Two million more people paying higher rate tax

- Published

The jump in the number of people paying higher rates of income tax comes as the cost of living soars

There are almost two million more higher and additional rate taxpayers in the UK, according to HM Revenue and Customs (HMRC).

The number of people paying 40% or 45% tax has risen from 4.25m to more than 6.1m workers since 2019, figures show.

It comes as prices rise at the fastest rate for 40 years and workers and unions push for pay rises to cope.

The Treasury has been urged to re-examine tax brackets, but it said most tax payers still paid the basic rate.

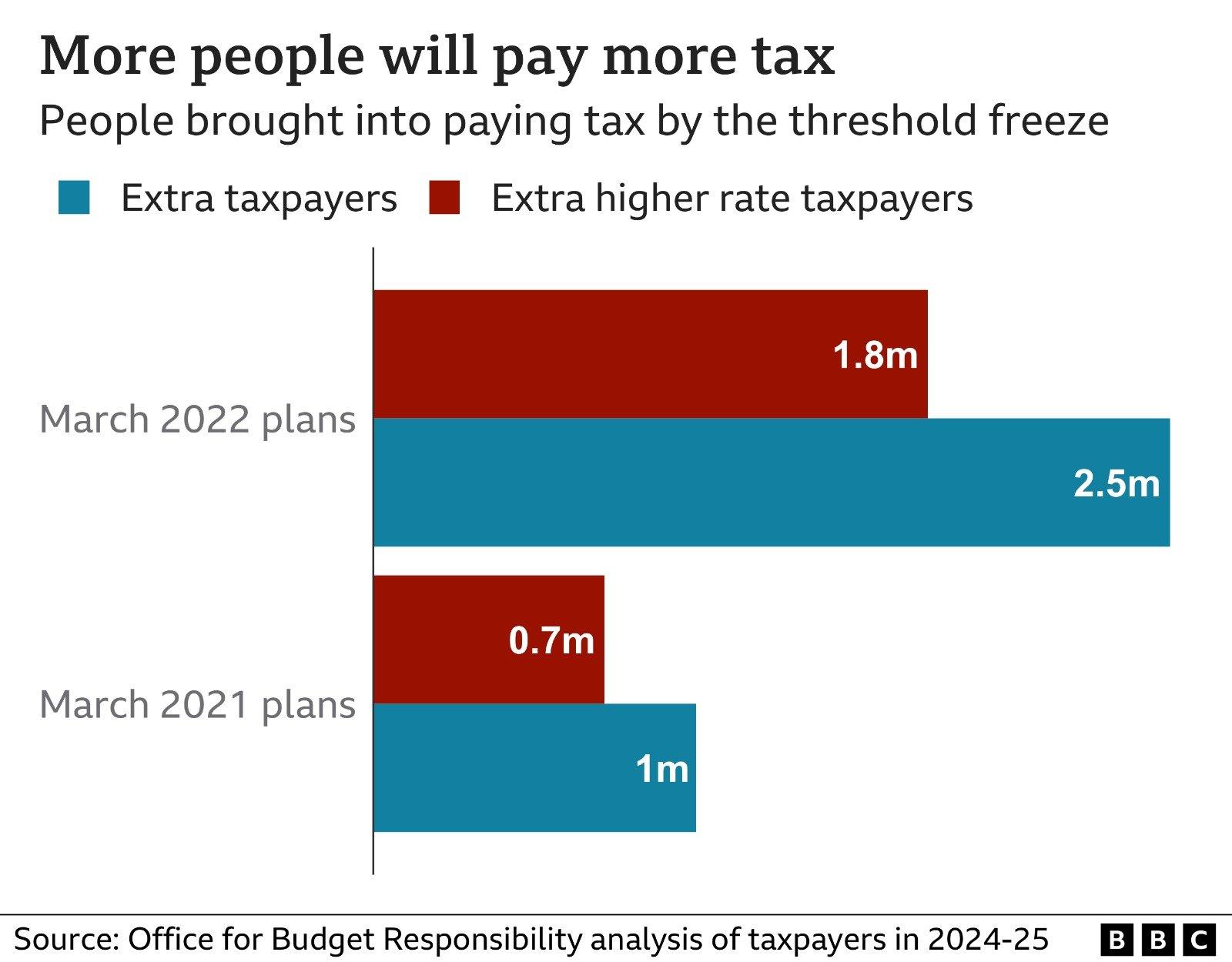

The amount a worker can earn before paying income tax, known as personal allowance, was frozen in the April 2021 Budget until 2026, along with all tax thresholds.

Usually, governments increase personal allowances each year, so that someone can get a pay rise that matches the rising cost of living without getting dragged into the next tax bracket.

But right now, inflation is at 9.1% and expected to rise further. This means pay rises are expected to lead to many more people paying higher tax rates, and generating more money for the Treasury.

At the time of March's Spring Statement, the government's independent watchdog, The Office for Budget Responsibility, estimated that by 2026 the government's tax take in relation to the size of the economy would rise to its highest since the 1940s.

The Treasury said it had taken "tough but responsible decisions" to "avoid saddling future generations with more debt" after record levels of borrowing during the pandemic.

"Maintaining income tax thresholds is a progressive approach. The vast majority of taxpayers will still pay the basic rate and the UK still has the highest personal allowance in the G20," the spokesperson added.

Countering this approach, former Liberal Democrat pensions minister Sir Steve Webb said that paying higher rate tax "used to be reserved for the very wealthiest".

But this has changed "very dramatically" in recent years, added the partner at consultants LCP.

"People who would not think of themselves as being particularly rich can now easily face an income tax rate of 40% and around 1 in 5 of all taxpayers will soon be in the higher rate bracket," he said.

More people will be paying more in taxes after the Spring Statement

Higher rate taxpayers paying 40% earn £50,271 in England, Northern Ireland and Wales. In Scotland the higher rate is 41% for those earning £43,663 or over.

Tax is not paid on the first £12,570 of earnings covered by the personal allowance.

They represent a projected 16.2% of the overall income tax-paying population in 2022-2023, according to the HMRC.

Meanwhile, additional rate taxpayers who earn over £150,000 and pay at 45% tax make up around 1.9%, it said.

'Responsible'

Clive Gawthorpe, partner at accountancy firm UHY Hacker Young said the government needs to "urgently" examine these tax brackets.

"Due to inflation, taxpayers sucked into the higher band were already having to make their monthly pay checks stretch further - without the additional burden of higher tax," he added.

When income tax brackets do not move in line with inflation, more taxpayers can fall into higher tax brackets, increasing overall income tax payments in an effect known as fiscal drag.

But Prime Minister Boris Johnson on Thursday defended the government's taxation policy, pointing to plans to raise the threshold for paying National Insurance in July.

"Next month, we've got a tax cut worth £330 on average...for all payers of National Insurance contributions coming in, a very substantial tax cut in addition to what we've done on fuel duty and on council tax.

"Of course, we always want to try to reduce burdens, but we have to do it in a sensible and a responsible way," he said.

- Published16 May 2022

- Published24 June 2022