always be, to act in the best interests of energy consumers. The months ahead will be difficult for many, and we are working with the government and energy companies to mitigate the impact as much as we can, particularly for the most vulnerable households."

Changing tariffs?

A significant rise in bills for 15 million people is inevitable in April, but Ofgem is also consulting on possible changes, external to the way tariffs are offered in the longer-term.

Options include customers being tied in to a standard tariff for six months, like a fixed term mortgage. If they left early for a cheaper deal, they would be charged an exit fee, unlike now.

The argument is that suppliers and remaining customers would not be left picking up the cost of their departure, although exit fees would be controversial.

Other suggestions include forcing companies to offer the same price to existing customers as they do to new customers. A similar rule is being introduced for home and motor insurance in January.

There might also be a charge paid by a supplier each time it takes on a new customer.

The price cap may also be reviewed every three months, rather than the current six, or an interim price cap introduced if market conditions changed dramatically.

When a host of energy companies collapsed, Ofgem was heavily criticised for having been asleep at the wheel, and unprepared for such a crisis.

Citizens Advice, the official advocate for energy customers, recently published what it described as Ofgem's "catalogue of errors" in recent years, that was now ultimately leaving customers having to pick up a multi-million pound bill.

That included an accusation that poor practice was rife, with many companies showing clear evidence of financial unsustainability, "including firms run out of the owners' living rooms and kitchens".

These latest announcement by Ofgem will address some of those concerns. They include:

If financial stress tests show up a weakness in a company, then an improvement plan will be drawn up with the regulator

Suppliers will have to self-assess their management

The regulator's assessment period before granting a new licence to operate will be extended to nine months

The regulator is also consulting on whether to block firms from taking on new customers once they hit certain milestones - such as 50,000 and 200,000 accounts - until it is happy with their balance sheet strength.

"What we want to say to suppliers is either get some insurance, buy your energy ahead or have enough money in the bank to weather a storm like this," Mr Brearley told BBC Radio 4's Today programme.

Customers of collapsed firms now have to pay more for their energy, because their original tariff was not protected. Those on the price cap also saw prices rises in October.

This has been a major factor in the rising cost of living, with inflation now rising at its fastest rate for a decade.

Mr Brearley said that customers should brace themselves for a further significant rise in gas prices in April, when a new price cap is introduced.

"Where you have legitimate price increases and the increase in gas is legitimate then those costs need to be passed onto customers. I know that's really hard, but we do expect a significant rise in April," he said.

He added that it was too early to give a figure and refuted that Ofgem had failed to take control of the market.

"Our job as a regulator is to make sure people pay a fair price for energy but no more than that," he said.

Ofgem said the cap had saved consumers an estimated £1bn a year since its introduction.

However it said the current methodology, while protecting consumers from price spikes, exposed suppliers to risks that are harder to manage at times of high energy price volatility.

"There is a risk that, if not tackled, this could lead to higher costs for consumers," the regulator said.

Related topics

- Published2 December 2021

- Published23 November 2021

- Published1 December 2021