State pension age hits 66 and set to rise further

- Published

- comments

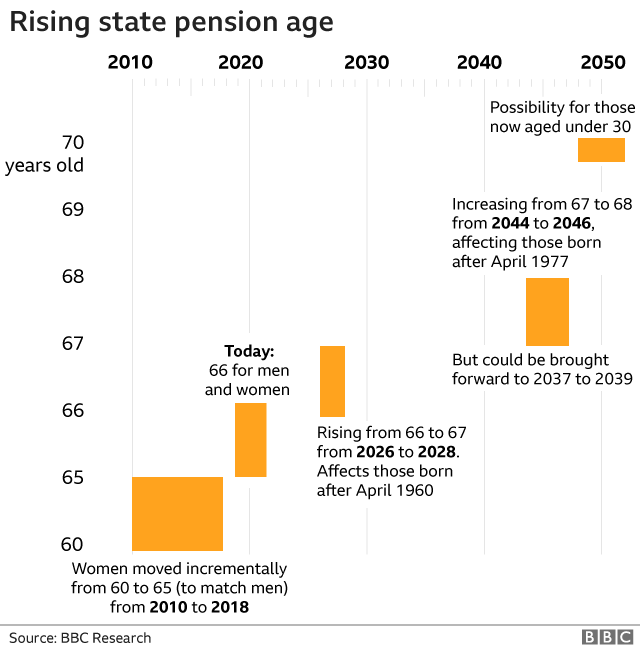

The age at which most people start to receive the state pension has now officially hit 66 after steady rises in the qualifying age in recent years.

Men and women born between 6 October, 1954, and 5 April, 1960, will start receiving their pension on their 66th birthday.

For those born after that, there will be a phased increase in state pension age to 67, and eventually 68.

It comes as the chancellor vowed the "triple lock" pledge is safe.

Under this pledge, the state pension increases each year in line with the highest of average earnings, prices (as measured by inflation) or 2.5%.

Coronavirus and the furlough scheme is set to distort the calculations for average wages and could mean one bumper year of pension increases. This has led MPs and economists to discuss how this could be smoothed out.

But, when asked by LBC radio whether the triple lock was safe, Chancellor Rishi Sunak said: "Yes, our manifesto commitments are there and that is very much the legislative position.

"We care very much about pensioners and making sure they have security and that's indeed our policy."

The full state pension for new recipients is worth £175.20 a week.

To receive the full amount, various criteria including 35 qualifying years of national insurance must be satisfied.

Women's pension campaign

The age at which people receive the state pension has been increasing as people live longer, and the government has plans for the increase to 68 to be brought forward.

However, the increases have been controversial, particularly for women who have seen the most significant rise.

Campaigners took their fight to court

Campaigners claim women born in the 1950s have been treated unfairly by rapid changes and the way they were communicated to those affected.

Some of those involved in the campaign recently lost a legal challenge, claiming the move was unlawful discrimination.

The coronavirus crisis has led many people to reconsider retirement plans, especially those who feel they are more at risk from the outbreak.

Former pensions minister Ros Altmann argued that the crisis meant there was a "strong case" for people to be given early access to their state pension, even if it were at a reduced rate.

She also pointed out the large differences in life expectancy in different areas of the UK.

Millions of people who will rely on their state pension in retirement need to know two things: how much will they receive, and when.

The future for both is not entirely clear.

Firstly, the age at which the state pension begins has been rising, and will continue to do so. MPs will decide on how quickly this happens, fully aware of the strength of feeling from the WASPI (Women Against State Pension Inequality) campaign over how this has been handled in the past.

Secondly, there is always plenty of debate over the future of the triple lock - the pledge to ensure the state pension rises by a minimum of 2.5% each year.

And if young workers think this has nothing to do with them, they should think again. How long we work before we receive state financial support in retirement is a vital issue for long-term financial planning.

'Plan ahead'

Younger workers have also been urged by pension providers to consider their retirement options, with a strong likelihood of state pension age rising further as time passes.

"As people live longer, it's clear many will also have to work for longer," said Pete Glancy, head of policy at Scottish Widows.

"The increase to the state pension age provides a timely reminder to everyone to check your pension pots and ask yourself whether the savings you've built up are enough for the kind of life you want in retirement."

Tom Selby, senior analyst at AJ Bell, said: "As average life expectancy continues to increase, the state pension age will inevitably follow suit.

"This means younger savers probably need to plan assuming they might not reach their state pension age until 70 or even beyond. Anyone who aspires to more than the bare minimum in retirement needs to take responsibility as early as possible to build their own retirement pot."

- Published19 July 2017

- Published5 October 2020

- Published15 September 2020