Rishi Sunak can afford new Covid support, says think tank

- Published

- comments

Chancellor Rishi Sunak can afford to step in and help struggling businesses hit by Omicron despite continued high public borrowing, says the Institute for Fiscal Studies.

IFS director Paul Johnson told the BBC that although interest rates were going up, borrowing was still "very cheap".

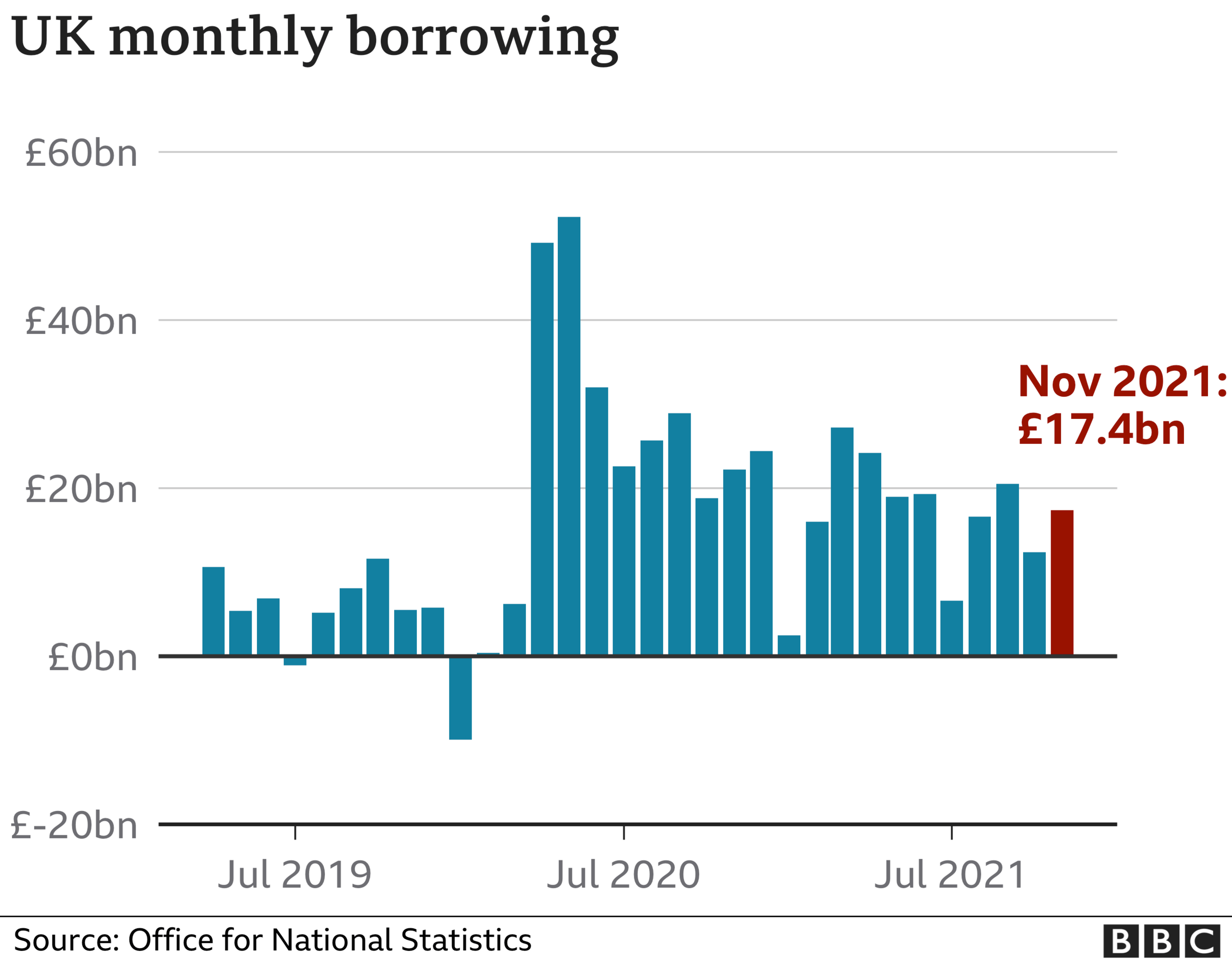

He spoke after figures showed the government borrowed less last month.

The gap between its spending and tax income stood at £17.4bn in November, £4.9bn down on a year earlier.

However, the figure was higher than analysts had forecast and it was also the second-highest total for November since monthly records began in 1993.

Borrowing hit record levels because of Covid as the government spent billions of pounds on emergency measures.

These included the furlough scheme, which wrapped up on 1 October.

Mr Johnson said the chancellor would be able to afford to meet demands from pubs, restaurants and nightclubs for financial support.

Although the Omicron variant of Covid has not led to lockdown measures as in previous waves of the pandemic, businesses are struggling because people are reluctant to go out.

Among those seeking help is nightclub operator Rekom, which has more than 40 venues across the UK.

Peter Marks, chairman of its UK board, told the BBC that attendances were 40% lower than usual "at a time that's absolutely critical for us as a business".

He also feared the possibility of not being able to open on New Year's Eve, which is when the chain makes 8% to 10% of its annual profits.

The IFS's Mr Johnson said, however, that it would be "very hard indeed" to provide targeted support to those who needed it most, given that city centres were harder hit than other areas.

He added that fears of fuelling high inflation meant Mr Sunak would be worried about "throwing more billions into the economy at this stage".

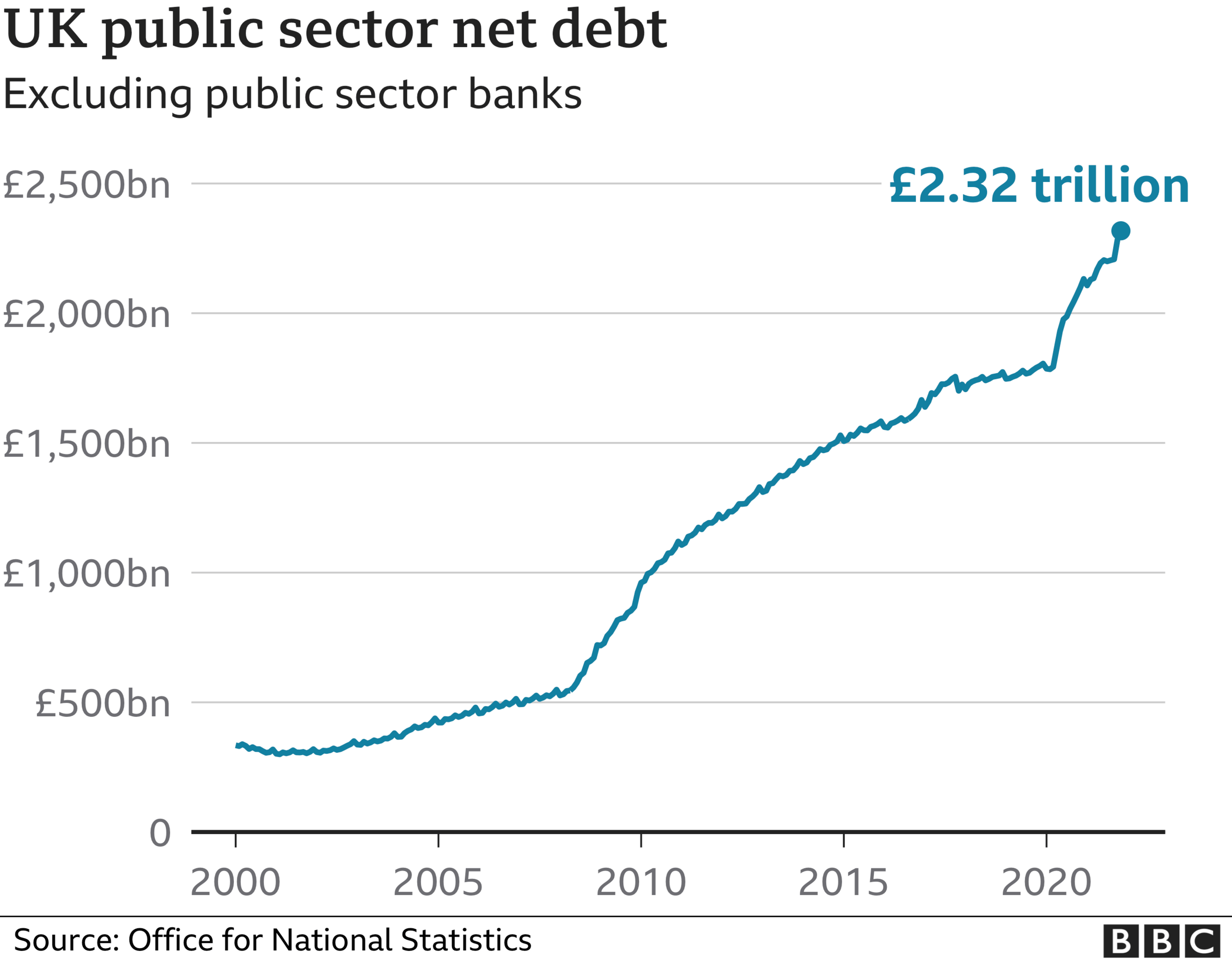

Government debt stood at more than £2.3 trillion at the end of November this year - about 96.1% of the UK's gross domestic product (GDP) and the highest level recorded since the early 1960s.

The Office for National Statistics (ONS), external estimates that the government has borrowed a total of £136bn so far in the current financial year (April to November), although this is £115.8bn less than in the same period last year.

As a result of a lower income from taxes and higher spending, the ONS now estimates that in the 2020-21 financial year the government borrowed £321.9bn. That amounted to 15% of GDP, the highest rate seen since the end of World War Two.

Borrowing costs

Rising inflation means that it is costing the government more to borrow money.

Interest payments on central government debt were £4.5bn in November 2021, £0.4bn more than in November 2020.

For this and other reasons, says Samuel Tombs of Pantheon Macroeconomics, "the trend in public borrowing is about to deteriorate markedly".

He says that the pick-up in inflation means full-year debt interest payments look set to exceed the Office for Budget Responsibility (OBR) forecast by £5bn.

"All told, we now think that public borrowing will equal about £190bn this year, and would revise up this forecast to around £192bn, if the government reimposed for one month the rules seen during Step Two of the unlocking earlier this year and set up a furlough scheme for businesses that were forced to close," he added.

"Public borrowing was broadly on course to meet the OBR's forecast, based on data up to November, but high inflation and Omicron will push it off track."

The figures for November seem "like old news now", according to Bethany Beckett of Capital Economics.

"These data predate the recent surge in coronavirus infections caused by the Omicron variant, with a near-term tightening of virus restrictions once again a possibility," she said.

"Although the economy has got better at coping with restrictions with each new wave, we still suspect it would prompt a deterioration in the public finances via lower tax revenues and the potential reintroduction of government support schemes."

- Published16 December 2021

- Published10 December 2021