Cost of living: 'My daughter won't ask me for money for period products'

- Published

Further support with the cost of living is urgent as income is failing to cover basic living costs for many people, a charity has warned.

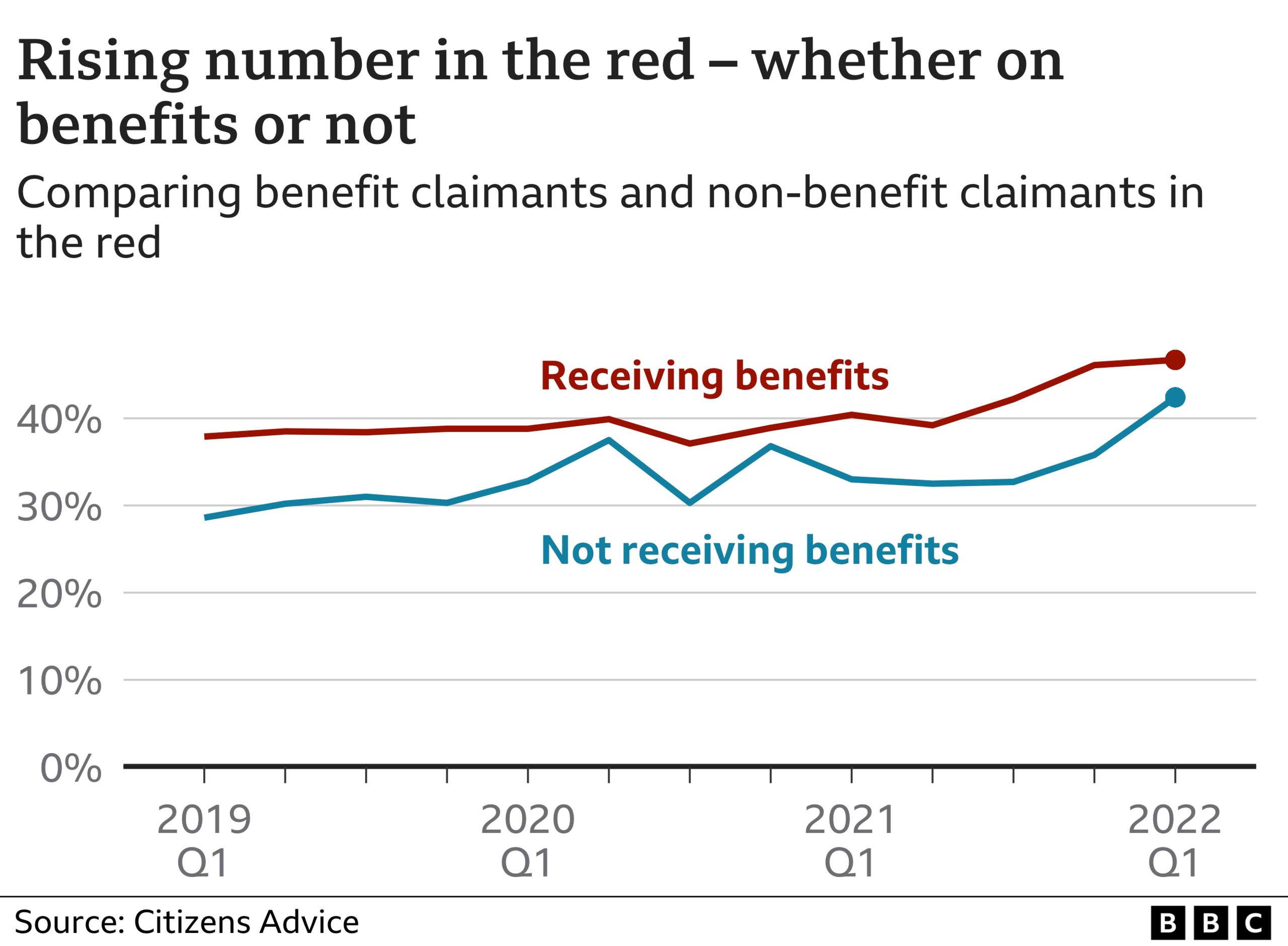

Citizens Advice said 46% of its debt clients had a so-called negative budget, up from 36% three years ago. That means they do not have enough money to meet essential living costs.

One mother-of-two said her teenage daughter did not want to ask her for money to buy sanitary products.

Extra support is expected soon.

Citizens Advice debt advisers have called for a return of the £20-a-week boost to Universal Credit, but Treasury chief secretary Simon Clarke has ruled that out, describing it as "a temporary response to the pandemic" which would not return.

Other measures could be outlined within hours, which could include help for vulnerable households.

'She worries'

Many people seeking help from Citizens Advice are already in a difficult financial state.

Their budgets are in the red, with income failing to cover daily living costs, even before paying bills such as credit card repayments.

Their situation has been made worse by prices rising at the fastest rate for 40 years, and particularly surging energy bills.

Among them is a mother-of-two, who we are not naming owing to her vulnerability. She is unable to work and has borrowed from family and friends, but has found it tough to budget, and is seeking official relief from her debts - all of which she said was having an impact on her children.

"We are eating sandwiches and things like that because I don't want to use the oven," she said. "We live off the basics with food shopping, but it is not all healthy.

"My daughter does not like to ask me for money. She worries that it is worrying me.

"With sanitary towels, she won't tell me that she needs them. When she needs them she gets them from school. But they are a necessity. It should not be down to the school; they are there only for an emergency."

Money advice supervisor Christopher Whitehead says food vouchers are often needed

The people who work at North Tyneside Citizens Advice are used to such stories, where more women than men seek debt and benefits advice, and contact with people aged in their early 20s is rising.

Most people in the area have a low income, but it is very mixed, with pockets of deprivation and also of wealth.

Even so, in the first three months of this year, there was an 89% rise in clients who needed charitable support compared with a year earlier.

In other words, the need for food and fuel vouchers or welfare support almost doubled in a year.

Sometimes staff even have to source second hand ovens for families so they can cook the food they are given.

Money advice supervisor Christopher Whitehead, 39, first started in debt advice in 2007 as the financial crisis of that time took hold.

"It was about credit card, store card, and catalogue debt back then. Now it is about people not being able to afford the essentials. There are debts on council tax, energy and rent which are day-to-day costs you should be able to meet," he said.

When somebody has a negative budget, it means they have nothing left, or have to borrow, after paying their living costs. And those costs don't include unsecured debt repayments such as credit cards.

On the quayside, just a few hundred yards from the Citizens Advice office, David Thompson is fishing, and is one of those struggling to pay the bills.

The 46-year-old has five children and four grandchildren and gets Universal Credit - which he calls "Universal Crisis".

David Thompson says food, energy and clothing are all costing more

"It is getting worse and worse, but you have just got to make do with what you have got. It is a struggle. You are worrying before you get paid, then when you get paid you worry how far it is going to go," he said,

"It is supposed to last a month, but you are skint after a week or two."

As typical household energy bills are rising, and are set to go up again in October, he said that any extra support given by the government was never going to match the rate of price rises at the moment.

"This is one of the worst times. I remember when the shipyards went down, and the miners' strikes. People are more well-off now than the 80s and the 90s, but things are a lot more expensive," he said.

It is not only those receiving benefits who are struggling with rising prices and potential debts.

The rate of people in debt who have a negative budget is rising fastest among those who are not on benefits, Citizens Advice said.

Whatever people's circumstances, whether in-work or not, Citizens Advice is urging anyone who is worried they could be facing a spiral of debt to get in touch for help.

"You have to speak out. You can't just struggle," said the mother referred to earlier. "If I hadn't, I would be in a big black hole now."

Advisers are able to do benefit checks and sometimes to find and apply for grants from benevolent funds run by former employers.

However, the charity is warning that there are limits to the support it can offer, so further assistance from ministers is vital.

Developments such as social tariffs from energy companies would also help, they said.

So far, government support has been a mix of broad, general assistance to help everyone, such as council tax rebates, and more targeted policy - such as allowing those on universal credit to take home more of what they earn.

The Treasury said it had already put together a £22bn package of support for people facing the rising cost of living, and the government is set to outline further help.

The government is expected to scrap a plan to give people £200 off bills from October which would be repaid over five years. Instead, the BBC understands that sum will be increased and possibly doubled, and will not need to be paid back.

Additional help for those on the lowest incomes is also expected.

- Published19 May 2022

- Published17 May 2022

- Published20 May 2022