National Insurance: Rise will squeeze budgets - CBI

- Published

A planned rise in National Insurance from April will "unquestionably place a further squeeze" on budgets and risk stunting economic growth, the CBI business group has warned.

The CBI said firms "weren't supportive" of the tax increase when it was first announced, and "they're still not".

The Federation of Small Businesses (FSB) said the rise could "spell the end for a lot of small firms".

The government has said the increase will help clear the NHS backlog.

Prime Minister Boris Johnson and Chancellor Rishi Sunak wrote in the Sunday Times, external to confirm the £12bn rise, which they said was "the right plan" and "must go ahead".

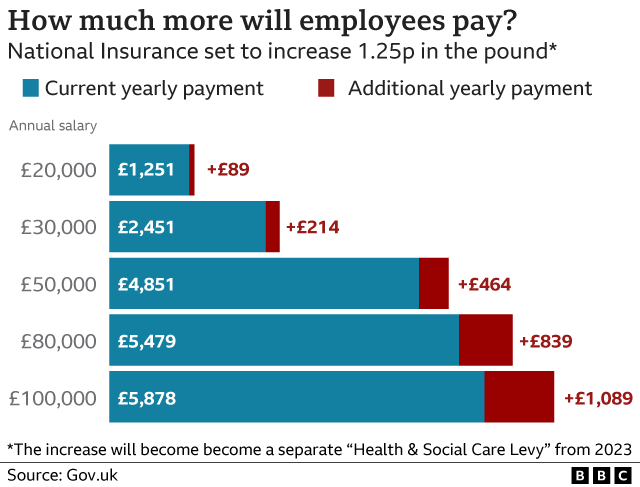

Under the government's plans, employees, employers and the self-employed will all pay 1.25p more in the pound for National Insurance from April 2022 for a year.

After that, the extra tax will be collected as a new Health and Social Care Levy.

The changes will see an employee on £20,000 a year pay an extra £89 in tax, while someone on £50,000 will pay £464 more.

Critics have said the increase could contribute to inflation - the rate at which prices rise - which is already at its highest point for three decades, reaching 5.4% in January.

There are also concerns the rise could contribute to the cost of living, with household budgets being squeezed by rising energy prices.

But the NHS Confederation, the body which represents health and care leaders, has said the funding is needed to care for vulnerable people.

The CBI, which represents 190,000 UK businesses, said increasing National Insurance would "risk curtailing growth at a critical moment in the recovery" from coronavirus restrictions.

A spokesperson said businesses recognised the "need to fund the increased demands on our health and social care service", but urged the government to look to other methods of raising funds it could.

"If the government goes ahead as planned, then it is incumbent on them to use the March Budget to bring forward more ambitious plans to raise the longer term growth potential of the economy," the CBI added.

'How can I afford to pay my staff more?'

For Lucy Bull, who manages Castle Grove Nursing Home in Devon, the rise in National Insurance will come at a time she wants to increase wages for her 45 carers.

She told the BBC she believed the extra tax revenue would mostly go to the NHS, and not reach the care sector.

She added while the NHS had done a "brilliant job" through the pandemic, the funding needed to be for the "care sector as a whole".

"We are working really hard to raise the salaries for our care workers - taxing even more is not going to help that," she said. "The cost of personal care, it's extremely expensive and it's just going up."

Ms Bull, who is also a director at Devon Care Homes Collaborative, said unlike other businesses, the care sector couldn't just decide to charge more money for beds.

"It's not just the same as deciding you're going to charge a bit more for a cup of coffee," she added.

"For most relatives and residents there's a finite pot of money."

Elsewhere, the boss of the Federation of Small Businesses, said its members had warned they would have "no choice but to increase prices, reduce wages or let staff go", if the government proceeded as planned, due to other increases in the National Living Wage and business rates.

National chairman Mike Cherry said: "This regressive tax hike will hit lower earners and struggling community small businesses the hardest, leaving less cash in people's pockets to spur our recovery."

Mr Cherry also warned National Insurance rising would coincide with the moment reliefs on business rates were due to end, which he said would "spell the end for a lot of small firms", unless "action is taken now".

'Longer waits'

UK Hospitality boss Kate Nicholls tweeted, external restaurants, bars and pubs also had to deal with business rates relief ending, on top of rising VAT and supply chain problems.

"All when consumers will already feel pinch and demand will be suppressed. Keep VAT at 12.5% will ease price pressure," she said.

Meanwhile, Matthew Taylor, chief executive of the NHS Confederation, said without the extra funding, the public would face longer waits for treatment and "hundreds of thousands of vulnerable people won't get the care and support they need from social care services".

"But it is for the government to decide how best to fund this extra investment," he added.

Sarah McClinton, vice-president of Association of Directors of Adult Social Services, said it was "essential that as a society we fund adult social care in the longer term", adding more tax needed to be assigned to social care.

Related topics

- Published30 January 2022

- Published6 November 2022

- Published29 January 2022