Inflation surge sends UK interest payments higher

- Published

- comments

Interest payments on government borrowing last month hit a record high for December as surging inflation increased the cost of debt.

The Office for National Statistics (ONS) said interest on government debt hit £8.1bn last month - up from £2.7bn a year earlier.

The increase came as soaring energy costs sent inflation to a 30-year high.

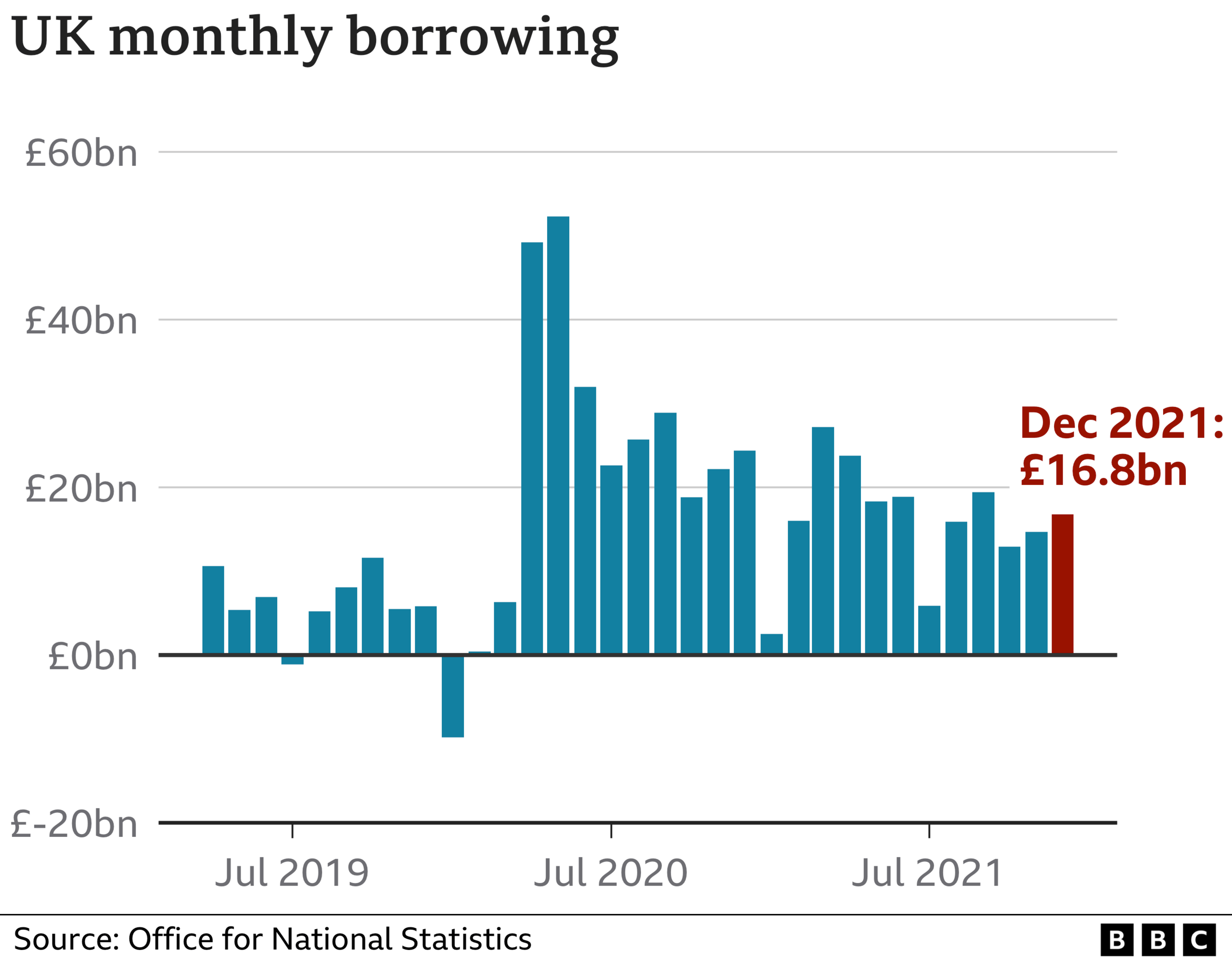

Official borrowing - the gap between spending and tax receipts - last month was a lower-than-forecast £16.8bn.

The figure was down £7.6bn from the same month a year earlier, with the Treasury's coffers bolstered by more income from housing stamp duty and fuel taxes.

But public debt interest payments are linked to the Retail Prices Index of inflation, which hit 7.5% last month, the highest rate since March 1991.

For the financial year to date, borrowing has now reached £146.8bn, the second-highest figure for the period since records began in 1993.

Chancellor Rishi Sunak, under pressure to relax planned tax rises in April, underlined the impact of rising debt repayments in a statement after the figures were released.

He said: "We are supporting the British people as we recover from the pandemic through our Plan for Jobs and business grants, loans and tax reliefs.

"Risks to the public finances, including from inflation, make it even more important that we avoid burdening future generations with high debt repayments.

"Our fiscal rules mean we will reduce our debt burden while continuing to invest in the future of the UK."

In total, more than 50 schemes have been announced by the UK government and devolved nations to support individuals and businesses during the coronavirus pandemic.

The consensus among economists was that December borrowing would reach about £18.5bn. However, with the rate of inflation set to continue rising until about April, analysts at Capital Economics said further falls were unlikely.

National Insurance (NI) is set to rise in April, piling more cost-of-living pressure on struggling households.

Although Mr Sunak has so far given no signal he will bow to pressure to scrap the rise, Capital Economics said the December figures suggest he "would have enough fiscal room to cancel" the NI rise without too much damage to the nation's finances.

Overall the public purse may be in better shape than some had feared - but that doesn't mean the chancellor is in a generous mood.

The amount of interest the Treasury paid on its debts in December was three times what it was a year ago.

About a quarter of public debt is linked to inflation as measured by the Retail Prices Index. And that inflation is now at a 30-year high of over 7%, and is set to rise further in the coming months.

Moreover, interest rates themselves are likely to rise in a bid to curb price rises - and every 1% on rates adds £20bn to the cost of public debt repayments.

It's mounting cost that a chancellor who is intent on reducing borrowing has zoomed in on. Rishi Sunak has stressed that it's "important that we avoid burdening future generations with high debt repayments".

That may be his way of hinting that he won't be swayed by calls to delay looming tax changes that are set to take a further chunk out of household budgets, and that the Treasury is prepared to give only limited help to reduce the pain of soaring energy costs.

Economists at the Institute of Fiscal Studies say that the chancellor does have the financial wiggle room to at least delay tax rises for now.

But they also say that those rises will have to eventually come, faced with rising demands from the likes of an ageing population, the public finances are to be knocked into a more sustainable state.

Related topics

- Published19 January 2022

- Published18 January 2022

- Published21 December 2021