Demands to delay rises in the state pension age

- Published

- comments

Plans to raise the state pension age from 66 should be shelved because we are not living as long as previously expected, a new report has suggested.

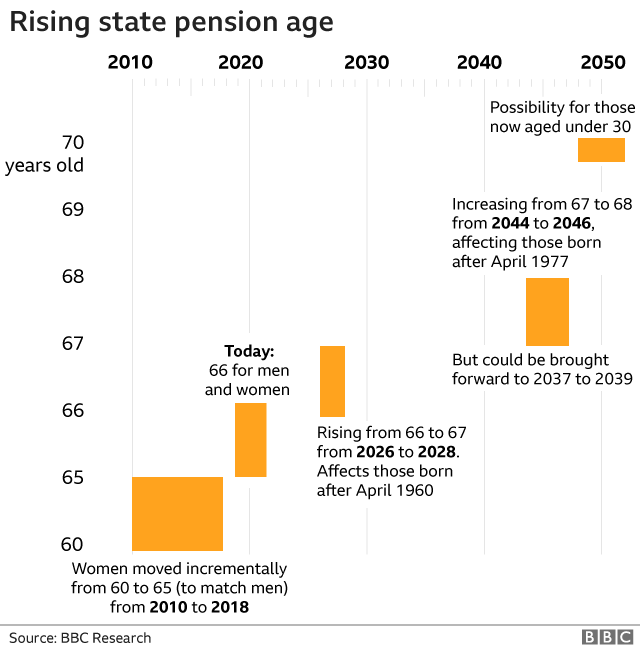

Current plans would see the age at which people are eligible for the state pension go up to 67 by 2028, and then eventually to 68.

Consultant LCP says life expectancy has stalled and no changes should be made for 30 years.

The government has just launched its latest review of the state pension age.

At present:

The full, new flat-rate state pension (for those who reached state pension age after April 2016) is £179.60 a week

The full, old basic state pension (for those who reached state pension age before April 2016) is £137.60 a week. They may also get a Pension Credit top-up

Men and women are now entitled to claim the state pension from 66 - an age which had increased steadily until October last year.

Under government plans state pension age would rise to 67 this decade, and 68 as early as 2039.

This is based on calculations that ensure no-one spends more than one third of their adult life in retirement.

However, since those plans were drawn up, official estimates of longevity have been scaled back, even before the effect of the Covid pandemic.

As a result, LCP argues that the move to 67 should not come until 2051, and the rise to 68 not before the mid-2060s.

Such an initial move would benefit 20 million people born in the 1960s, 1970s or early 1980s, but cost the Treasury an estimated £200bn.

Steve Webb, partner at LCP and a former pensions minister, said: "The government's plans for rapid increases in state pension age have been blown out of the water by this new analysis.

"Even before the pandemic hit, the improvements in life expectancy which we had seen over the last century had almost ground to a halt, but the schedule for state pension age increases has not caught up with this new world."

He said the government's plans should be revisited as "a matter of urgency" and there was "no case" for another state pension age increase so soon.

Earlier this month, the Department for Work and Pensions (DWP) announced that the next review of the state pension age would start, headed by Baroness Neville Rolfe.

"The government needs to make sure that decisions on how to manage its costs are, robust, fair and transparent for taxpayers now and in the future. It must also ensure that as the population becomes older, the state pension continues to provide the foundation for retirement planning and financial security," the DWP said.

Pensions experts have called for a rethink in the way state pension ages are calculated.

Baroness Ros Altmann, also a former pensions minister, said the current system helped the healthy and wealthy, but not those likely to die early.

"At the moment, the state pension only has flexibility for those who are healthy and wealthy enough to wait longer. If they start their pension later they can receive a higher amount. But those in poor health with no private provision, cannot get any money sooner, even at a reduced rate," she said.

Becky O'Connor, head of pensions and savings at Interactive Investor, said: "The idea of a long, enjoyable retirement seems set to be consigned to the history books.

"Many will have spent much of their working life expecting to retire at 65. They have been disappointed before and look set to be disappointed again. It is no wonder today's younger workers have little faith in the state pension being there for them at all when they stop work, with many thinking they will end up working forever."

- Published6 October 2020

- Published3 August 2021

- Published7 September 2021