Use Russian money to rebuild Ukraine, says bank boss

- Published

- comments

Kyrylo Shevchenko, Governor of National Bank of Ukraine, in September 2021

Frozen Russian assets should be used to rebuild Ukraine after the war, the governor of Ukraine’s Central Bank has told the BBC.

Kyrylo Shevchenko called for an extensive list of extra sanctions, from cutting card payments to suspending Russian access to the IMF.

Every day that sanctions are delayed "is costing the lives of civilians and children", he said in an interview.

For security reasons, he answered questions sent by email.

Mr Shevchenko, governor of the National Bank of Ukraine, said that Russia should eventually be made to pay to repair the damage caused during the invasion.

“The need for money will be huge,” he told the BBC. “It could be fulfilled through loans and grants from multinational organisations and direct help from other countries. However a large share of financing is needed to be obtained as a reparation from the aggressor, including funds that are currently frozen in our allied countries.”

The government building in Kharkiv, destroyed by Russian missiles. Rebuilding Ukraine will cost billions

Much of Russia’s $630bn of foreign exchange reserves are thought to be held outside the country, and effectively frozen by sanctions in the US, the EU and other places.

That would make billions available for reconstruction – if Ukraine is able to access it once the war is over.

Extra sanctions

Mr Shevchenko welcomed the financial sanctions already imposed by the international community, but said the world should go much further. He called on governments, institutions and companies to impose an extensive list of further financial sanctions, targeting every corner of Russia's economy.

He called on:

Trading and financial data platforms Refinitiv and Bloomberg to terminate access for Russian and Belarusian clients.

US and EU to instruct their banks to sever correspondent relationships with Russian banks.

The central banks’ organisation, the Bank for International Settlements, to expel Russia's central bank.

The International Monetary Fund to suspend Russia and Belarus from its meetings, block their access to assets issued by the IMF called Special Drawing Rights, “as these funds may be used to finance military action against our country.”

China’s UnionPay card payment system (similar to Mastercard and Visa) to stop servicing payment cards issued by Russian banks.

Armenia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkey and Vietnam to block the Russian payment system, Mir.

International money transfer operator Western Union to cease deliveries of cash to Russian and Belarusian banks.

“We already see the effect [of sanctions] on the aggressor’s financial system, but we are still waiting for more to be done. I would like to underline that every day that sanctions are delayed is costing the lives of civilians and children,” Mr Shevchenko said.

“These are the lives of Ukrainians who have chosen the European way and are now defending not only their own country, but also the entire system of values that lies at the core of the Western civilization.”

Central bankers normally target inflation.

What is clear from the testimony of the Ukraine's version of Andrew Bailey is that in this war they are leaving no stone uncovered in their targeting of the Russian financial system.

Every pipeline of cash into the "aggressor" has been identified, even as Mr Shevchenko's team tries to keep the cash flowing in the Ukrainian financial system and to its millions of refugees, and even set his country's monetary policy from a bunker.

The IMF, the Bank for International Settlements, Western Union, Chinese credit card payment systems, former Soviet nations' use of Russia's payments system, all are the subject of Kyiv's lobbying to subject the Russian financial system to an unprecedented squeeze.

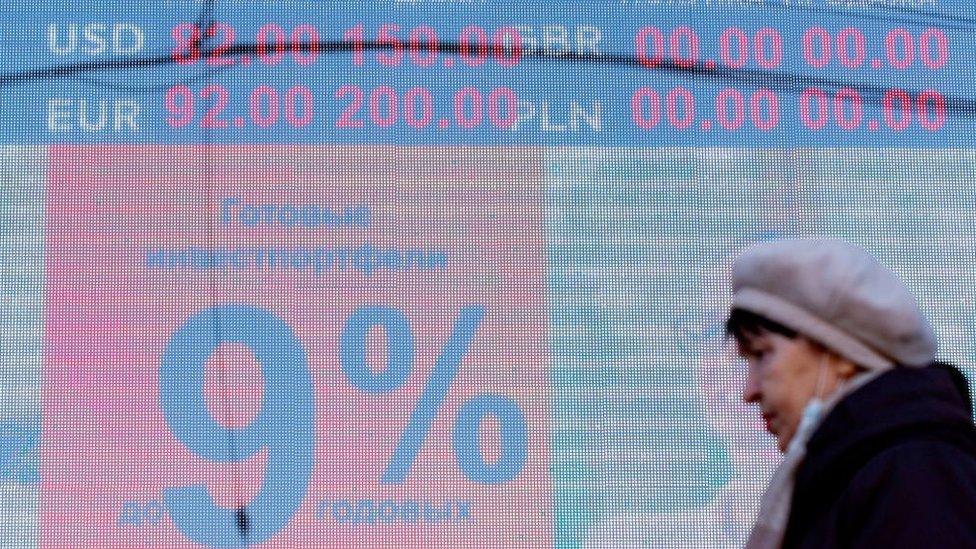

Above all, that targeting of Russia's Central Bank, agreed by G7 nations, has disarmed its warchest of foreign exchange reserves and halved the value of the rouble.

I asked him if he was worried about the precedent being set here for institutions normally given sovereign immunity. He pauses. "I can answer from the bottom of my heart. We see that the Central Bank of Russia supports military invasion and thus is also guilty, responsible in deaths of civilians in Ukraine".

Donations

Around 11bn hryvnia ($350m, £280m) has been paid in to the two special accounts set up by the National Bank of Ukraine to receive donations for the military and for humanitarian causes, Mr Shevchenko told the BBC.

The account for the military was set up on 24 February to accept international and local donations in multiple currencies.

A similar account for humanitarian purposes was set up on 1 March.

Oil embargo

Western countries have wrestled with the difficulties of suspending purchases of Russian energy. While the cash Moscow receives for oil and gas exports is a vital lifeline, European governments have decided that they can’t live without vital Russian supplies, at least for now.

Mr Shevchenko said: “Today we can see that Russia is using its energy resources capacities to put economic pressure on Europe. Energy is also one of the leading narratives in the Russian media. They are using it to misinform the Russian public about the West’s unwillingness to take tougher measures, out of fear of losing access to Russian oil and gas.

Kyrylo Shevchenko, filmed yesterday by NBU staff

“We realise how difficult this decision is for our Western partners. We understand the cost of such a step. But we must work together to find and use all possible tools to stop the killing and the suffering that Russia is increasingly causing in Ukraine.”

Keeping going

Mr Shevchenko also described some of the challenges of keeping the country’s financial system running during a war.

His staff are working round the clock, he said, many sheltering from bombardment in underground bunkers.

But he said electronic payments and ATMs were still working, and cash was being delivered to everywhere but active combat zones.

“I can proudly say that Ukrainian banking system remains stable and liquid even under martial law.”

“This is extremely difficult time for every Ukrainian - for the people and the country,” he said. “The National Bank of Ukraine is doing everything in its power to support Ukraine, its defenders, and the population affected by Russian aggression.”

- Published8 March 2022

- Published2 March 2022

- Published6 March 2022