Benefits and state pension increase outpaced by rising prices

- Published

- comments

A 3.1% rise in the state pension and various benefits has now taken effect but charities have warned it fails to tackle cost of living pressures.

Official figures show that prices are rising twice as fast, and they are expected accelerate further.

The government said it recognised people's difficulties and was helping.

Late last year, ministers decided to temporarily cut the state pension's link to average earnings, which would have led to an 8% rise now.

They have pledged to reinstate the so-called pension "triple lock" in future years.

Squeeze on household budgets

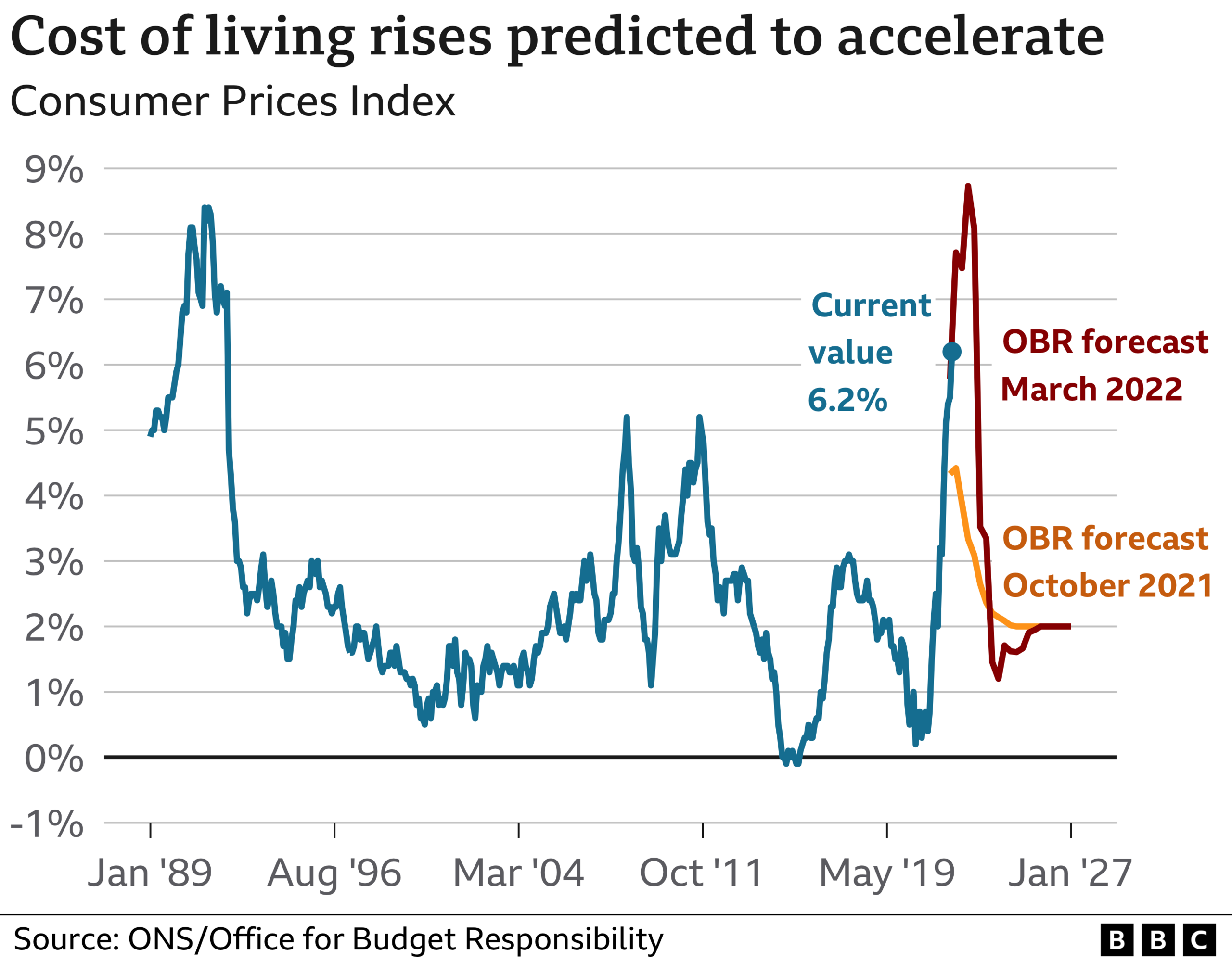

Prices are rising at their fastest rate for 30 years, with costs going up across a variety of sectors of the economy.

This increase in the cost of living is measured by the rate of inflation, which official forecasters expect to peak at close to 9% later this year owing mostly to more expensive gas and electricity bills.

Official statisticians and a range of economists have said that those on the lowest incomes are likely to be most stretched by the rising cost of living.

How is the rising cost of living affecting you? Get in touch.

WhatsApp: +44 7756 165803, external

Tweet: @BBC_HaveYourSay, external

Please read our terms & conditions and privacy policy

Those affected include Collette, a mother-of-two, whose income is from universal credit - one of the benefits that has now risen by 3.1% for the year.

"Gas and electricity is eating into everything," she told the BBC. "Food bills are going up as well. We have got into debt this year. This is all going to burst at some point."

She said she wished she could work, but was unable to due to ill health. People she knew who were doing two jobs - as she used to - were still struggling to cope financially, she added.

The extra government household support grant she received had been spent on gas bills, she said.

April changes

Long-standing policy links the rise in a series of benefits and tax credits each April to the rate of inflation the previous September.

That is why means-tested benefits such as universal credit, as well as disability and carer's allowances, have now gone up by 3.1%. The actual amounts individuals receive depends on their circumstances.

Child benefit has also gone up by 3.1% to £21.80 a week for the eldest child, and £14.45 a week for other children.

'If I eat late in the morning, I don't have to eat again until evening'

Once a week Andrew gets a free meal from a local charity and says he likes to make an effort to look smart

Andrew McIntyre owes his energy supplier £1,200, and his monthly bill is about to go up from £75 to £120 a month.

The 57-year-old lives off universal credit, and already regularly faces a shortfall between what he has got coming in and what he needs to pay on bills.

As he gets ready to go to a local food charity for a free meal - something he does one day a week and likes to get dressed up smartly for - he explains that it means he has had to choose between paying his rent and heating his flat.

"Every month I'm robbing Peter to pay Paul," he says. Andrew gets £325 a month in universal credit, and £351 a month in housing benefit. He has no savings. He pays £400 for rent, leaving him with £276 for food and bills.

"If I can eat late in the morning then I don't have to eat again until my evening meal," he says.

Dame Clare Moriarty, chief executive at Citizens Advice, said: "We've heard stories of families resorting to heating up tins of beans over a tealight, or choosing between giving their kids a hot bath at bedtime and putting on the heating for an hour while they dress for school. With energy bills rocketing this month, things will only get worse.

"At the bare minimum, the government should reconsider and increase benefits by the current inflation rate to help people keep up with the rapidly rising cost of living. And as costs continue to soar, they must bring in further support to stop more households being pushed into hardship."

A government spokesman said: "We recognise the pressures people are facing with the cost of living, which is why we're providing support worth £22bn across the next financial year and benefits are being uprated by the usual measure, September's inflation figure."

He added that support also included cutting fuel duty and money to help pay for energy bills. The minimum wage had also been increased.

If the rate of inflation is high in September, then benefits could rise significantly in April 2023, when the rate of price increases is forecast to slow.

The uprating of some social security benefits is devolved, with the Scottish government setting a 6% increase in eight of them from 1 April.

The move affected the Job Start Payment, Young Carer's Grant, Funeral Support, three Best Start Grants and Carer's Allowance Supplement - which had all been due to increase by 3.1%. It also covered Child Winter Heating Assistance, which was to rise by 5%.

Ministers said it was an "urgent" response to growing pressures on the cost of living.

Triple-lock suspension

Normally under the triple lock formula, pensions increase by inflation, the increase in earnings between May and July or 2.5% - whichever is highest.

Ministers said last September that the figures had been "skewed and distorted" by the average earnings rise, which was "statistical anomaly", owing to the impact of Covid and the withdrawal of furlough. The House of Commons Library said that would have been about 8% and cost an extra £4bn to £5bn.

So the government decided to limit this April's rise to the greater of the inflation rate last autumn or 2.5%, hence the 3.1% increase now.

It means:

The full, new flat-rate state pension (for those who reached state pension age after April 2016) is £185.15 a week, a rise of £5.50 a week

The full, old basic state pension (for those who reached state pension age before April 2016) is £141.85 a week, a rise of £4.25 a week. They may also get a Pension Credit top-up

Work and Pensions Secretary Therese Coffey has committed to reinstating the triple lock from now on, telling the Commons: "I am again happy to put on record that the triple lock will be honoured in the future."

Jonathan Cribb, associate director at the Institute for Fiscal Studies, said that had the government considered making a change to next year's triple lock promise, it would be a much worse policy that the current temporary suspension.

He added that there was a "good case" to smooth out pensions and benefits rises but government policy - which included some help with energy bills - should be considered as a whole.

Related topics

- Published1 April 2022

- Published1 April 2022

- Published1 April 2022